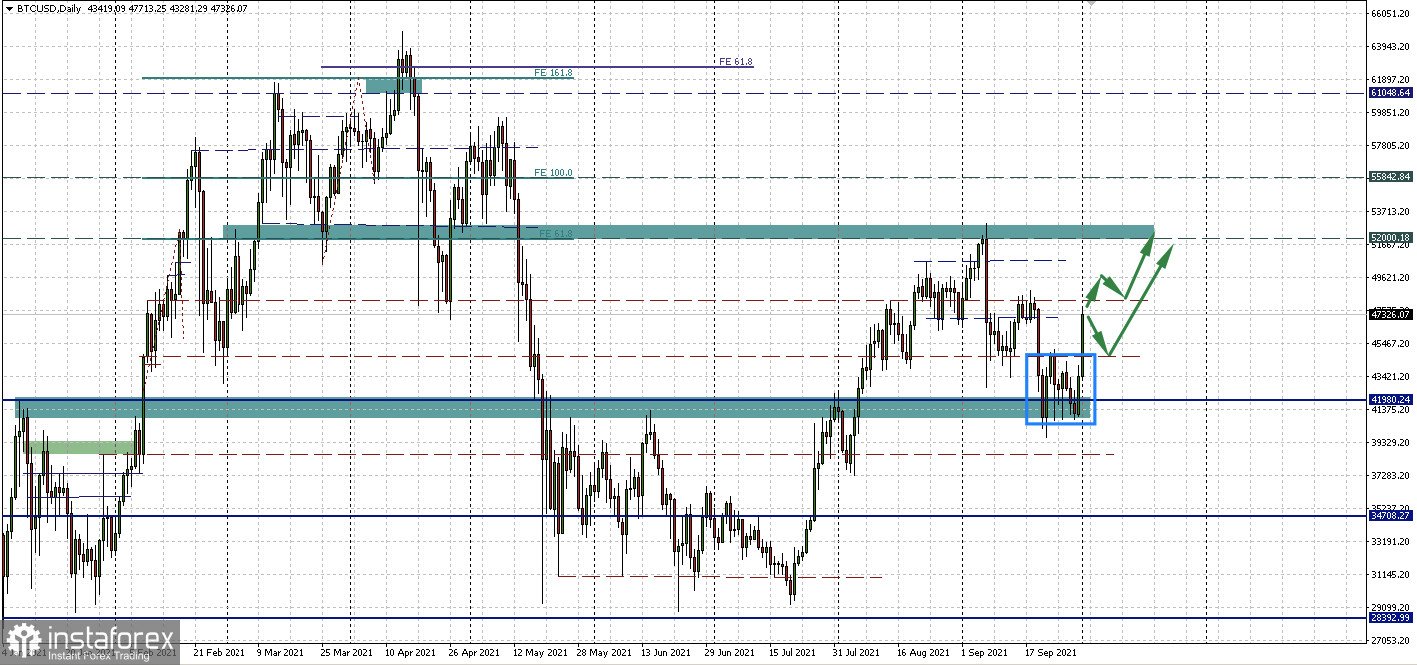

Bitcoin moved up on Friday from a narrow consolidation range between the support area of 40,977.38 - 41,980.24 and the resistance of 44,807.24 (red dotted line). Now the main cryptocurrency has an open path to the range of $50,000 - $52,000 per coin, and when it passes through, the next target is to the historical maximum at $64,000. At the time of writing, bitcoin is already trading above $47,000, but let's see how the daily candle closes.

Now the closest technical benchmarks for BTC/USD will be the nearest resistance of 48,178.13, and in case of consolidation above it, the next target will be the zone of 52,000.18 - 52,929.15 (from a technical, not psychological point of view).

Well, by all accounts, concerns about Chinese repression, risk aversion, and regulatory complexities have already been worked out by the market. And now, according to various analysts, October could be very good for the main cryptocurrency.

Bobby Lee, a veteran of the cryptocurrency industry who is the co-founder of the BTCC exchange and the brother of Litecoin creator Charlie Lee, believes that bitcoin will see a rally caused by the fear of lost profits (FOMO) by the end of the year. Against this background, its price may well rise above $100,000.

The crypto veteran noted that the ban on the use of bitcoins in China was predicted even earlier, and now the hammer has fallen. According to him, the bad news "went out of the way," and now the market "processes, digests this information."

Lee claims that Bitcoin's move to the $100,000 mark will result in widespread media coverage. This means that it will lead to a new rally in the market, which will be fueled by investor fears of missing out.

It is worth noting that Lee's early forecasts are generally worked out. In August 2018, he announced that the price of the flagship cryptocurrency would surpass $60,000 by 2020. Although his forecast did not coincide in time (and the timing in financial markets is extremely difficult to predict), bitcoin reached a record high near $64,000 a few months later before heading off for a correction.

At the end of 2019, Lee also noted that he believed BTC/USD could reach $100,000 in the next phase of growth after the correction.

Going back to China and its bans, it was previously noted that the new wave of restrictions did not frighten the market, and crypto investors used this time to increase their positions. MicroStrategy CEO Michael Saylor recently confirmed this idea, saying that China is constantly banning something. But, despite this, market participants managed to earn trillions of dollars on assets prohibited by China.

What should private traders do now? It is hardly worth trying to jump into the current rally. It is worth waiting for the close of the daily candle, and then buying either on a pullback to the level of 44,807.24, if it is confirmed as a support, or from the level of 48,178.13, if the price consolidates higher.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română