Wave pattern

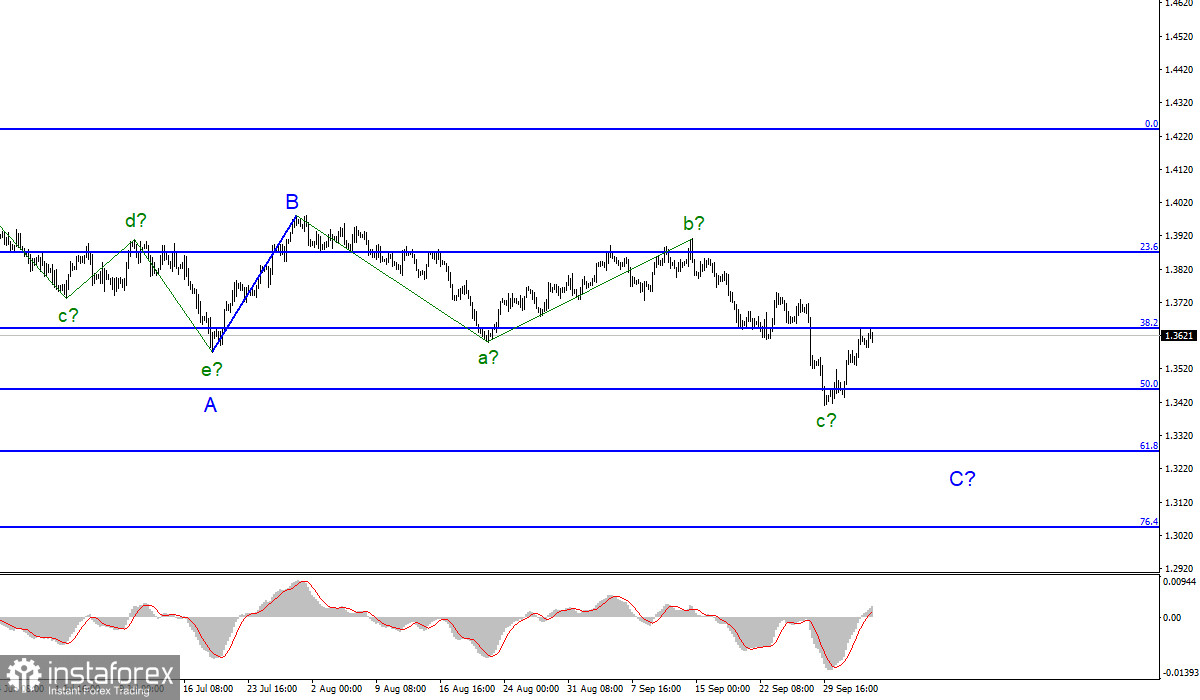

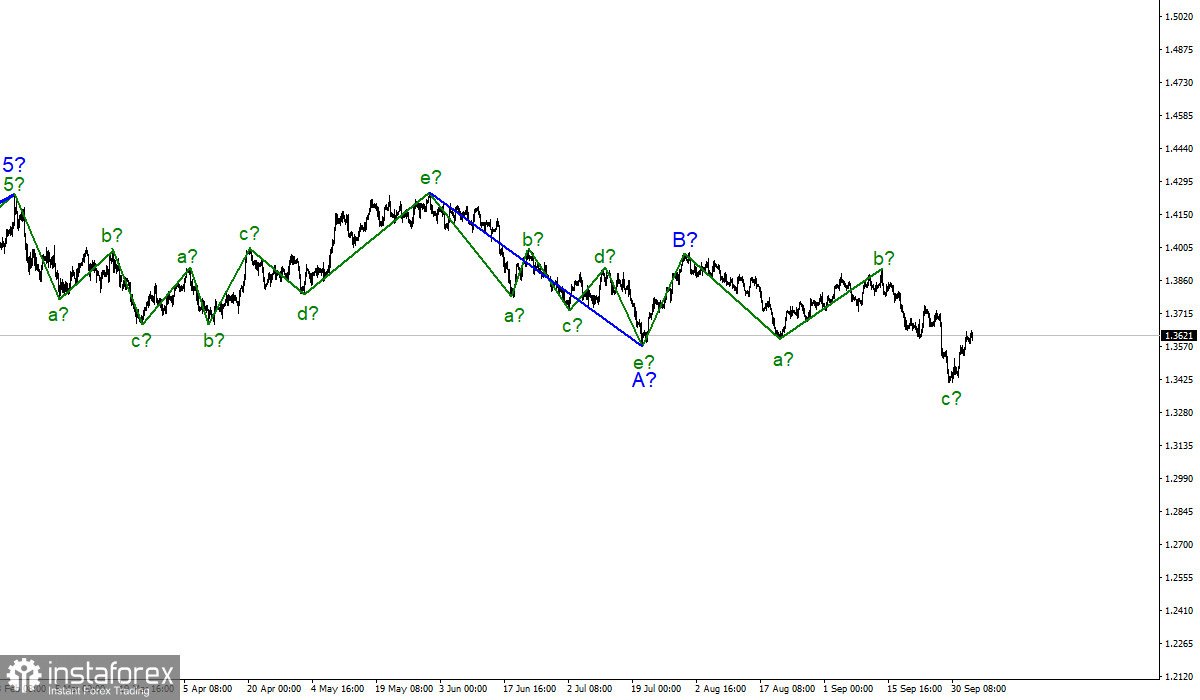

The wave counting for the GBP/USD has become more complicated and now it is expected to continue building a downward trend section. The instrument declined by 300 basis points over the past week, and also made a successful attempt to break the low of the previous waves a and e. Thus, adjustments were made to the wave pattern and now it has acquired the form of a downward trend section, which can also be corrective in nature. This assumption is prompted by the internal structure of the supposed wave A, which cannot be called impulsive. The supposed wave c in C of this trend segment also takes on an absolutely non-impulsive form. However, given the length of each wave in the composition of C, we can assume that it will turn out to be very long. If this assumption is correct, then the British pound gets a high probability of continuing the decline with the nearest target located near the level of 61.8%. However, the price has risen 220 basis points for the past three days, hence, I conclude the construction of wave d in the composition of C.

The pound survived the "fuel shock"

The exchange rate of the Pound/Dollar instrument increased by 25 basis points on Tuesday. Thus, the recovery of the British pound is slowing down. The quotes of the instrument reached the 38.2% Fibonacci level, an unsuccessful attempt to break through it will indicate the readiness of the markets for new sales of the pound. The most important news background concerning the fuel crisis in the UK has already exhausted its usefulness for the markets, so the movement of the instrument is slowing down. Meanwhile, the business activity index for the services sector in the UK recorded higher on Tuesday and it turned out to be better than market expectations.

In America, two indices of business activity for the service sector were released at once and both turned out to be higher than market expectations. Thus, it would be logical to see the increase of the instrument first, and then its decrease. However, the markets did not pay any attention to the ISM index, although the European currency did not ignore it. Based on this, I conclude that the pound is still in demand against the background of an improvement in the situation in Britain with fuel at gas stations. Thus, the 1.3643 mark will be important now. A successful attempt to break through it will indicate that the markets are ready to continue buying the pound, and the reason for this can only be an improvement in the fuel situation in the UK, since today we saw that the market does not pay attention to economic reports.

General conclusion

The wave pattern has changed dramatically after Monday's decline. Now the wave pattern has received a downward view, but not an impulse one. Therefore, now I advise you to sell the instrument for each MACD signal based on the construction of wave C, which can get quite long, with targets located near the calculated mark of 1.3273, which corresponds to 61.8% Fibonacci level. The instrument may continue to increase within the framework of the expected corrective wave d in C for some time. Its prospects depend on the success of the markets around the 1.3643 mark.

The upward section of the trend, which began its construction a couple of months ago, has taken a rather ambiguous form and has already been completed. The construction of the upward trend section has been canceled and now we can assume that on January 6, the construction of a new downward trend section began, which can turn out to be almost any size.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română