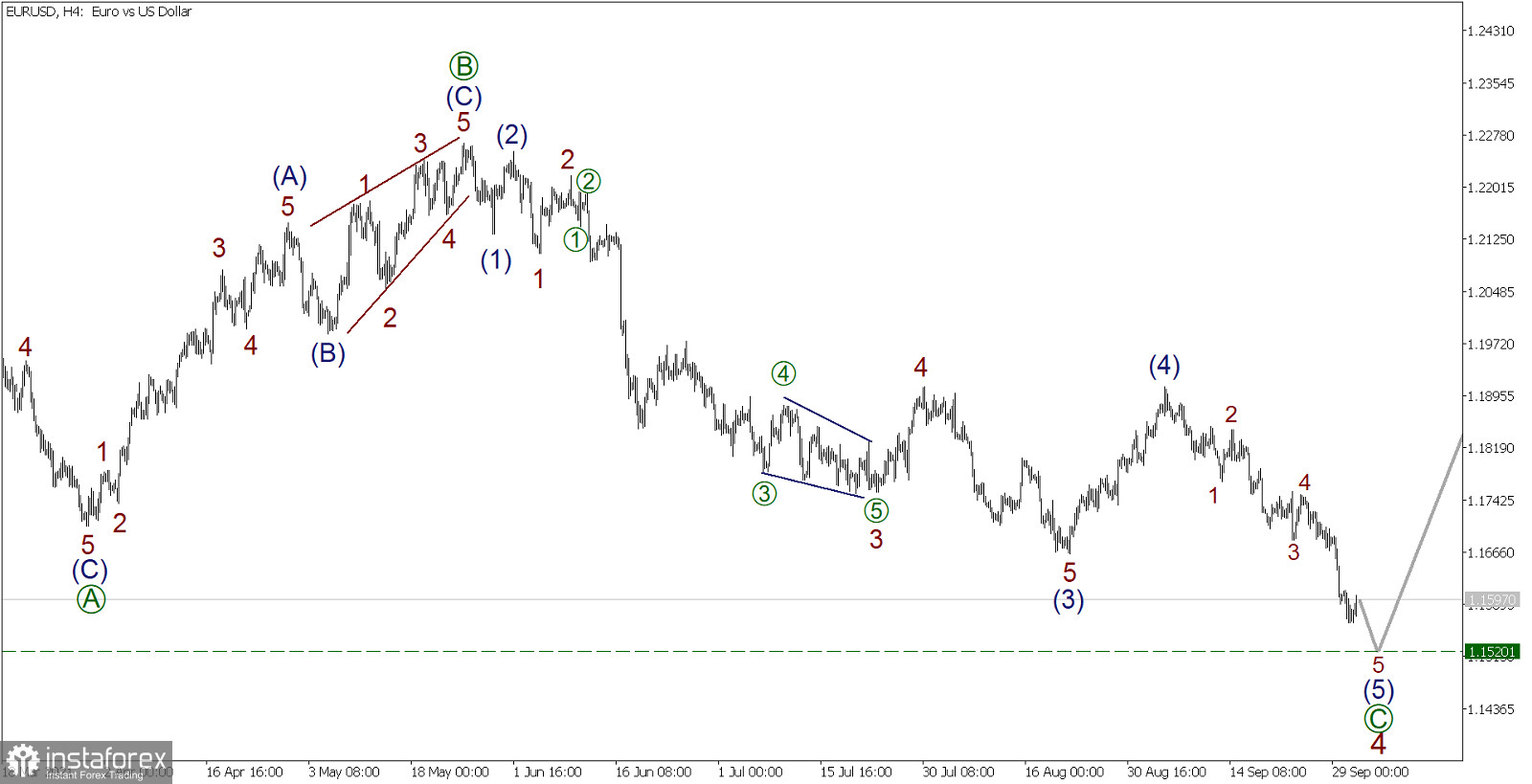

EUR/USD, H4:

The formation of the EUR/USD currency pair presupposes the continuation of the development of horizontal correction 4. It consists of three subwaves and is a wave plane [A]-[B]-[C]. The subwaves [A] and [B] are zigzags, and subwave [C] is an impulse that is still under development.

We are currently in the final fifth wave of impulse [C]. Wave (5) consists of subwaves 1-2-3-4-5. It seems that the last subwave 5 is still developing and may end near the 1.1625 level. The market will then begin to rally higher in the fifth wave of a major bullish momentum.

The ISM Manufacturing PMI will be released today at 14:00 UTC. This data is considered a very important and reliable economic indicator that can affect the acceleration of the decline in value to the specified level, and then the Eurodollar can start to move up impulsively.

In the current situation, it is possible to consider opening sales transactions in order to take profit at the specified level.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română