The GBP/USD pair rallied in the short term as the Dollar Index dropped after yesterday's rebound. The DXY remains under pressure ahead of the FOMC. The currency pair is trapped within an up-channel pattern, so it could try to approach new highs.

Fundamentally, the USD took a hit from the CB Consumer Confidence yesterday. The indicator came in at 95.7 points below 97.3 points expected. In addition, the New Home Sales and the HPI came in worse than expected as well. On the other hand, the CBI Realized Sales was reported at -4 points above -10 points expected.

As you already know, the volatility could be huge today as the Federal Reserve is expected to increase the Federal Funds rate from 1.75% to 2.50%. The FOMC Press Conference and the FOMC Statement could really shake the markets. Also, the US Durable Goods Orders, Core Durable Goods Orders, and the Pending Home Sales could bring more action as well later today.

GBP/USD Bullish Momentum!

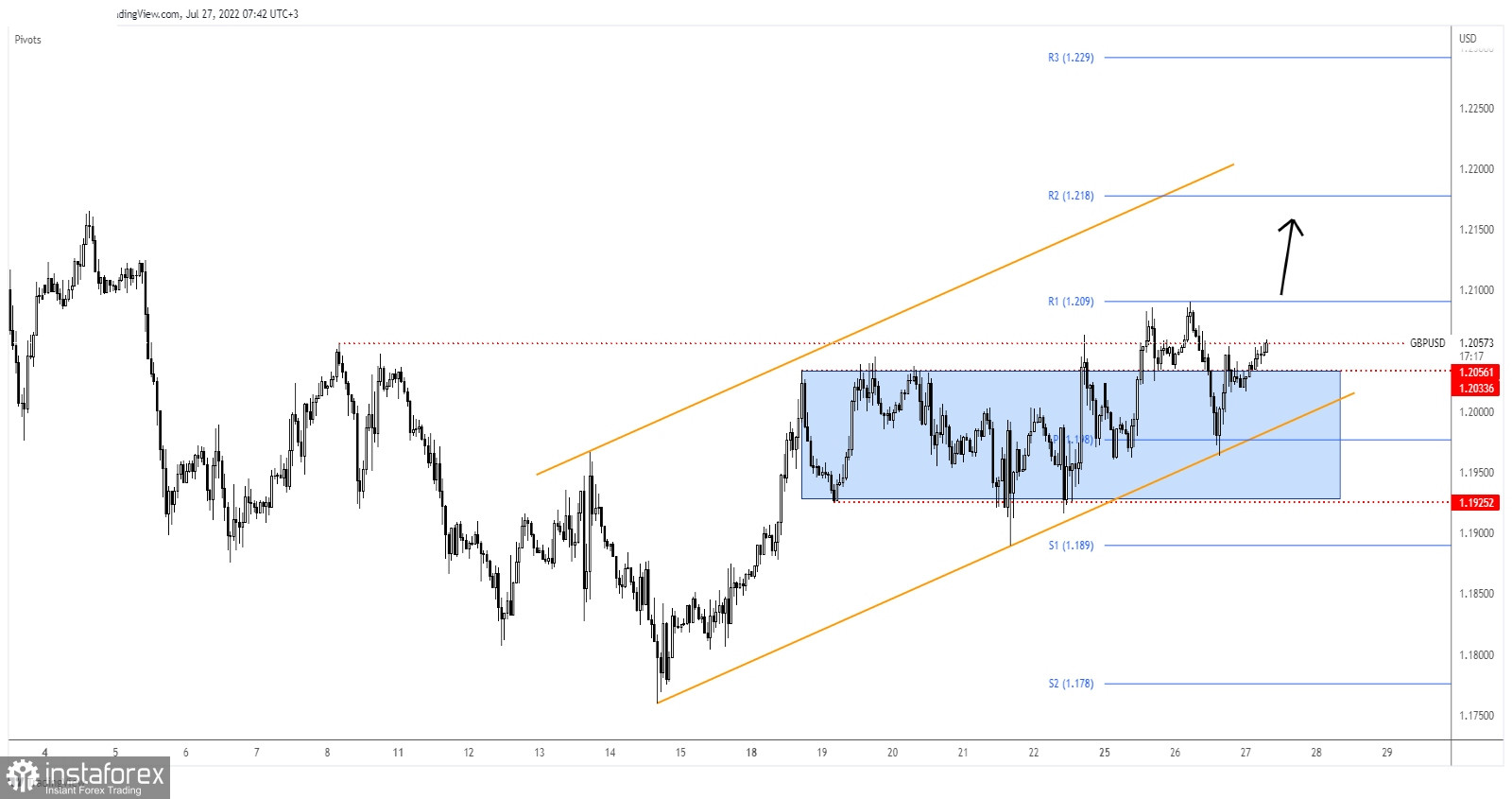

GBP/USD retreated a little after finding resistance at the weekly R1 (1.2090). It has retested the uptrend line and now it challenges the 1.2056 key resistance again. The false breakdown with great separation through the uptrend line and below the weekly pivot point of 1.1980 signaled strong upside pressure.

As long as it stays above the uptrend line, the GBP/USD pair could resume its growth. The weekly R1 (1.2090) stands as major static resistance.

GBP/USD Outlook!

Jumping, closing, and stabilizing above the R1 (1.2090) and above the 1.2100 psychological level activates an upside continuation and brings new long opportunities with an upside target at the weekly R2 (1.2180).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română