Global stock markets ended the previous week in the negative zone, while the US dollar continued to consolidate against major currencies. Commodity markets also had a tough week. Crude oil prices came under pressure for the first time since late August.

The main reasons for this market behavior are still investors' expectation of the beginning of a reduction in the flow of dollar liquidity due to the Fed's decision to begin the process of "narrowing" asset purchases – government bonds and secured mortgage corporate obligations, as well as uncertainty about when the decision will be made to raise the US government debt ceiling or not. The deadline is on October 18. In addition, the focus of the market is the corporate reporting of companies for the third quarter.

The problem with America's employment is another negative news for the markets as a whole, and the US market in particular. The data published last week on the number of applications for unemployment benefits showed depressing values. It rose to 362,000 instead of the forecasted decline to 335,000 from 351,000 a week earlier. This news caused a drop in US stock indexes and had a negative impact on other global stock markets.

What threatens the markets with weak employment statistics in America for September?

This week, the market's attention will be focused on the publication of the most important data on unemployment in the United States, which should have a strong impact on market behavior, and possibly on the result of the Fed's next meeting. According to the forecast, the US economy was to receive 460,000 new jobs in September against 235,000 a month earlier. In addition, the unemployment rate should decline from 5.2% to 5.1%.

If the data really turn out to be in line with expectations or even higher, this will serve as a reason for an increase in demand in the stock markets and, oddly enough, to its equally limited decline after the local strengthening of the US dollar. The reason for such dynamics will be the growth of expectations on the part of investors that the US economy will continue to recover. But if the number of new jobs is noticeably lower than forecast again, this will hit demand in the stock markets. Meanwhile, the US dollar is unlikely to grow noticeably after a local decline, since the next negative data from the labor market may serve as a basis for the Fed's decision to slow down a reduction in incentive measures, as well as a promising increase in interest rates.

In general, this week may have a noticeable impact on the behavior of the markets during this month with far-reaching consequences.

Forecast of the day:

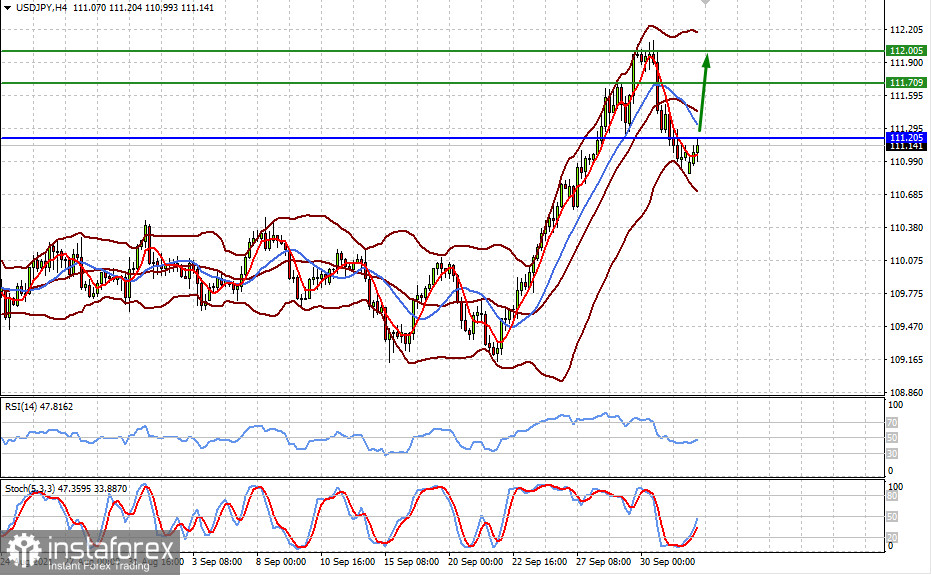

The USD/JPY pair is trading below the level of 111.20 but above 111.00. If the negative mood continues on the markets, the pair, breaking the level of 111.20, will rush to 111.70, and then to 112.00.

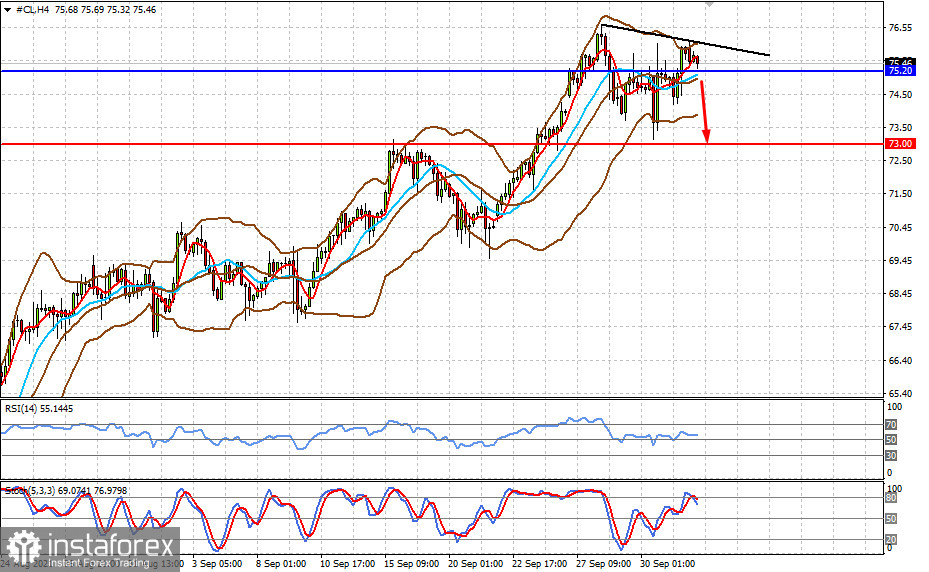

WTI crude oil prices may decline if the OPEC + summit decides to increase crude oil production. In this case, oil quotes will drop to $ 73.00 per barrel.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română