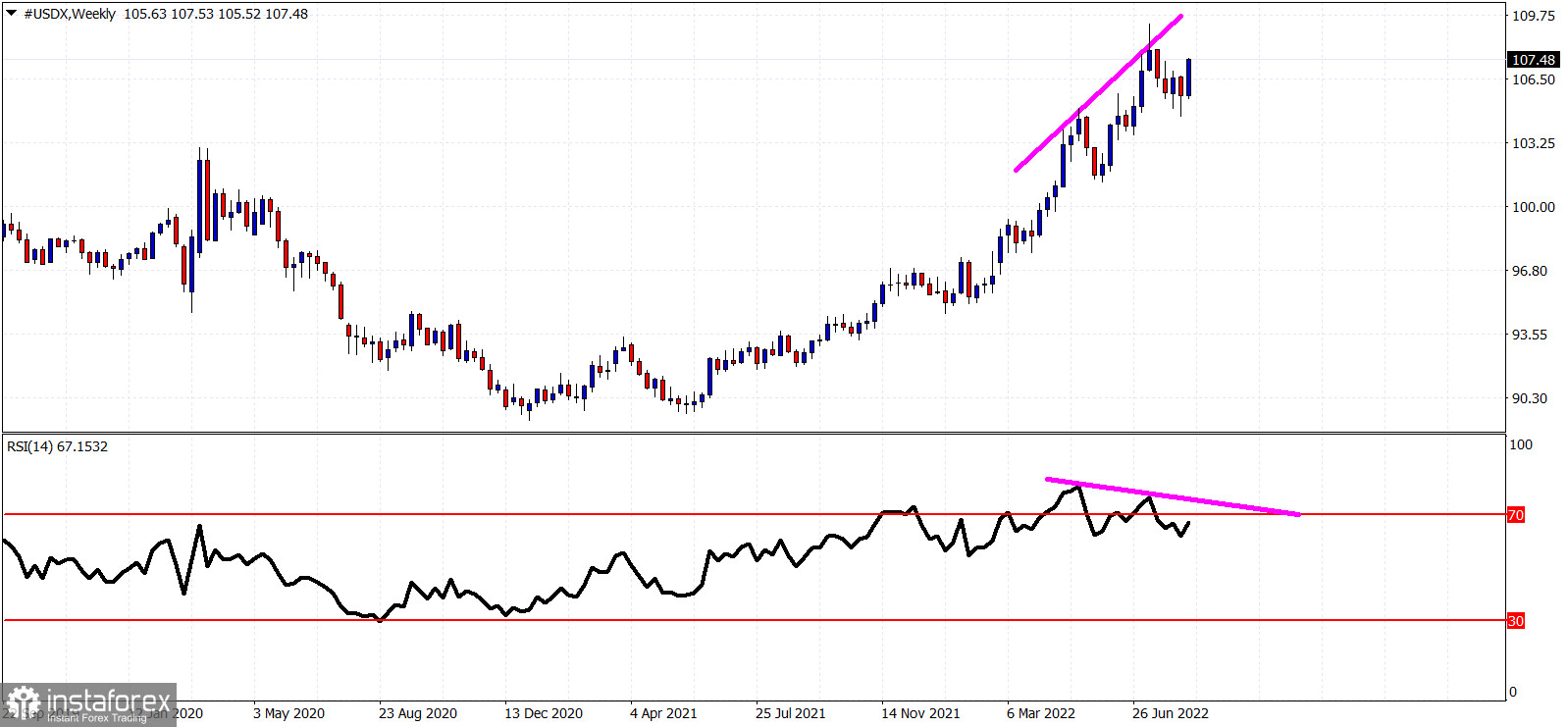

Red lines- bullish channel

The Dollar index broke above the short-term resistance at 106.60. Price remains inside the upward sloping channel that was created back in 2021. The Dollar index has completed the decline from 109.30 and is now at least making a counter trend bounce. Because price continues to respect the bullish channel, there are increased chances of making new 2022 highs. Support remains key at 104.50 and as long as price holds above 104.50-105, we expect to see new highs.

The Dollar index as we said above has the potential to make new 2022 highs. So far the weekly chart has provided us with one bearish RSI divergence. The bearish divergence is not a reversal or sell signal. Only a warning signal of a weakening trend. The new higher high is not ruled out because of the divergence. It is very important to see if price makes new higher highs and if the RSI makes a lower high providing a second divergence. The weekly RSI is showing signs that a new move towards the purple line has started and a strong bounce is coming.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română