To open long positions on GBP/USD, you need:

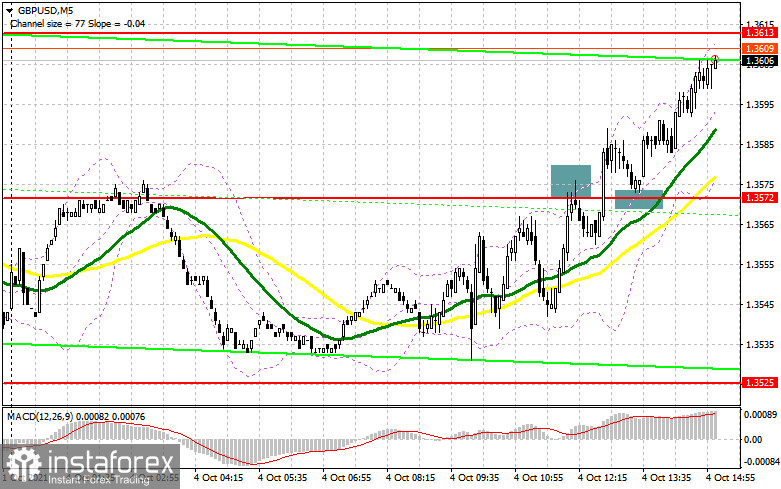

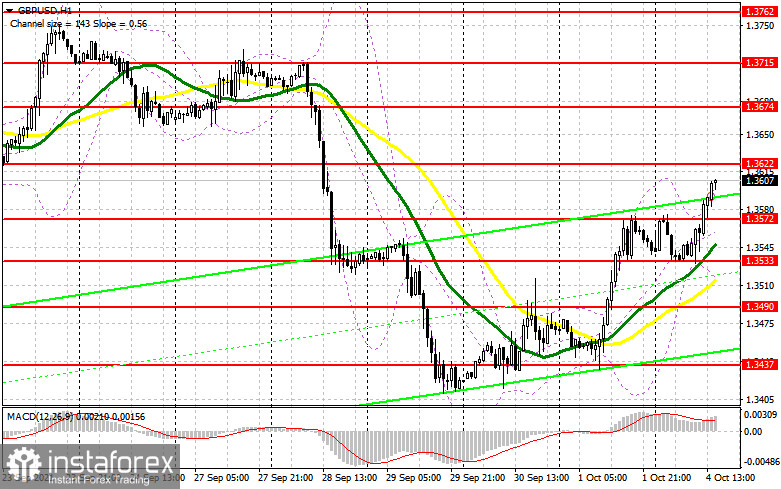

In the first half of the day, several signals were formed to enter the market. Let's look at the 5-minute chart and sort them all out. The formation of a false breakdown and an unsuccessful consolidation above the resistance of 1.3572 led to a sell signal for the pound. However, after moving down by about 10 points, the pressure quickly weakened, which led to a retest and a breakthrough of 1.3573. After some time, it was possible to observe a reverse test from top to bottom of 1.3573, which led to the formation of a signal to open already long positions in the continuation of the upward correction. At the time of writing, the pair has gone up about 35 points, and the demand for the pound remains. The primary task of buyers is to protect the support of 1.3572, which they formed following the results of morning trading. Only the formation of a false breakdown at this level will form a signal to open long positions to continue the upward trend and count on the recovery to the resistance of 1.3622. Below the level of 1.3572 are moving averages, playing on the side of buyers of the pound. Only a breakthrough and a test of 1.3622 from top to bottom against the background of weak data on the American economy forms an additional entry point into long positions to increase GBP/USD by the next resistance of 1.3674, where I recommend fixing the profits. A more distant target will be the 1.3715 area, the test of which will indicate the end of the September bearish trend. If the GBP/USD pair falls and there is no activity around 1.3572, the optimal scenario will be buying the pound from the minimum of 1.3533, but provided that a false breakdown is also formed there. I advise you to open long positions in GBP/USD immediately for a rebound in the area of 1.3490, or even lower - from 1.3437 with the aim of an upward correction of 15-20 points within a day.

To open short positions on GBP/USD, you need:

The bears did not cope with the initial task, and now they need to think carefully about how to regain the 1.3572 level. They need to try not to miss the large resistance of 1.3622, which buyers are now targeting. Only the formation of a false breakdown there during the American session will signal opening short positions. In this case, we can expect a decline in GBP/USD to the support of 1.3572. A breakthrough and a reverse test of this area from the bottom up, together with strong data on changes in the volume of production orders in the US, will hit the bulls' stop orders. It will form an additional entry point into short positions to reduce GBP/USD to the level of 1.3533, just above which the moving averages pass. With very active sales of the pound, we can expect an update of 1.3490, where I recommend fixing the profits. In the absence of active actions of bears in the area of 1.3622, there will be a real reason for panic since a break in this range will lead to a larger movement of GBP/ USD up. In this case, I advise you to postpone sales until the next major resistance of 1.3674, from where I also recommend opening short positions only if a false breakdown is formed. It is possible to sell GBP/USD immediately for a rebound from the maximum in the area of 1.3715, counting on a downward correction of 25-30 points within a day.

The COT reports (Commitment of Traders) for September 21 recorded both a sharp increase in short ones and an increase in those who bet on further growth of the pound. The meeting of the Bank of England on monetary policy, which took place last week, significantly influenced the mood of buyers of risky assets. The decision to raise rates in November this year will support the buyers of the pound in any serious downward corrections of the pair, so it is best to bet on the growth of GBP/USD in the medium term. The deterioration of inflation may force the Bank of England to act more aggressively, which is also an additional signal to buy the pound. The only problem that stands in the way of the bulls is the Federal Reserve System. However, it will not raise interest rates yet, but also going along the path of tightening monetary policy. The lower the pound falls, the more active buyers of risky assets will be, betting on real changes in the monetary policy of the Bank of England in the future. The COT report indicates that long non-commercial positions increased from 44,161 to the level of 51,910.

In contrast, short non-commercial positions jumped almost one and a half times – from the level of 39,371 to the level of 52,128, which led to the complete capitulation of the advantage of buyers in the market and the preponderance towards sellers of the pound. As a result, the non-commercial net position regained its negative value and dropped from 4,790 to the level of -218. The closing price of GBP/USD fell 1.3837 to 1.3662 last week.

Signals of indicators:

Moving averages

Trading is conducted above 30 and 50 daily averages, which indicates the continuation of the bull market.

Note: The author considers the period and prices of moving averages on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

In case of a decline in the pound, the average border of the indicator around 1.3555 will provide support.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet specific requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română