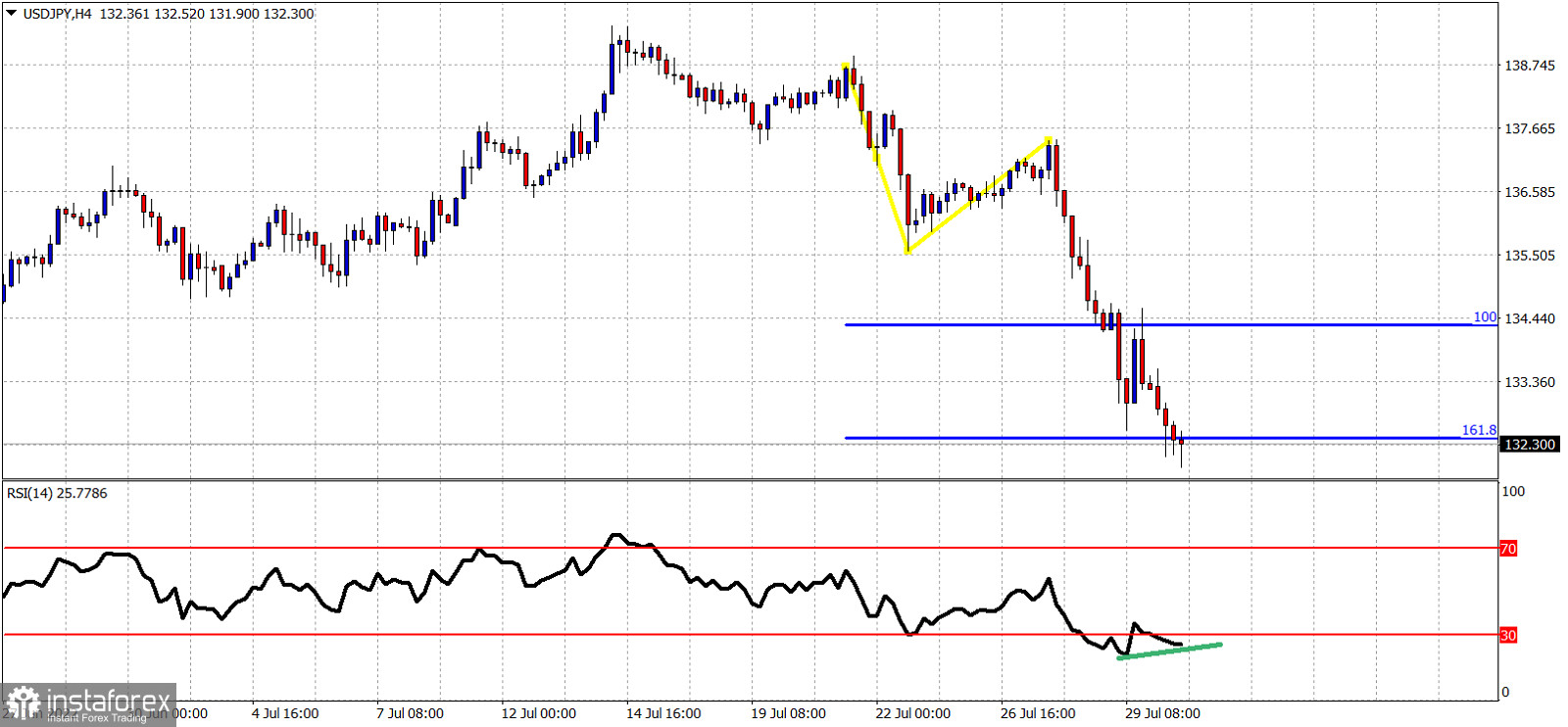

Blue lines- Fibonacci extensions

Green line- bullish RSI Divergence

USDJPY continues trading in a bearish trend making new lower lows and lower highs. Price has reached the 161.8% Fibonacci extension of the previous leg down. The RSI is at oversold levels providing bullish divergence signals. In the 4 hour chart price justifies a strong bounce higher. As we mentioned in a previous analysis, USDJPY July performance was terrible and the monthly candlestick was a bearish reversal one. Our longer-term view remains bearish, expecting a pull back towards 130-126 where we also find the neckline of the inverted head and shoulders pattern. A back test of the neckline is justified. Nevertheless in the near term I believe USDJPY could produce a bounce towards 134-135.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română