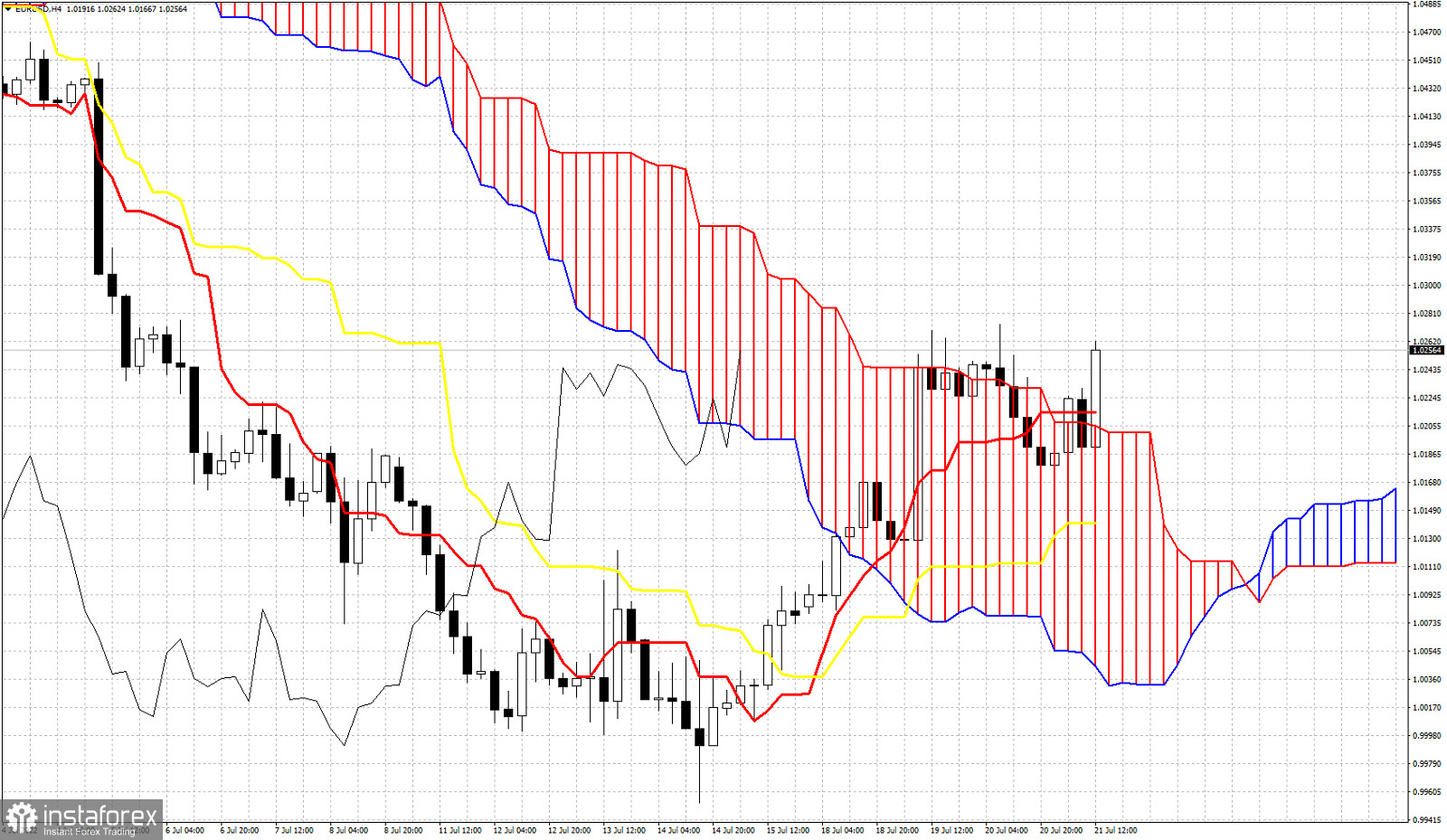

EURUSD is trading around 1.0270. After the announcement from the ECB regarding the rate decision, EURUSD spiked higher as rates increased by 0.50%, double the normal 0.25% rate hike we were used to. Price is breaking above cloud resistance and if bulls manage to hold the positive vibes around EUR, we could see a bigger bounce higher. We noted in previous posts that EURUSD was breaking out of the short-term bearish channel and short-term trend is getting more bullish as it is justified to see a strong bounce in EUR. Will EUR bulls be able to hold price above the cloud? It is important for trend to change bulls, for price to stay above the Daily Kumo (cloud). Support by the cloud is at 1.0205. The kijun-sen (yellow line indicator) is the next support level at 1.0143. Bulls do not want to see price fall below 1.02. This would be an important sign of weakness.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română