The first month of fall was the best of the year for the USD index, thanks to the belief in a federal funds rate hike in 2022 and strong demand for safe-haven assets. The correction of the US stock indices has created a tailwind for the bears on EUR/USD, and it can be assumed that the volatility of the US stock market will only increase next year. A deep recession in the S&P 500 is not very likely, but storms are likely to occur more often than in 2021.

In my opinion, there are three reasons for this. First, the market will have less liquidity than in the outgoing year. The Fed will taper QE and the US economy will get stronger, so it will be able to absorb more money. Secondly, US GDP will return to its normal growth rate, which suggests that the S&P 500 will do the same. It is hardly worth expecting an increase in the stock index by 15%, which it did in January-September. Finally, higher costs, including those associated with supply chain disruptions and increased patches, will lead to lower corporate profits.

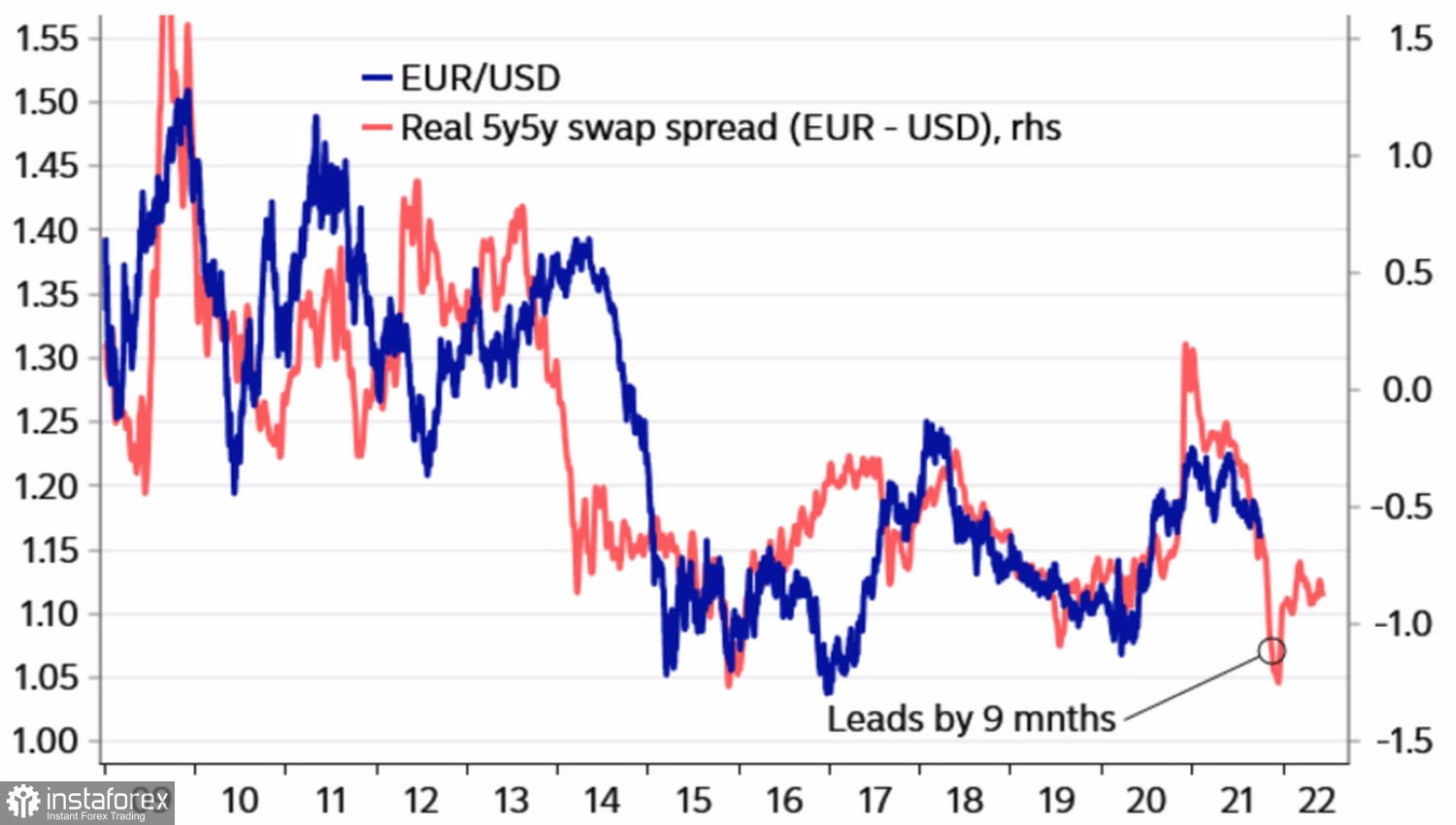

As for the debt market, the growth of Treasury bond yields will continue, but this is a double-edged sword. Rising borrowing costs are usually bad news for companies' bottom line, but they also signal a stronger economy. The latter, in turn, is a reason to buy shares. Faster growth in real debt rates in the US than in the eurozone is the key to the future dynamics of EUR/USD. In terms of differential real interest rate swaps, the pair should trade at 1.05. Is it where it's going?

