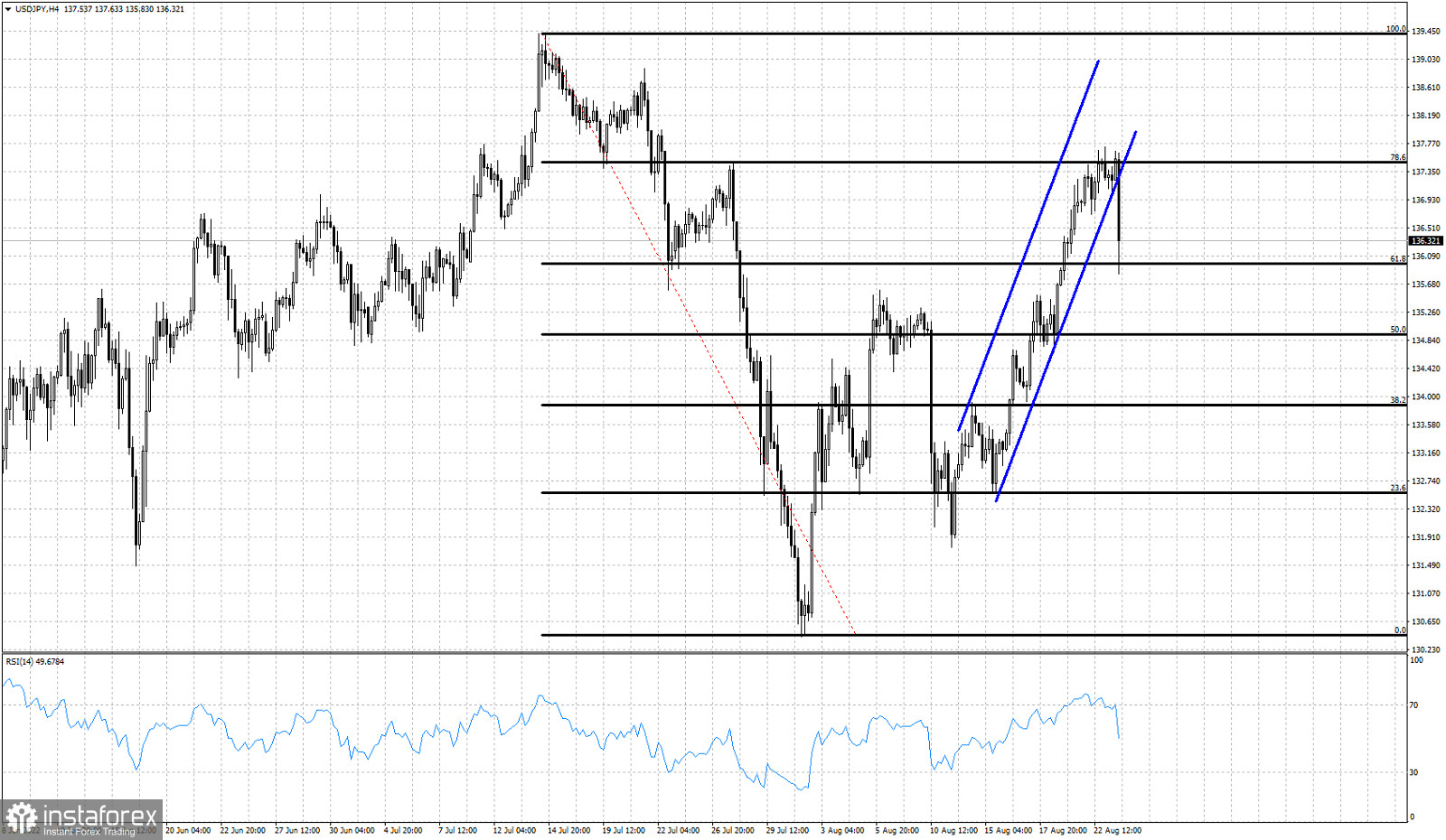

Blue lines- bullish short-term channel

Black lines- Fibonacci retracement levels

USDJPY is under pressure. Price has broken down below the bullish short-term channel and is already testing the 136 level, while yesterday it was making new short-term higher highs around 137.80. In our analysis yesterday we warned bulls that this is not the time to be buying USDJPY. A reversal was justified because price had reached a Fibonacci extension target and was testing an important Fibonacci retracement level. Moreover the RSI was producing bearish divergence signals. We warned that it was a matter of time to see a reversal and lower levels in USDJPY. Today's price action has helped a lot in formulating our strategy from now on. It seems very probable that an important top has been formed. Price has formed a lower high relative to the July highs. As long as price is below 137.80 we expect USDJPY to continue lower towards 130 and even lower. First important support is at 135.30-135. Failure to hold above this level will increase chances of a move towards 130. Next support will be at 131.75. These two levels are key support for bulls. On the other hand bears do not want to see price forming another higher low and breaking above 137.80. This would strengthen the bulls and will increase chances for a move towards 140 and higher.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română