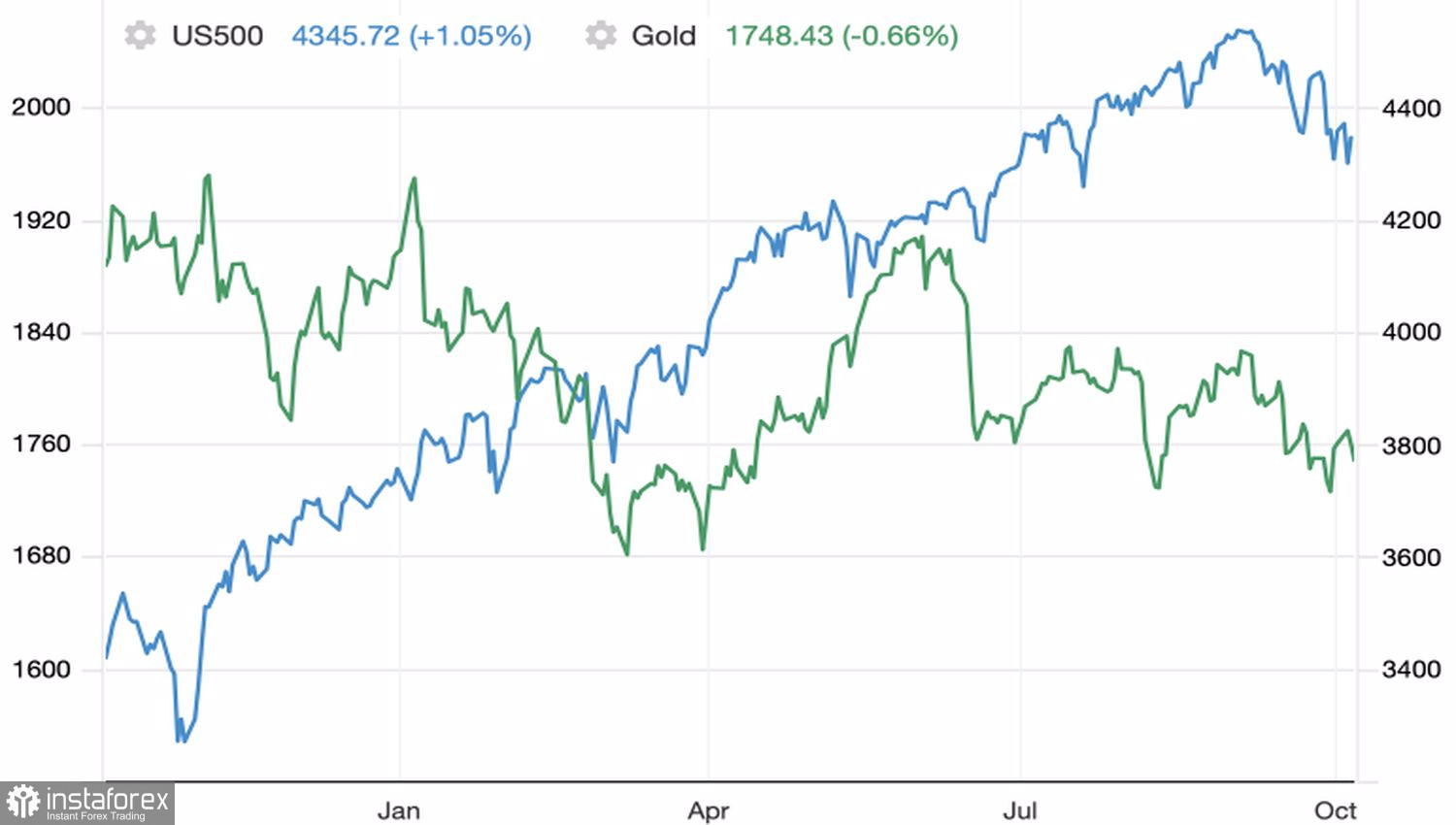

For many years, gold has been perceived as a safe haven asset, which is bought in order to diversify the investment portfolio and insure various kinds of risks, including inflation. Nevertheless, 2020-2021 proved that there are many flaws in this approach. Last year, the precious metal reached record highs thanks to colossal monetary incentives from the Fed, this year it moved to a downward trend amid rejection by the Central Bank. It behaves like a risky asset and is likely to continue doing so in the near future.

Indeed, the market is dominated by the view that good news from the US economy is bad news for both gold and stock indices. If the growth in September employment outside the agricultural sector is close to or exceeds the expected 488,000 by Reuters experts, the Fed will most likely begin to taper the $120 billion quantitative easing program as early as November. When this happened in 2013-2014, the precious metal fell hopelessly, eventually collapsing to $1,050 an ounce. History repeats itself, forcing investors to sell XAUUSD amid the S&P 500 correction.

Something similar happened at the height of the recession: in March 2020, the stock index pulled gold into the abyss with it, as investors, in their desire to maintain positions in stocks, threw the precious metal out of the portfolio, receiving cash in return.

