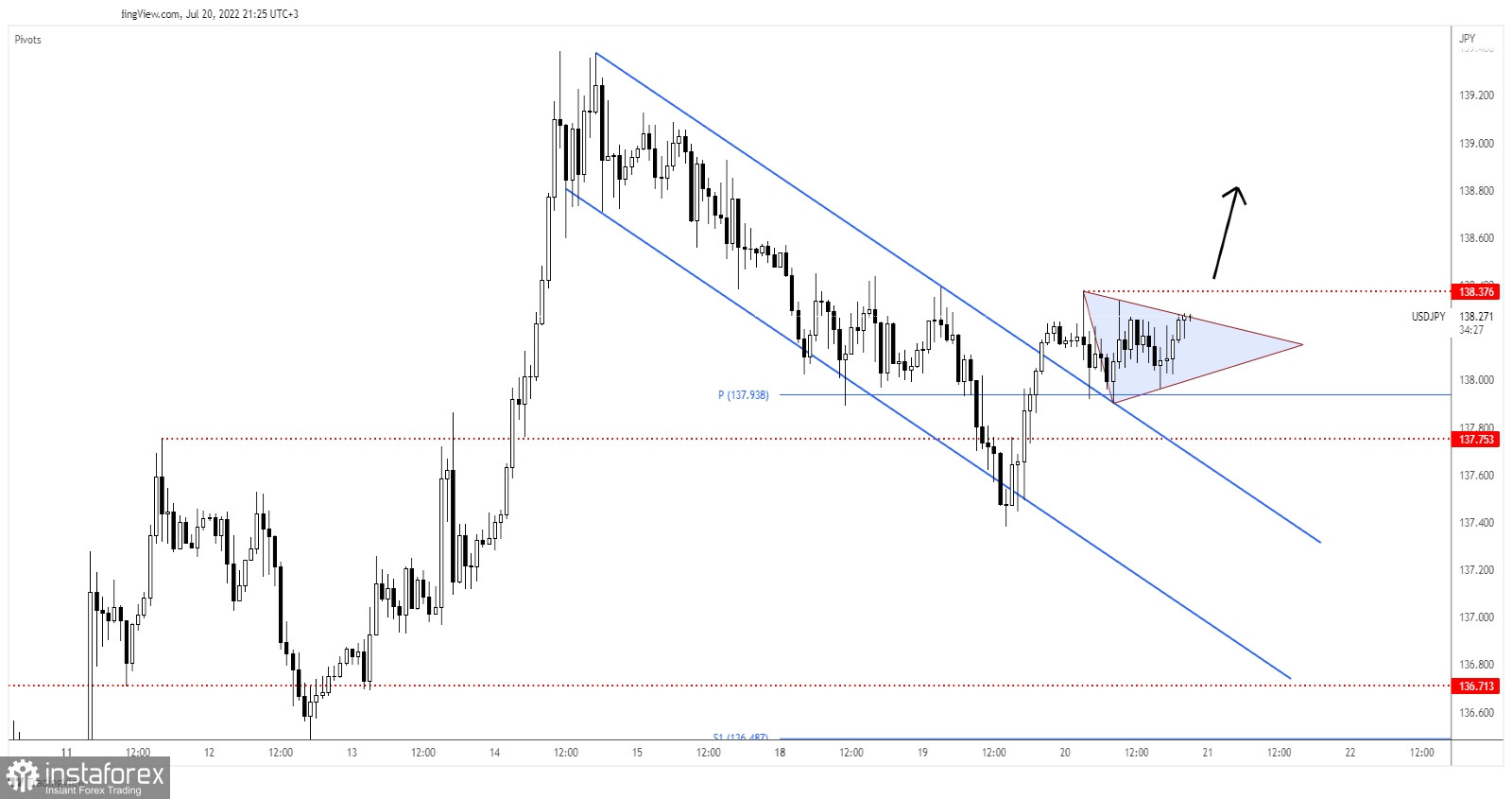

The USD/JPY pair was trading at 138.25 at the time of writing. It continues to move sideways in the short term after escaping from a major down-channel pattern. The price action signaled that the downside movement ended and that the price could come back higher.

It has changed little because the traders are expecting the BOJ. The Bank Of Japan is expected to keep the BOJ Policy Rate unchanged at -0.10% tomorrow. Still, the BOJ Press Conference, Monetary Policy Statement, and the BOJ Outlook Report could bring high volatility.

USD/JPY Fresh Triangle!

As you can see on the H4 chart, USD/JPY escaped from the down-channel pattern and now it has stabilized above the weekly pivot point of 137.93. In the short term, it has developed a triangle pattern. A valid breakout could bring new opportunities.

It's trapped between 138.37 and the weekly pivot point of 137.93. Technically, the price action developed a potential inverse Head & Shoulders pattern.

USD/JPY Forecast!

A new higher high, jumping and closing above 138.37 could activate further growth and could bring new long opportunities.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română