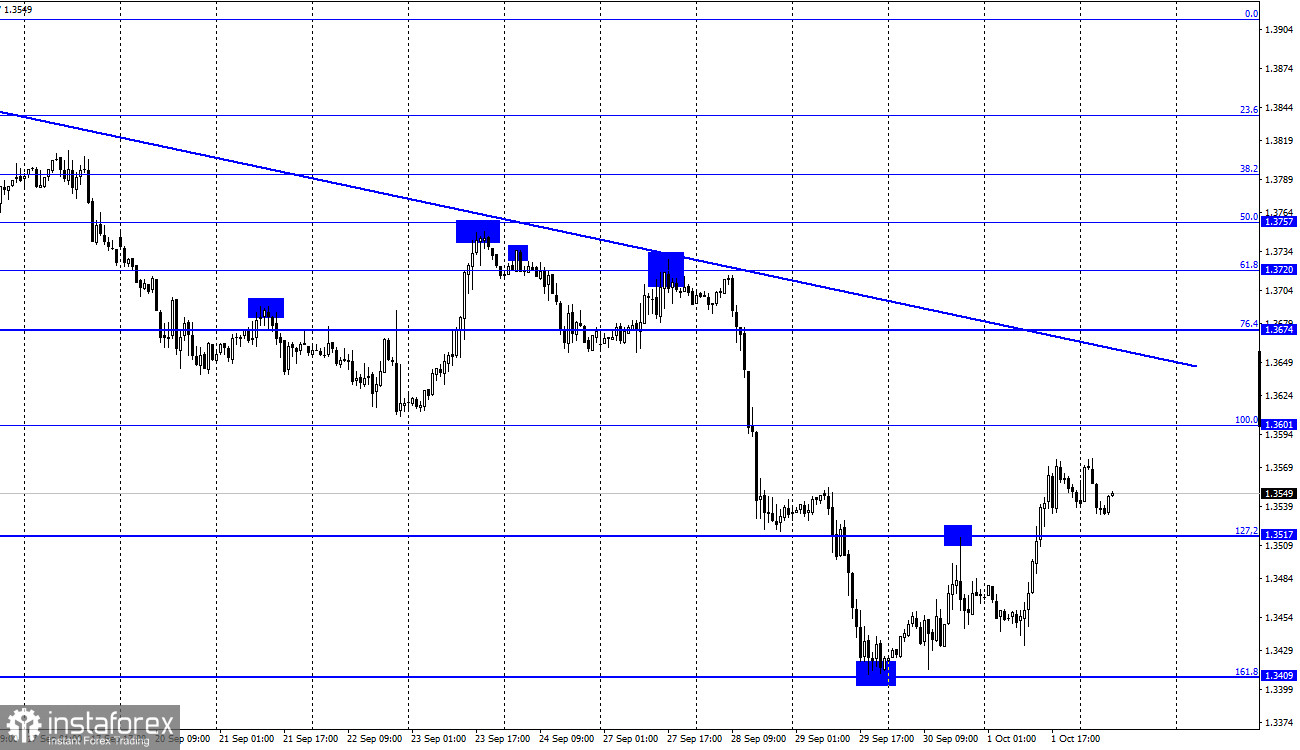

GBP/USD – 1H.

According to the hourly chart, the GBP/USD pair continued the growth process in the downward trend line on Friday. It was also fixed above the corrective level of 127.2% (1.3517), allowing us to count on continued growth in the direction of the Fibo level of 100.0% (1.3601). The consolidation of quotes below the level of 1.3517 will favor the US currency and the resumption of the fall in the direction of the corrective level of 161.8% (1.3409). The information background for the pound on Friday was very weak. As I said in the article on the euro/dollar, the American data did not impress traders. And in the UK, only one report on business activity in the manufacturing sector was released. Its value turned out to be better than traders' expectations, so the pound showed growth in the morning.

However, I also believe that the British were supported by the news about Britain's "fuel chaos." Over the past few days, it became known that the British government has taken several steps to resolve the situation. In particular, Boris Johnson allowed the extension of temporary visas for 5,000 truckers and ordered the country's military forces to deliver fuel at gas stations. According to British journalists, the situation is gradually improving, although fuel shortages persist at some gas stations. Nevertheless, the situation is still improving, so the pound could show growth on Friday against the background of this improvement. In the same week, the information background for the British will be very weak. An important Nonfarm Payrolls report will be released only on Friday, which should have a serious impact on the mood of traders. And there won't be a single interesting and important report in the UK during the week. Attention can be paid only to the indices of business activity in the construction sector and the services sector. However, they are unlikely to affect the exchange rate change of the British greatly.

