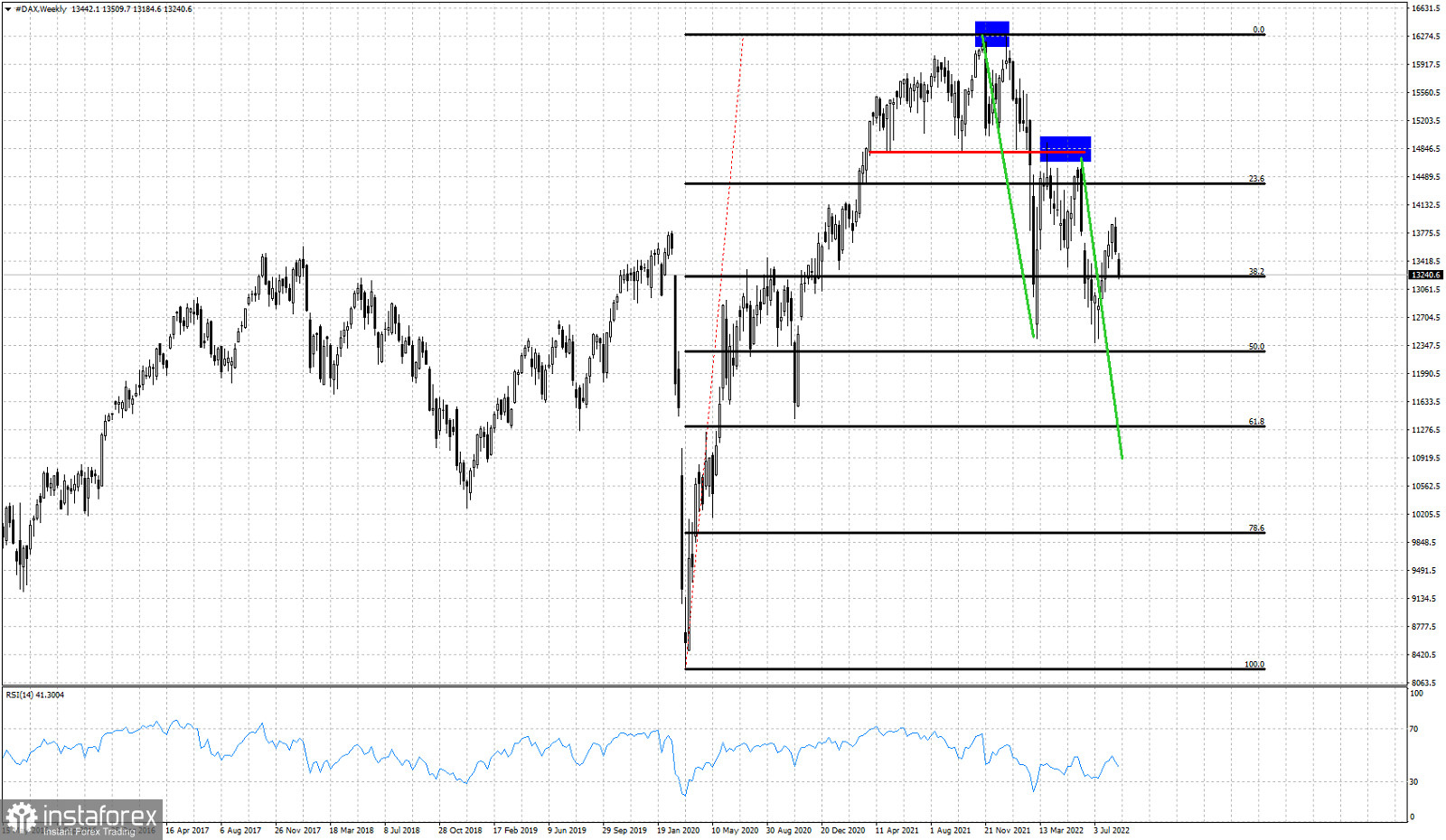

Blue rectangles- lower highs

Green lines- downward legs expectations

Black lines- Fibonacci retracements

Red line- neckline support

July and August were risk on months for DAX helping the index rise from 12,500 to 14,000. Looking at the bigger picture this upward move has not changed much at our longer-term bearish scenario. Instead the lower high created offers us another key level to lower the stop for bears. Let's not forget the head and shoulders bearish signal activated at 14,800 that remains valid since February. DAX remains vulnerable to a move towards 11,000 if not lower. The recent high at 14,000 level is now a key resistance that bulls need to overcome, in order to avoid the danger of another sell off. Over the coming weeks I believe it is very probable for DAX to move towards the 61.8% Fibonacci retracement level if not lower. Bulls need to be very cautious trying to fish a bottom.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română