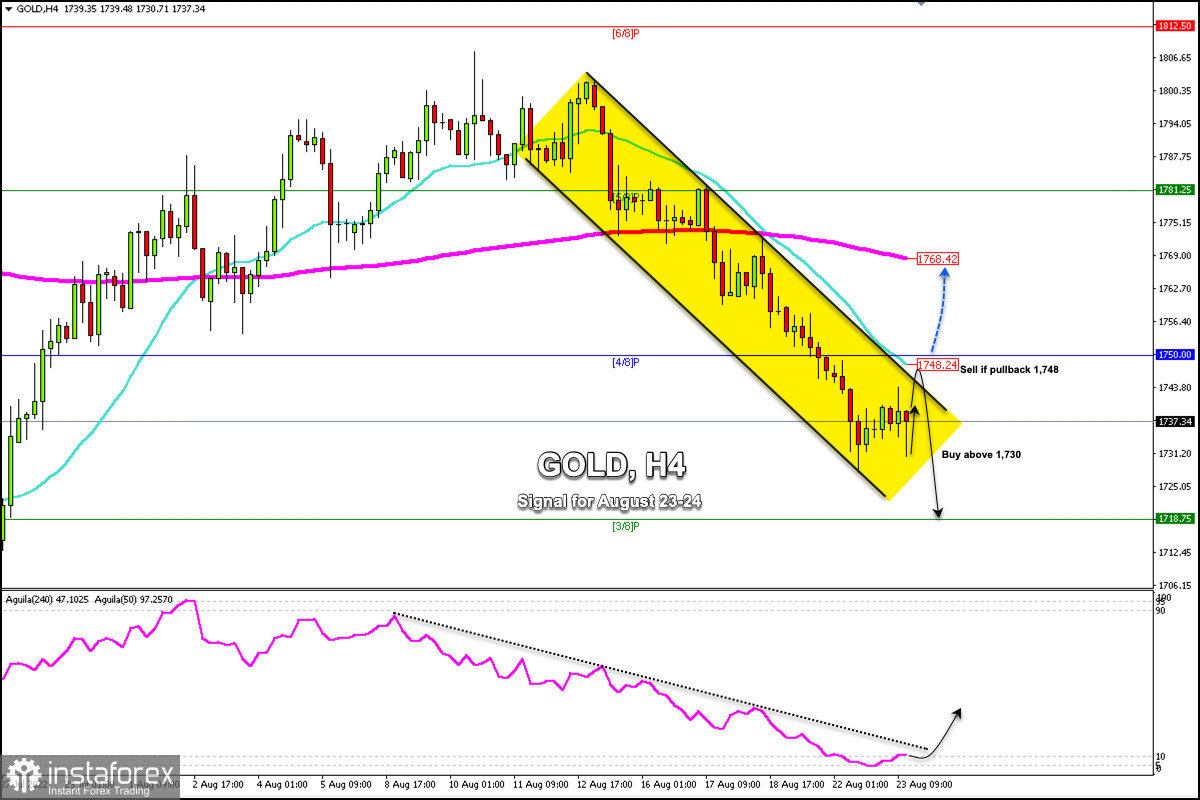

Early in the American session, gold (XAU/USD) was trading around 1,737. It is bouncing after hitting a daily low at 1,731.37.

Gold is is staying within its downtrend channel formed since August 11. It is likely that in the coming hours it could continue to bounce to the top of the downtrend channel around 1,743 and could even reach the 4/8 Murray zone located at 1,750.

Treasury yields are in the overbought zone, the 10-year note is trading around 3.08%. A decline in bonds could favor the recovery of gold.

The retracement from the levels above 1,807 bottomed on Monday at 1,727. A reduction of more than 80 dollars means that gold could make a technical correction in the next few hours towards the resistance zone of 1,750.

A break of the downtrend channel and consolidation above the pivot point of 1,750 (4/8 Murray) means there could be a change in the trend and it could reach the 200 EMA at 1,768.

The eagle indicator has reached the extreme oversold level, which may enable the technical rebound to continue until it reaches the 4/8 Murray zone or 1,768 (EMA 200).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română