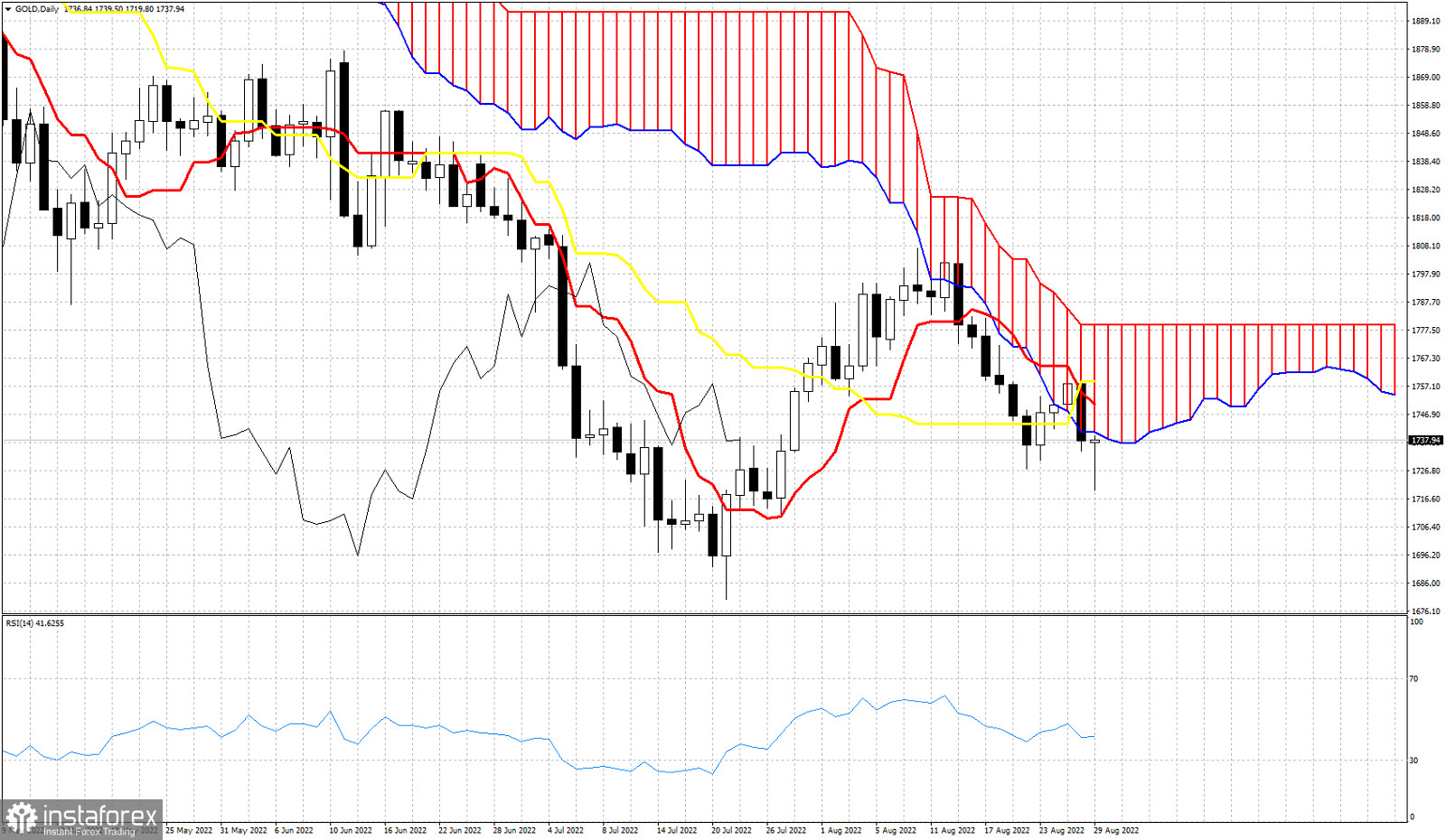

Gold price ended last week under pressure with price breaking below the Daily Kumo (cloud). This week Gold price started again under heavy pressure making new lower lows around $1,720, but bulls made a come back and are now reclaiming $1,740. Gold bulls are trying to re-enter the Kumo. This would turn Daily trend to neutral from bearish. It is important to see a daily close above $1,740 as this could lead to a bigger bounce towards $1,780. The tenkan-sen (red line indicator) has already crossed below the kijun-sen (yellow line indicator). This is a bearish sign. On the other hand the daily candlestick in Gold suggests that bulls are strong around $1,720 and that long upper tail candlestick is a sign of a bullish reversal. Gold is showing reversal signs the day we reached the 61.8% Fibonacci retracement of the entire rise. All bulls want to see now is for price to start forming higher highs and higher lows.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română