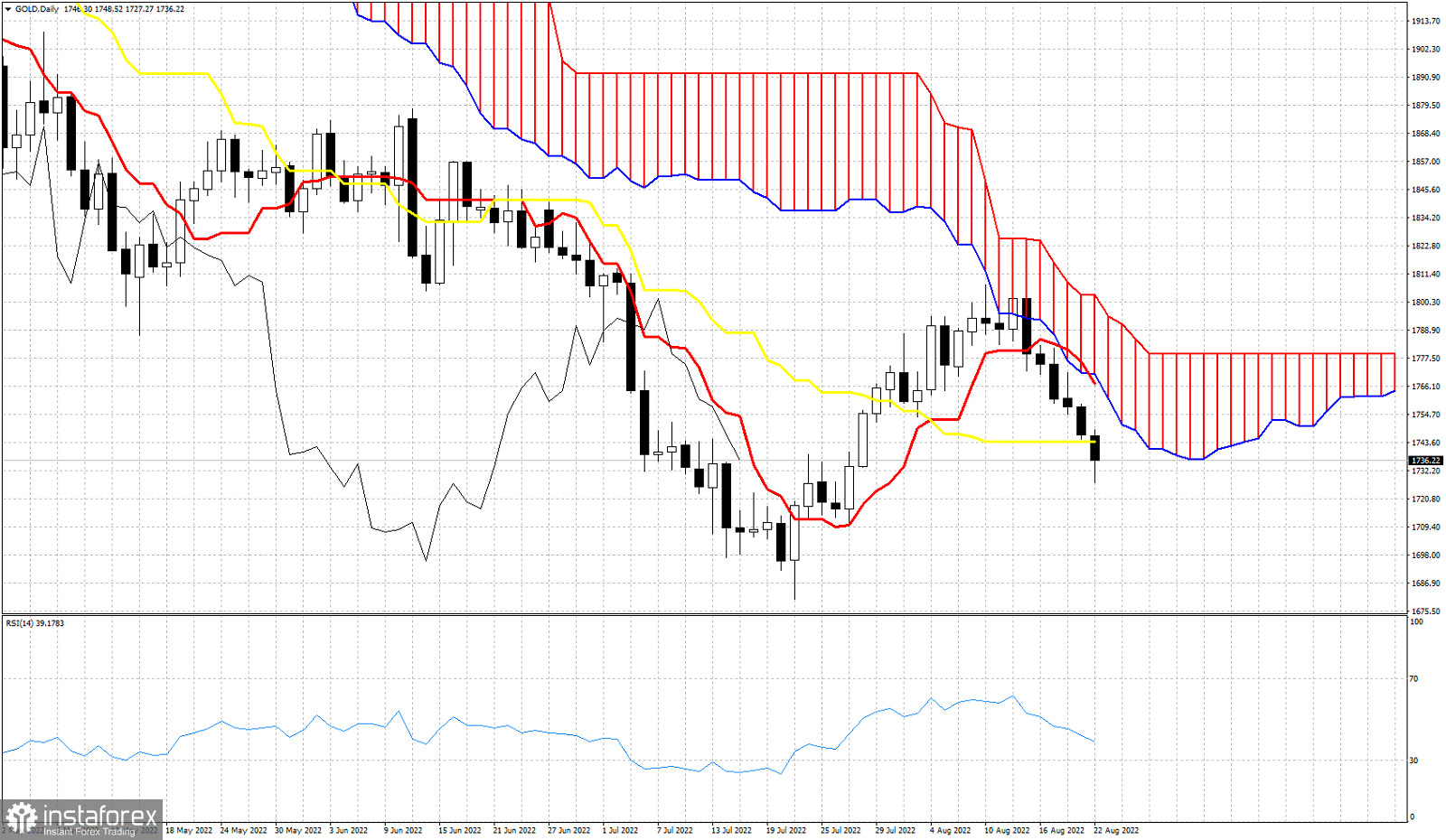

Gold price has started the week under pressure, exactly the way it ended last week. Price has broken below $1,740 and price is now trading below the Daily Kijun-sen (yellow line indicator). Gold price remains vulnerable to more downside. Gold remains below the Daily Kumo (cloud). Trend remains bearish according to the Ichimoku cloud indicator. Price got rejected last week at the cloud resistance and is breaking support levels since then. First price broke the tenkan-sen (Red line indicator) and today is breaking below the kijun-sen. As long as price remains below the Kumo, bears will remain in control of the trend. Resistance by the cloud is at $1,770. Gold as expected at $1,800 is pulling back down. Our first target of $1,750 was achieved and now our second target of $1,729 was also achieved a couple hours earlier. Price has also retraced 61.8% of the entire upward movement. The 61.8% retracement level is a key Fibonacci level where we usually see trend reversals. If bulls manage to defend $1,729 we could see at least a short-term bounce higher. Failure to hold above $1,729 will bring Gold price towards $1,711.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română