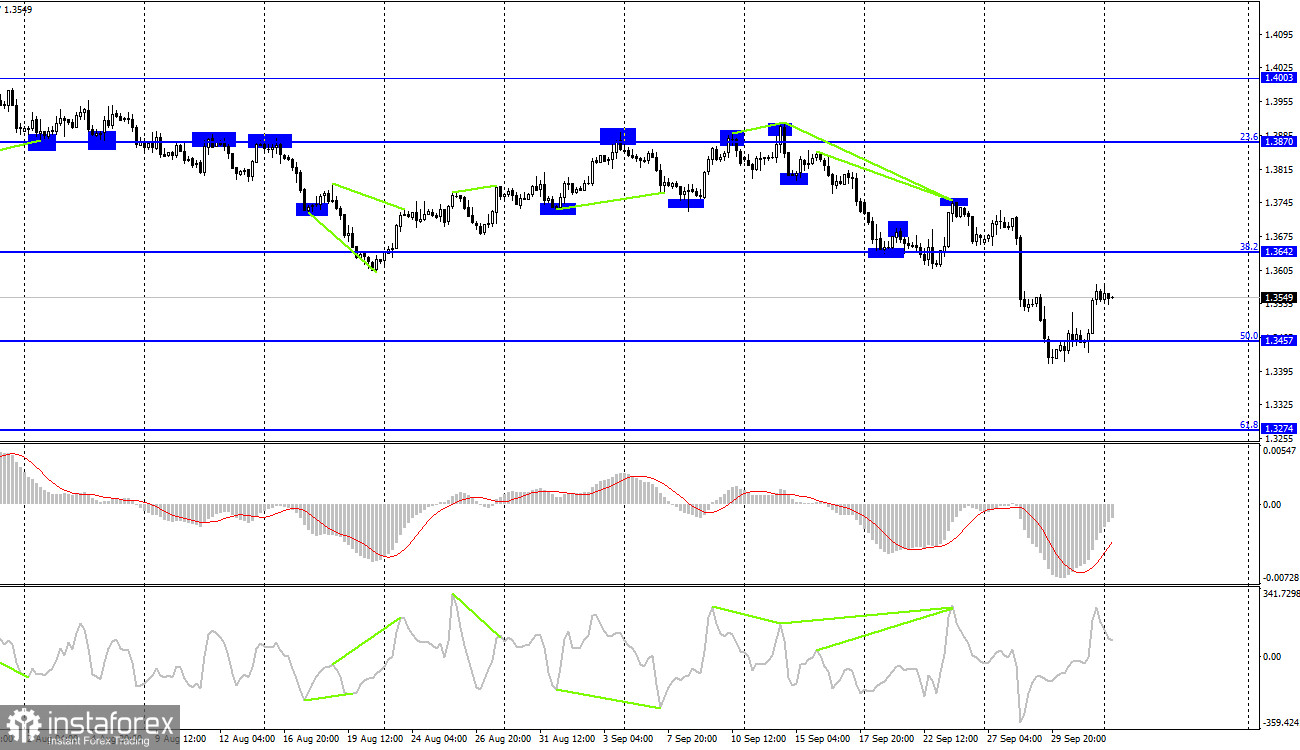

GBP/USD - 4H.

The GBP/USD pair on the 4-hour chart performed a reverse consolidation above the corrective level of 50.0% (1.3457). The growth process can be continued towards the next Fibo level of 38.2% (1.3642). Fixing the pair's exchange rate below the level of 50.0% will work in favor of the US currency and the resumption of the fall in the direction of the corrective level of 61.8% (1.3274).

News calendar for the US and the UK:

On Monday, the calendars of economic events in the US and the UK are empty. Thus, the information background will not be weak. It will be absent today. Traders will be waiting for the Nonfarm Payrolls report, which will be released on Friday. During the week, I also highlight a rather important ISM report in the US services sector.

COT (Commitments of Traders) report:

The latest COT report from September 28 on the pound showed that the mood of the major players has become a little more "bullish." In the reporting week, speculators opened 5,412 long contracts and 4,577 short contracts. So the difference is not too big. In general, there is almost complete equality in the number of open long and short contracts for all categories of traders. It means that the mood of speculators is now as neutral as possible. Nevertheless, in recent months, the mood of the "non-commercial" category has only become more "bearish," so there is a trend that suggests a further decline in the British dollar.

GBP/USD forecast and recommendations to traders:

I recommend buying the pound when the quotes rebound from 1.3517 on the hourly chart with a target of 1.3601. It was also possible to open purchases when closing above the level of 1.3517 and now stay in them. I recommend opening new sales when closing below the level of 1.3517 with a target of 1.3409.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy foreign currency not to make speculative profits but to ensure current activities or export-import operations.

"Non-reportable positions" are small traders who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română