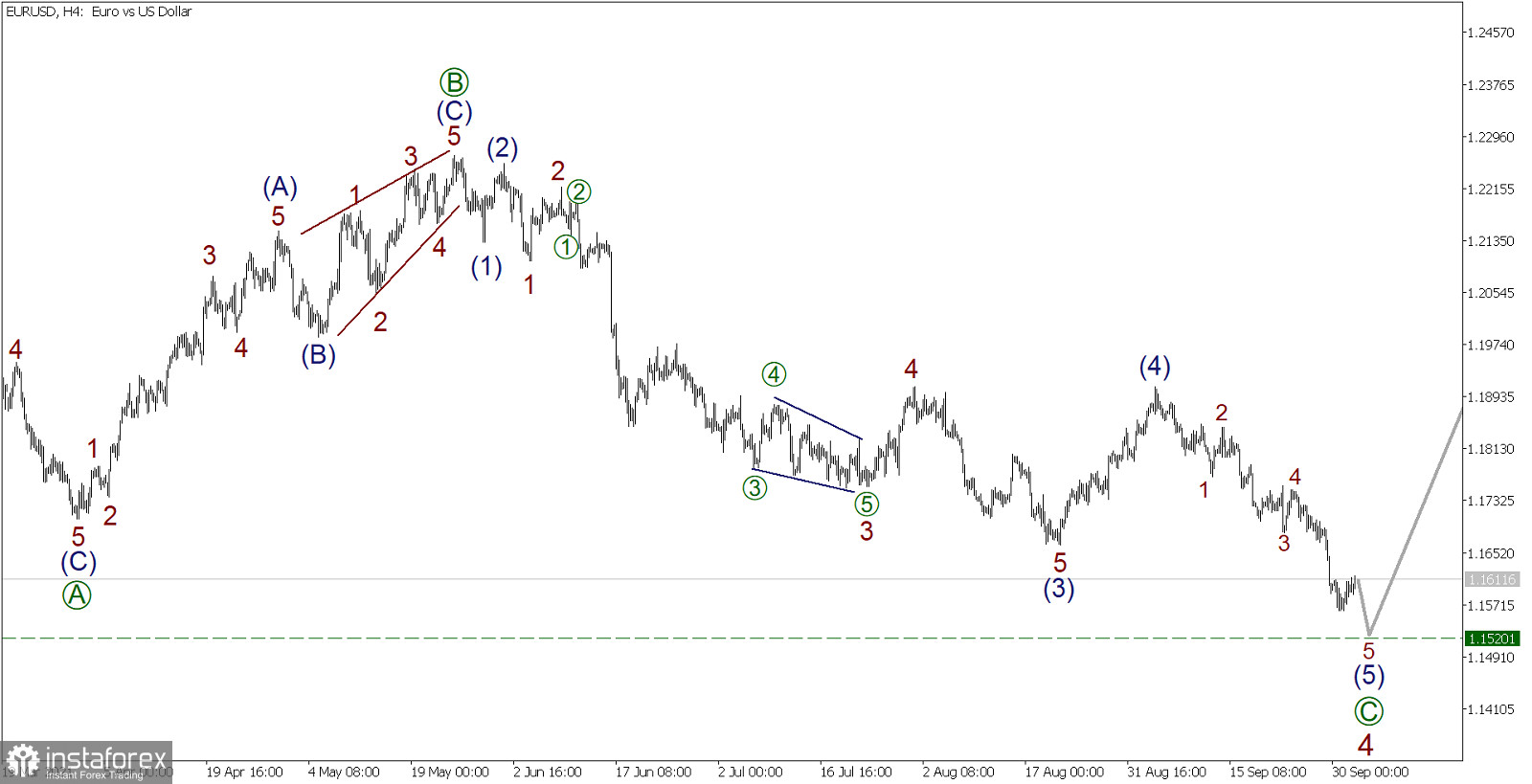

EUR/USD, H4 timeframe:

Let's continue to analyze the situation of the EUR/USD pair through Elliott's theory.

Just like the past trading week, a horizontal correction wave 4 is being formed for the EUR/USD pair, which consists of three main sub-waves and taking the form of a wave plane [A]-[B]-[C].

It seems that the first two zigzag waves [A] and [B] are fully done. A bearish impulse wave [C] is now forming. As part of impulse [C], sub-waves (1)-(2)-(3)-(4) were completed, while the final sub-wave (5) is still under development.

It is assumed that the price will decline to the level of 1.1520 in the near future, where the sub-wave (5) will be completed, which may be followed by a growth in the currency pair.

Currently, it is recommended to consider opening sell deals in order to take profit at the specified level.

There is no economic news expected today, so it can be assumed that the market will behave predictably within the chosen scenario.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română