Early in the American session, gold reached a new high at around $1,807.78. This is due to the plunge of the US dollar in light of the US CPI which gave the commodity a good boost.

The US headline CPI remained flat in July, versus expectations for a modest 0.2% rise, following a 1.3% increase in the previous month. In addition, the annual rate fell more than expected to 8.5% in July from 9.1% previously.

These data suggest that US inflation may have peaked and could change expectations of an aggressive tightening by the FED, which, in turn, affects the strength of the US dollar.

This data also triggered a sharp decline in US Treasury bond yields, which helped gold appreciate due to their inverse correlation.

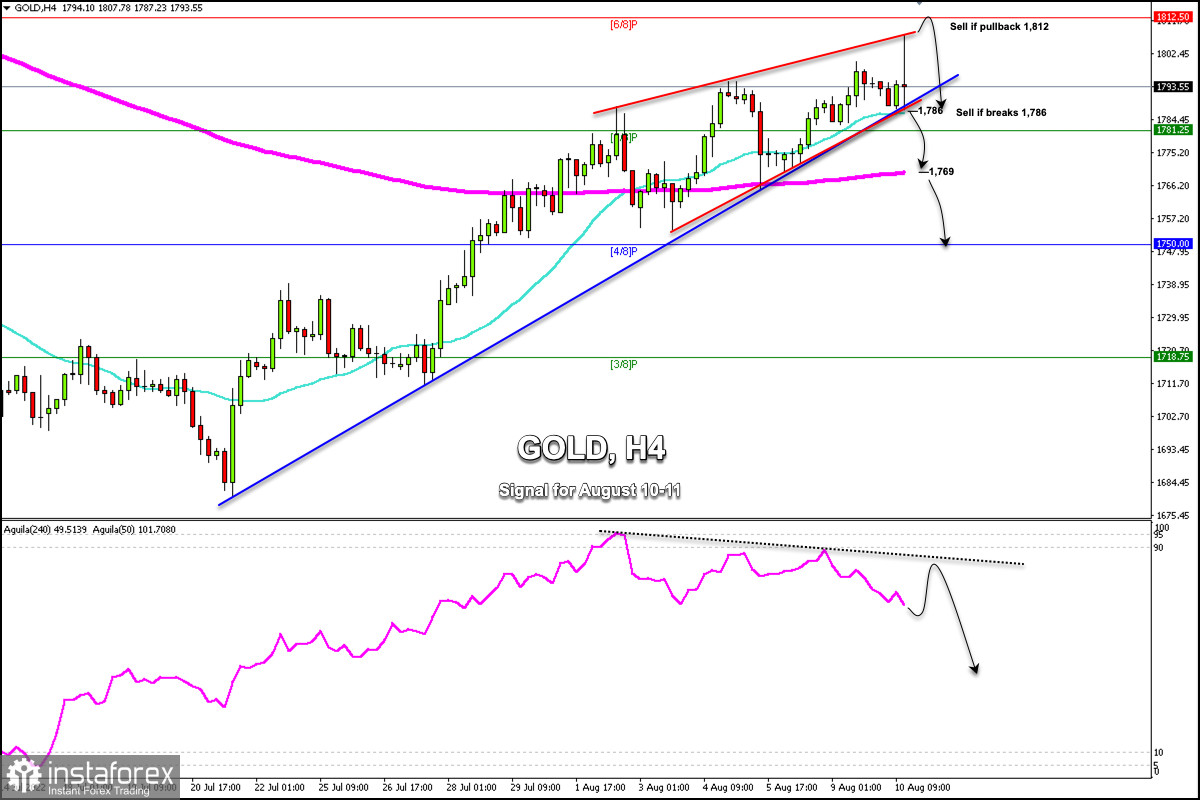

According to the 4-hour chart, gold is showing signs of trading at overbought levels and exhaustion of bullish strength. In case it resumes its bullish cycle, gold is likely to face strong resistance of 6/8 Murray located at 1,812.

This resistance zone of around 1,812 could offer an opportunity to sell the XAU/USD pair in case it fails to break above it.

On the other hand, we can see that since July 20 gold has had an intact uptrend channel. If the price bounces above this channel, it could continue its rise and could reach the zone of 7/8 Murray at around 1,849.

On the contrary, a sharp break of the uptrend channel and a daily close below the 21 SMA located at 1,786, will mean a change in trend and gold could fall towards the 200 EMA located at 1,769 and towards 4/8 Murray at around 1,750.

Our trading plan for the next few hours is to wait for a pullback towards 1,812 to sell, or to wait for a sharp break below 1,786 (21 SMA) to sell with targets at 1,781 (5/8) 1,769 (200 EMA), and 1,750 (4/8).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română