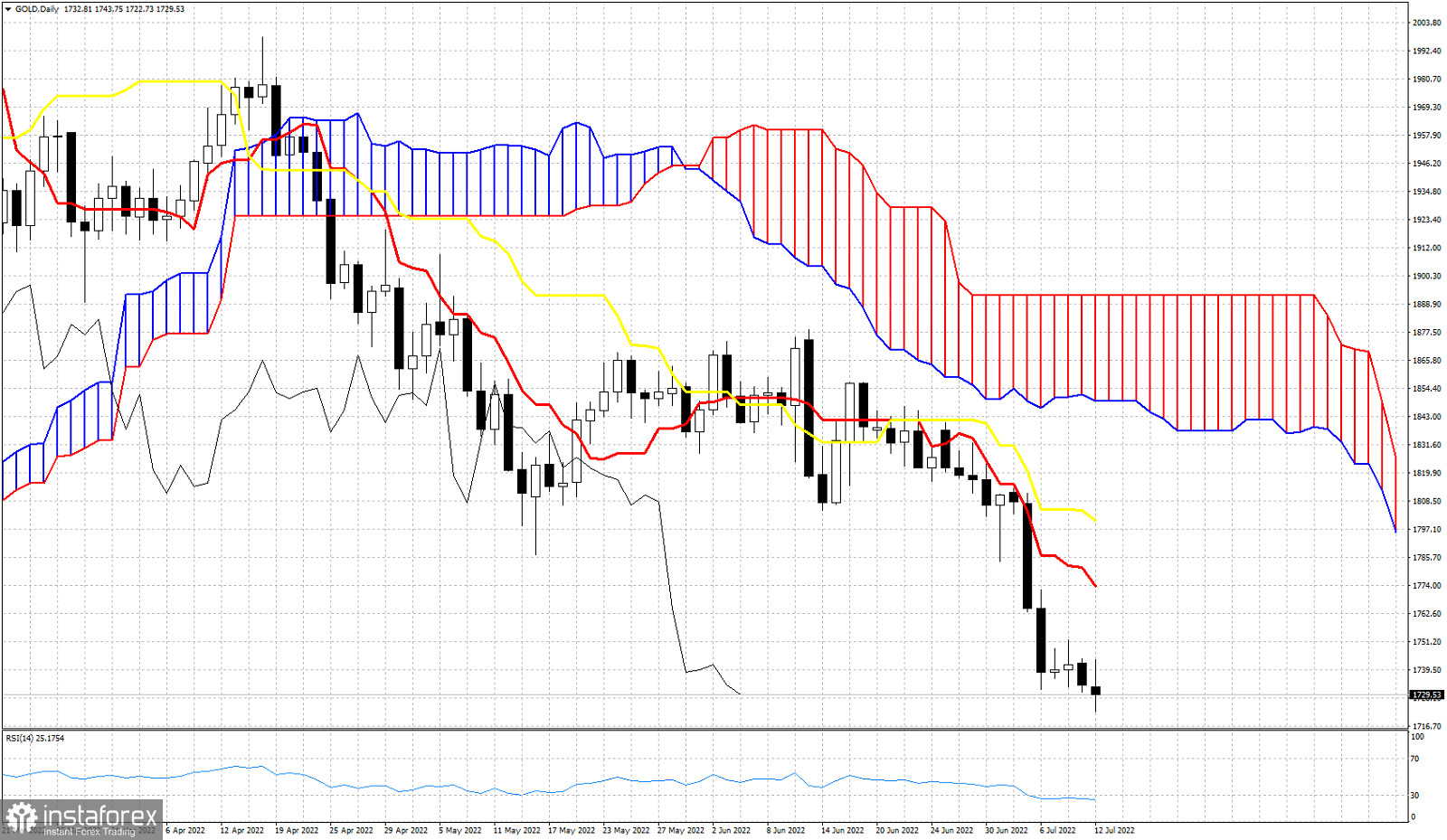

Gold price continues trading above $1,700. Trend remains bearish for the medium-term as price is still below the Daily Kumo (cloud). As we explained in previous posts Gold price justifies a bounce towards $1,770. Today we use the Ichimoku cloud indicator in order to identify key short-term resistance levels that will signal this possible bounce higher. The tenkan-sen (red line indicator) is at $1,773 and this is the first important short-term resistance. The kijun-sen (yellow line indicator) is at $1,800. Previous support is now resistance. The Chikou span (black line indicator) is below the candlestick pattern confirming we are in a bearish trend. The Daily Kumo (cloud) provides the most important resistance at $1,850-90. As long as price is below the Daily Kumo, trend will be controlled by bears. In the shorter time frames, trend remains controlled by bears and bulls will need to recapture $1,770-$1,800 in order to change it.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română