EURUSD dynamics and real swaps differential

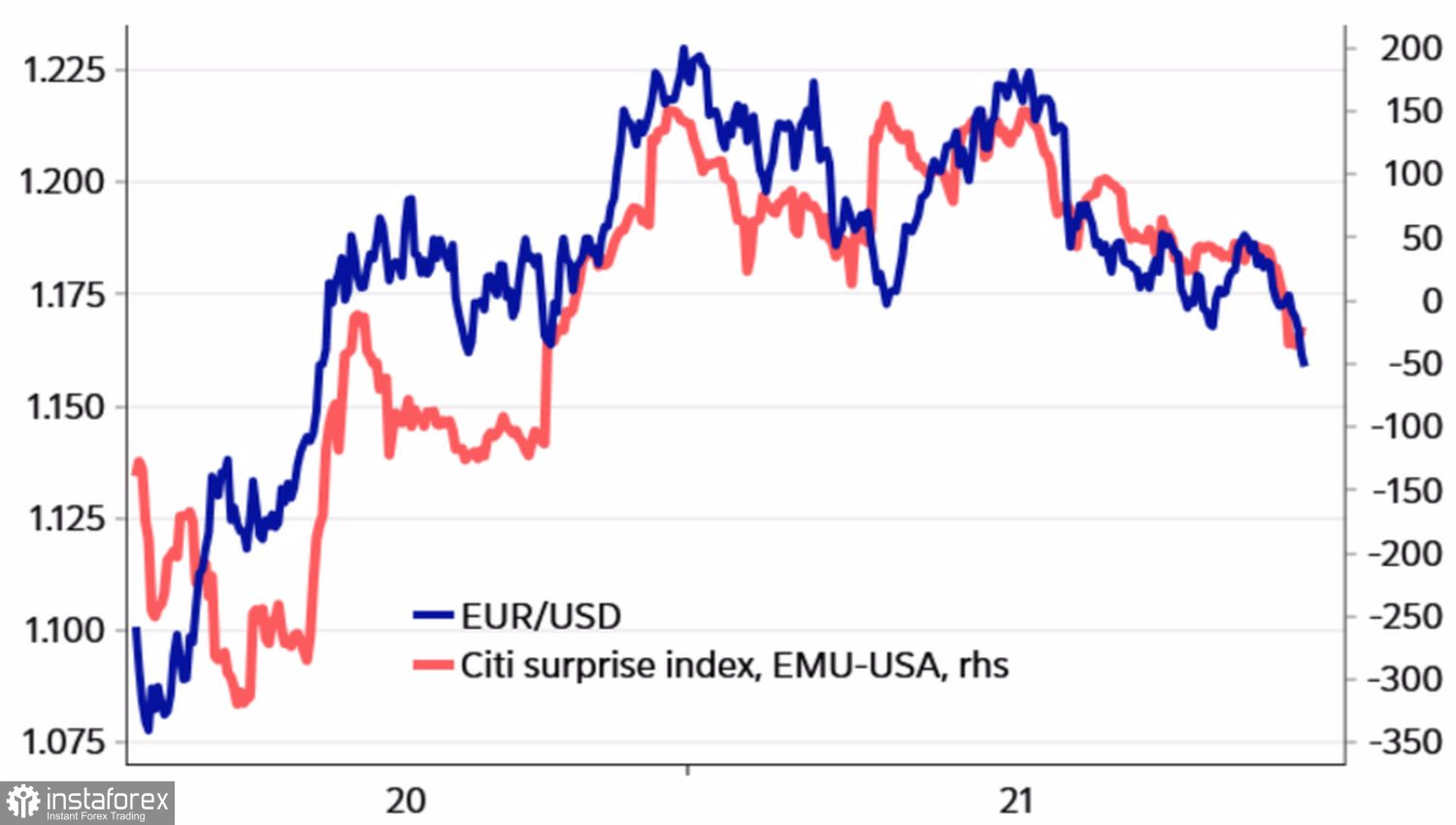

It is clear that you can fall to such a low level by today's standards, or you can crawl. In September, the euro collapsed against the US dollar, including because the US macro statistics unexpectedly began to pleasantly surprise, while the European indicators, on the contrary, were more often disappointing. As a result, from the point of view of the difference in the dynamics of the indices of economic surprises for the US and the currency block, the fall of EUR/USD looks natural.