Dynamics of gold and the S&P 500

What will happen to gold in the next 12 months? First you need to understand that getting rid of monetary incentives is an objective reality. American QE will become history by mid-2022, just as the program's predecessor did. Another thing is whether the Fed will follow the path of aggressive monetary restriction by raising the federal funds rate more than once next year, as investors currently believe, and resorting to 2-3 acts of monetary restriction? Much will depend on how long inflation remains at elevated levels. Contrary to consumer prices, which retreated from multi-year highs in August, the Cleveland Fed's trimmed mean inflation continued to rise.

If a high PCE is serious and for a long time, the Fed will simply be forced to act aggressively than sign a death sentence on gold. Another thing is that if stagflation breaks out in the United States, the Central Bank will have its hands tied. A return to unconventional monetary policy instruments will allow gold to rise from the ashes.

In the short term, the dynamics of XAUUSD will be determined by the strength of the American labor market. At the same time, one should look not at unemployment - the fall of which has recently given false signals, since only those Americans who are looking for work are taken into account in its calculation - but at employment. As Jerome Powell pointed out recently, the Fed does not need a very strong September report to start tapering QE in November.

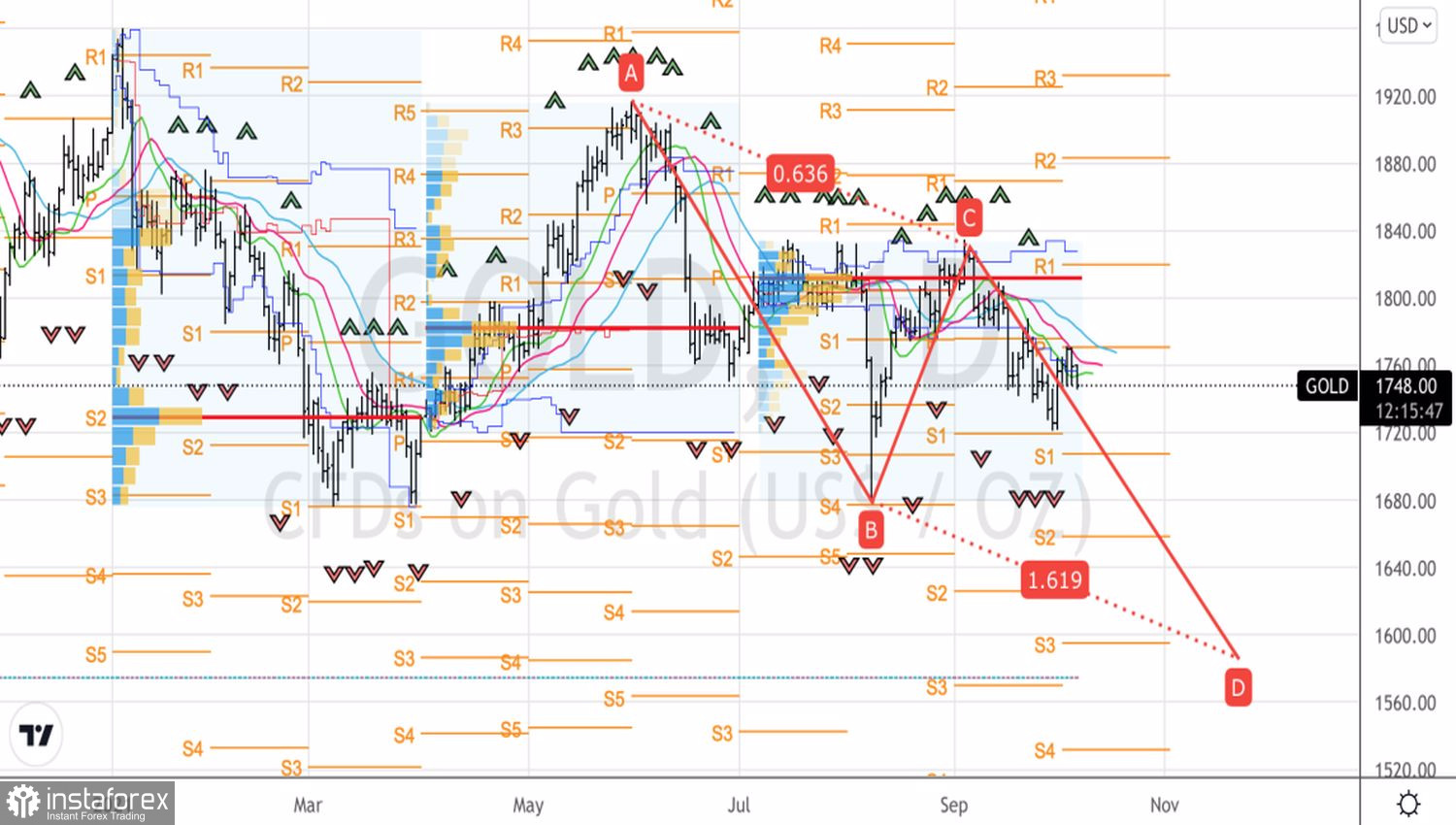

Technically, a breakout of the supports at $1,735 and $1,720 per ounce will increase the risks of activating the AB=CD pattern with a target of 161.8% and will become the basis for the formation of short positions in gold.

Gold, Daily chart

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română