The AUD/USD pair was trading in the green on the H1 chart at the time of writing. After its massive drop, a temporary rebound was natural. It was located at 0.7037 versus today's low of 0.7011. In the short term, it could come back to test and retest the near-term resistance levels before dropping deeper.

USD took a hit from the Empire State Manufacturing Index which came in at -31.3 points versus the 5.1 expected. On the other hand, the Aussie was weakened by the Chinese Retail Sales, Fixed Asset Investment, and Industrial Production indicators which came in worse than expected.

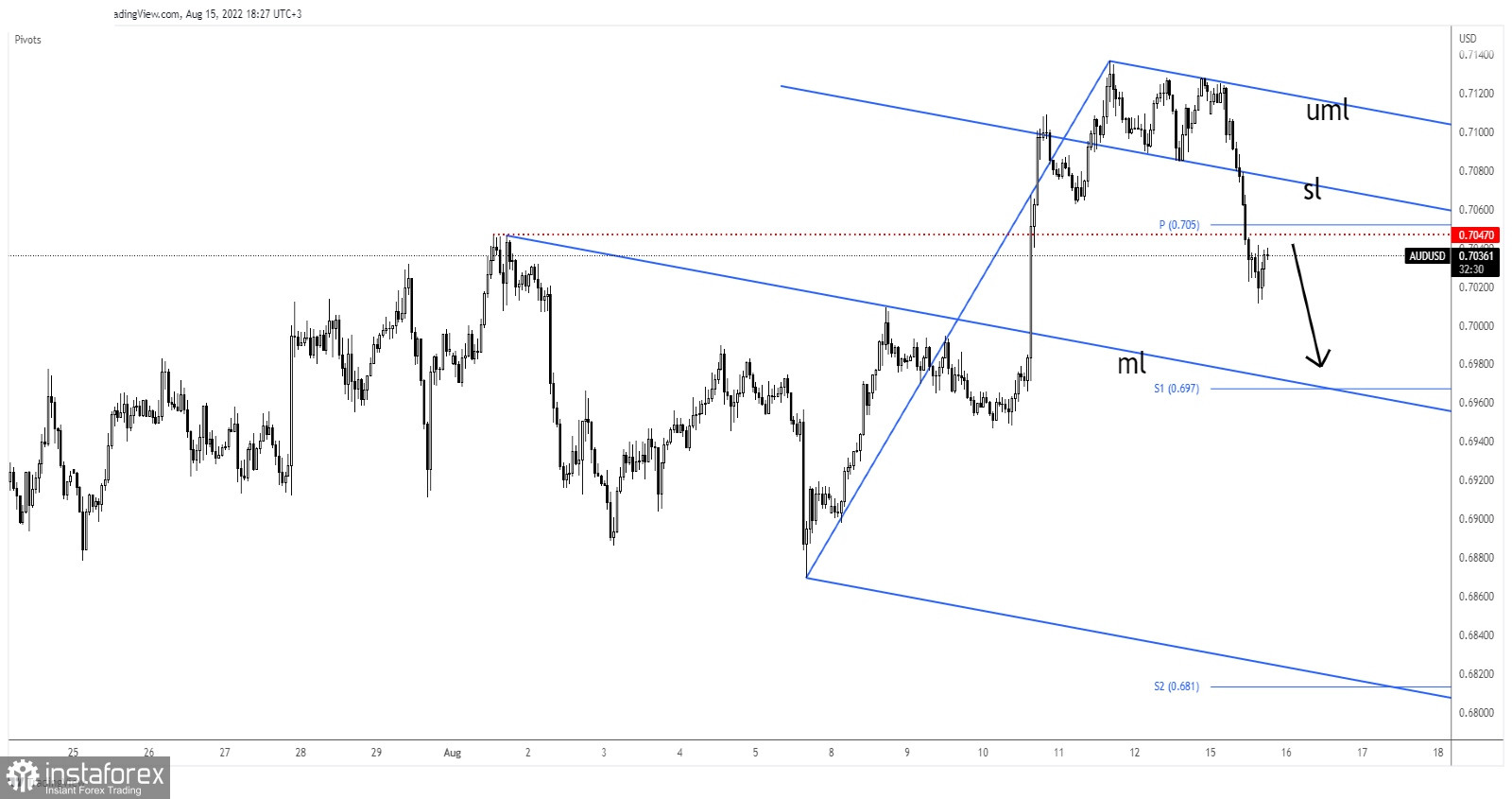

AUD/USD 0.7047 Retest

The AUD/USD pair plunged after retesting the upper median line (uml) and after closing below the sliding line (sl). It has failed to reach the 0.7000 psychological level signaling exhausted sellers.

Now, it was almost about to reach and retest the 0.7047 static resistance (support turned into resistance). The weekly pivot point of 0.7050 stands as an upside obstacle as well.

AUD/USD Forecast

Testing and retesting 0.7047 and registering only false breakouts above this level may signal a new sell-off, a downside continuation. A new lower low, which is dropping and closing below 0.7011, may activate more declines and could bring new selling opportunities.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română