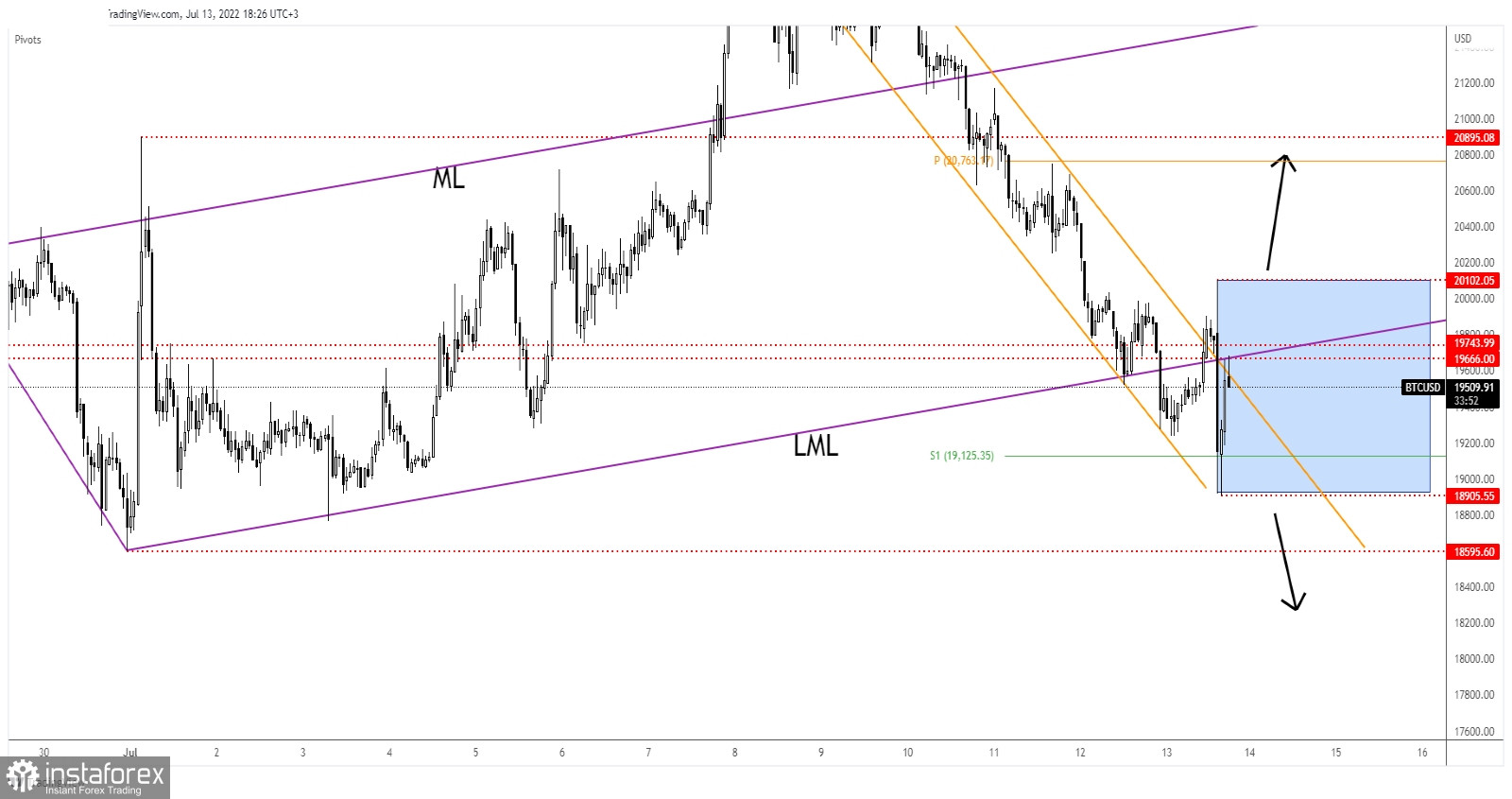

Bitcoin was trading in the red at 19,405 at the time of writing and it seems determined to come back down towards the near-term downside obstacles. The price action invalidated a new upside movement, so more declines are expected as the bias remains bearish.

BTC/USD dropped by 5.95% from 20,102 today's high to 18,905 daily low. Now, it has rebounded as the markets were shaken by the US inflation data and by the BOC rate hike. In the short term, it could only test and retest the immediate resistance levels before going down again. In the last 24 hours, BTC/USD is down by 2.30% and by 3.37% in the last 7 days.

BTC/USD In The Sellers' Territory!

BTC/USD tried to escape from the down channel pattern but it has registered only a false breakout above the 20,000 psychological level and through the downtrend line. I've told you in my previous analysis that the BTC/USD could develop an upside movement if it makes a valid breakout above the downtrend line and if it stays above the lower median line (LML).

Now, it has retested the LML, the downtrend line, and the 19,666 key level. As long as it stays below these levels, the rate could develop a new sell-off.

BTC/USD Outlook!

Failing to stay above the LML, the downtrend line, and above the 19,666 signaled strong bearish pressure. The S1 (19,125) stands as a downside obstacle. A valid breakdown below this level and a new lower low, a bearish closure below the 18,905 could activate more declines and could bring new short opportunities.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română