Dynamics of EURUSD and differential of economic surprise indices

The highlight of the first full week of October appears to be the US labor market report, although, in reality, it is unlikely to have a bombshell effect. Employment is sensitive to indicators such as the spread of COVID-19 across the United States, and the fact that the number of infections is starting to decline suggests that the September labor market report will be better than the August one. This will be enough to inspire the Fed to taper QE in November.

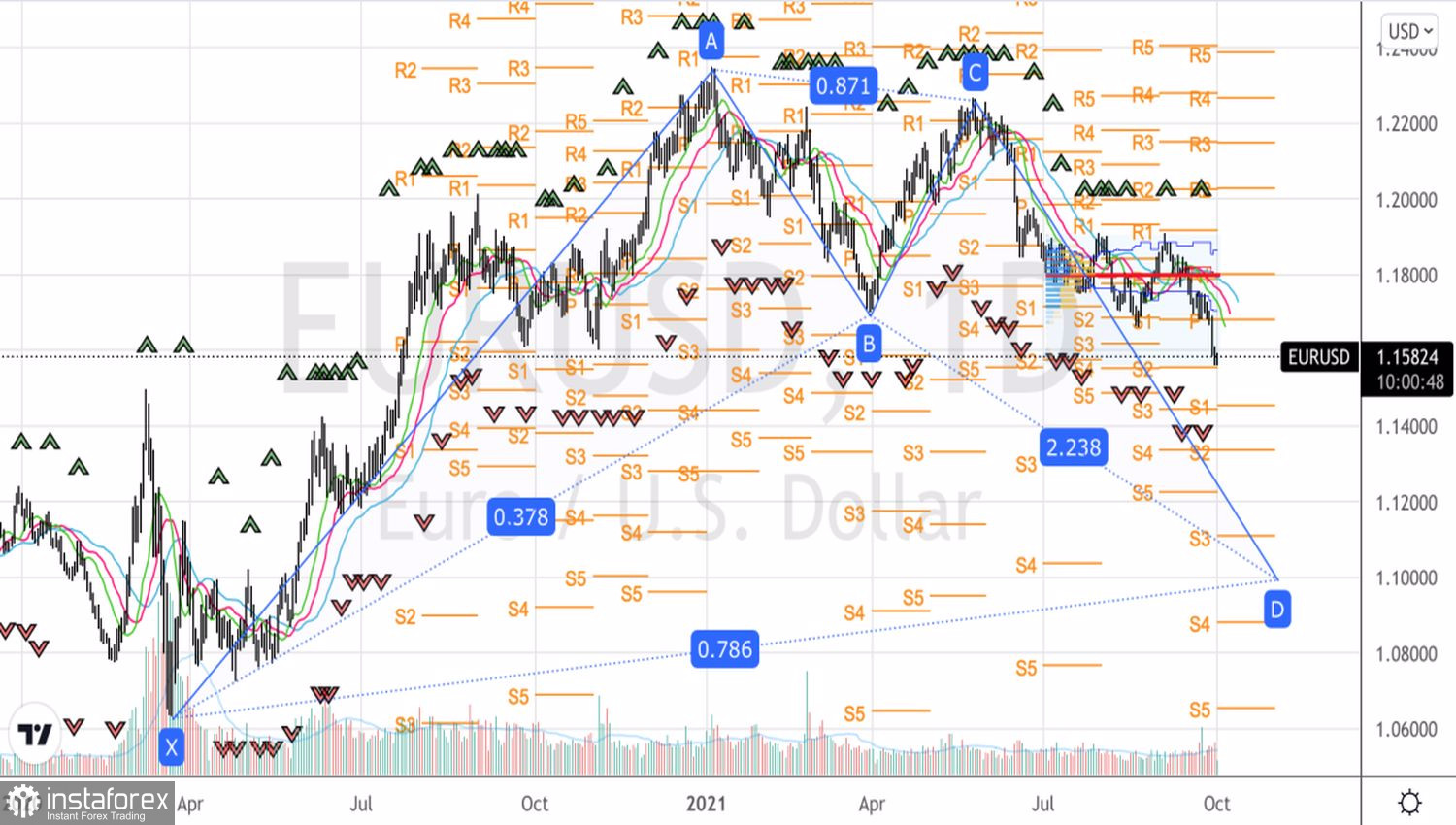

Technically, there is a Gartley pattern on the EUR/USD daily chart. Its target of 78.6% corresponds to 1.1. Thus, based on the principles of harmonious trading, the potential of the downward movement of the main currency pair is far from being exhausted, and the best strategy in such conditions is to sell the euro against the US dollar on the rise.

EUR/USD, Daily chart

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română