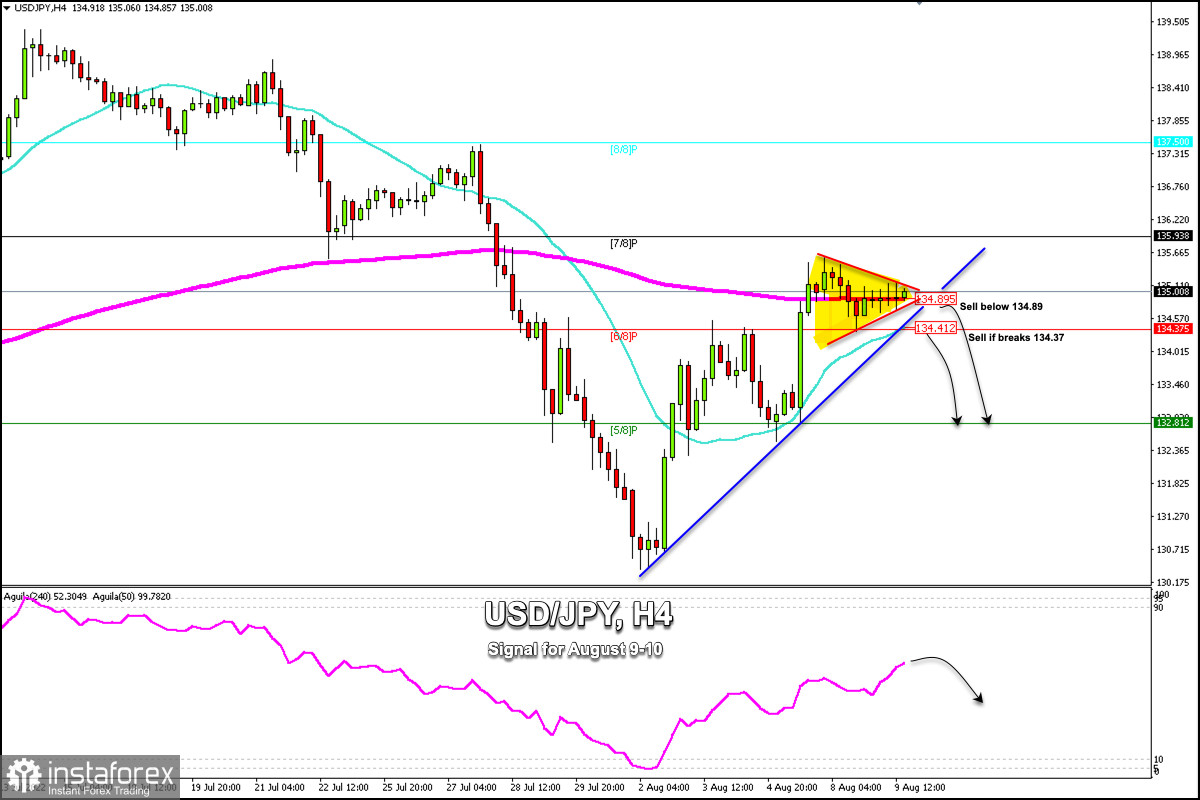

USD/JPY is trading at around 135.00, forming a symmetrical triangle pattern. The consolidation could extend until tomorrow when the market gets to know the inflation data from the United States.

The Japanese Yen is consolidating above the 200 EMA and above 6/8 Murray. The uptrend still prevails and the currency pair is likely to resume the bullish cycle if there is a sharp break above this pattern.

The latest candlesticks on the 4-hour chart show that USD/JPY has encountered a strong resistance zone around 135.50 - 135.00 and is also showing signs of exhausting bullish strength.

A break below 6/8 Murray at 134.37 could mean a continuation of the downtrend and the price could hit 5/8 Murray at 132.86.

Our trading plan for the next few hours is to sell below the 200 EMA located at 134.89. Or we could wait for a sharp break of the uptrend channel at around 134.40 to sell with targets at 133.00 and 132.81.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română