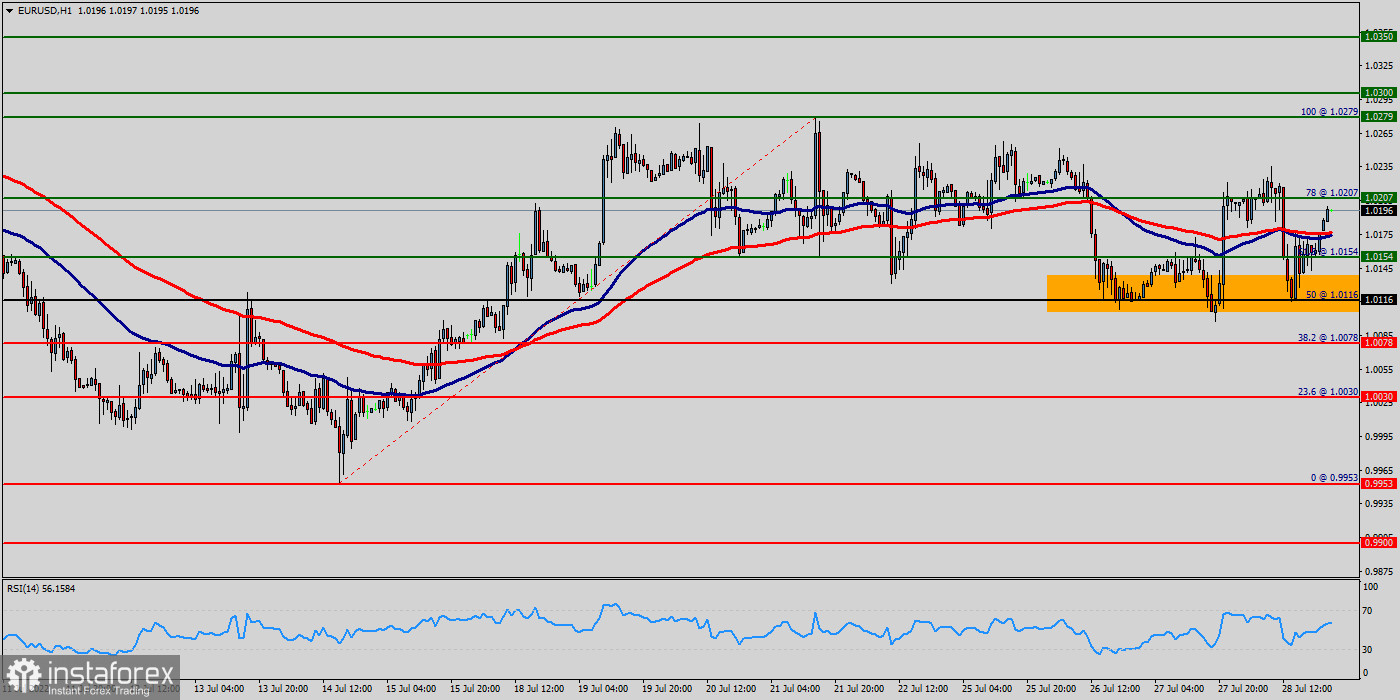

On the one-hour chart, the EUR/USD pair continues moving in a bullish trend from the support levels of 1.0163 and 1.0154.

Currently, the price is in a bullish channel. This is confirmed by the RSI indicator signaling that we are still in a bullish trending market. This suggests the pair will probably go up in coming hours.

As the price is still above the moving average (100), immediate support is seen at 1.0154, which coincides with a golden ratio (61.8% of Fibonacci). The trend is still showing strength above the moving average (100) - support 1.0154.

Consequently, the first support is set at the level of 1.0154. So, the market is likely to show signs of a bullish trend around the spot of 1.0154.

Also, the level of 1.0154 represents a weekly pivot point for that it is acting as major resistance/support this week.

In other words, buy orders are recommended above the golden ratio (1.0154) with the first target at the level of 1.0207.

Furthermore, if the trend is able to breakout through the first resistance level of 1.0207. We should see the pair climbing towards the double top (1.0279) to test it.

The market is indicating a bullish opportunity above the above-mentioned support levels, for that the bullish outlook remains the same as long as the 100 EMA is headed to the upside.

It would also be wise to consider where to place a stop loss; this should be set below the second support of 1.0070.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română