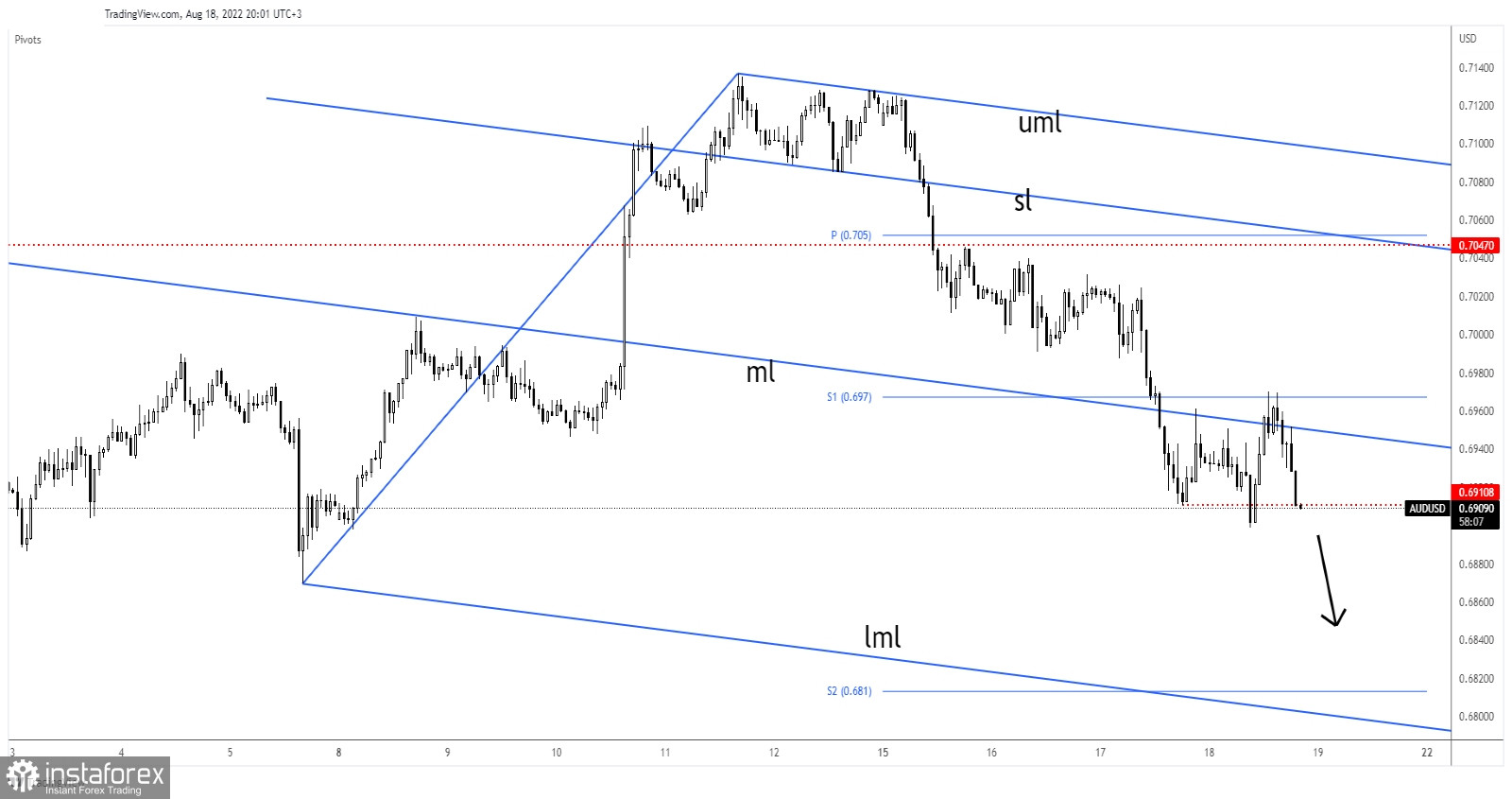

The AUD/USD pair was trading in the red at 0.6908 at the time of writing. In the short term, it has tried to rebound but the price action invalidated a larger rebound, so more declines are in the cards.

Today, the Australian Unemployment Rate dropped unexpectedly from 3.5% to 3.4%, while the Employment Change came in at -40.9K versus 26.5K expected. On the other hand, the US Philly Fed Manufacturing Index, Unemployment Claims, and the CB Leading Index came in better than expected, thus boosting USD.

AUD/USD Strong Downside Pressure

As you can see on the H1 chart, the AUD/USD pair rebounded after registering only a false breakout below 0.6910. The rebound was only a temporary one as the price found strong resistance at the weekly S1 (0.6970).

Now, it has challenged the 0.6910 downside obstacle. A valid breakdown and a new lower low could activate more declines.

AUD/USD Forecast

After the current sell-off, AUD/USD could try to rebound again. So, only a new lower low and a valid breakdown below 0.6899 could validate a further drop and could help the sellers catch a larger sell-off.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română