The AUD/USD pair plunged in the short term as the Dollar Index jumped towards new highs. It was trading at 0.6898 level at the time of writing. Today, the currency pair rebounded as the DXY retreated a little after its strong rally.

Fundamentally, the AUD received a helping hand from the Australian Retail Sales indicator which rose by 1.3% versus the 0.3% expected, much stronger than the 0.2% growth registered in the previous reporting period. Tomorrow, Building Approvals may drop by 3.1%.

On the other hand, the US is to release high-impact economic data. The CB Consumer Confidence is expected at 97.4, above 95.7 in the previous reporting period, while JOLTS Job Openings could drop from 10.70M to 10.43M.

AUD/USD Throwback

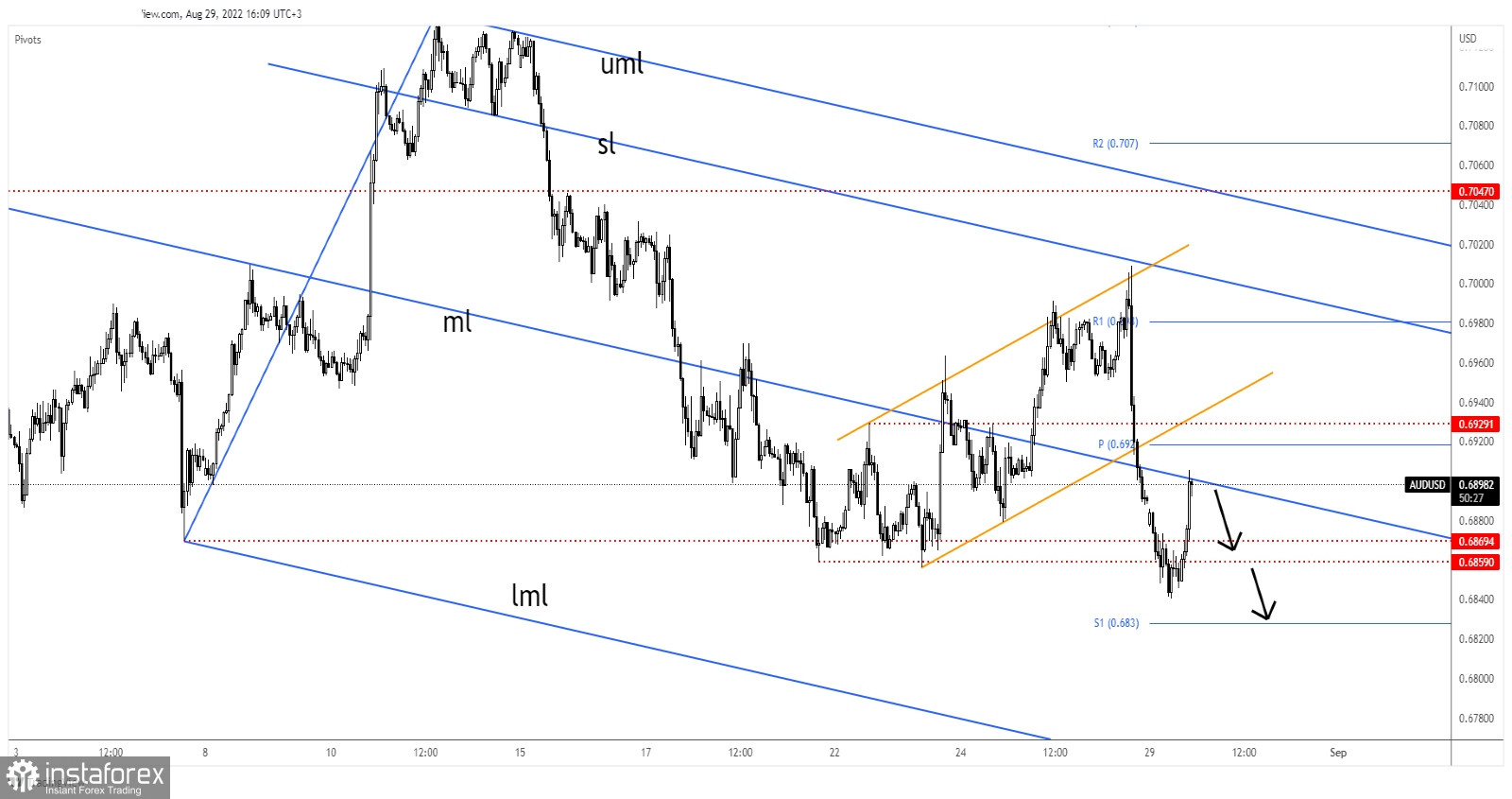

The AUD/USD pair rebounded after reaching the 0.6840 level. Now, it is challenging the descending pitchfork's median line (ml) which stands as a dynamic resistance. The weekly pivot point of 0.6920 and the former high of 0.6929 represent upside obstacles as well.

After its massive drop, a temporary rebound was expected. It could test and retest the near-term resistance levels before dropping deeper. In my opinion, only jumping and stabilizing above 0.6929 could invalidate a larger downside movement.

AUD/USD Forecast

Testing and retesting the median line (ml) and the pivot point (0.6920), registering only false breakouts above these levels may announce a new sell-off. It's hard to believe that AUD/USD may register a larger growth.

Still, a downside continuation could be viewed by a valid breakdown below the 0.6858 key support level. Staying below the median line (ml) may announce a larger downside movement towards the lower median line (lml).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română