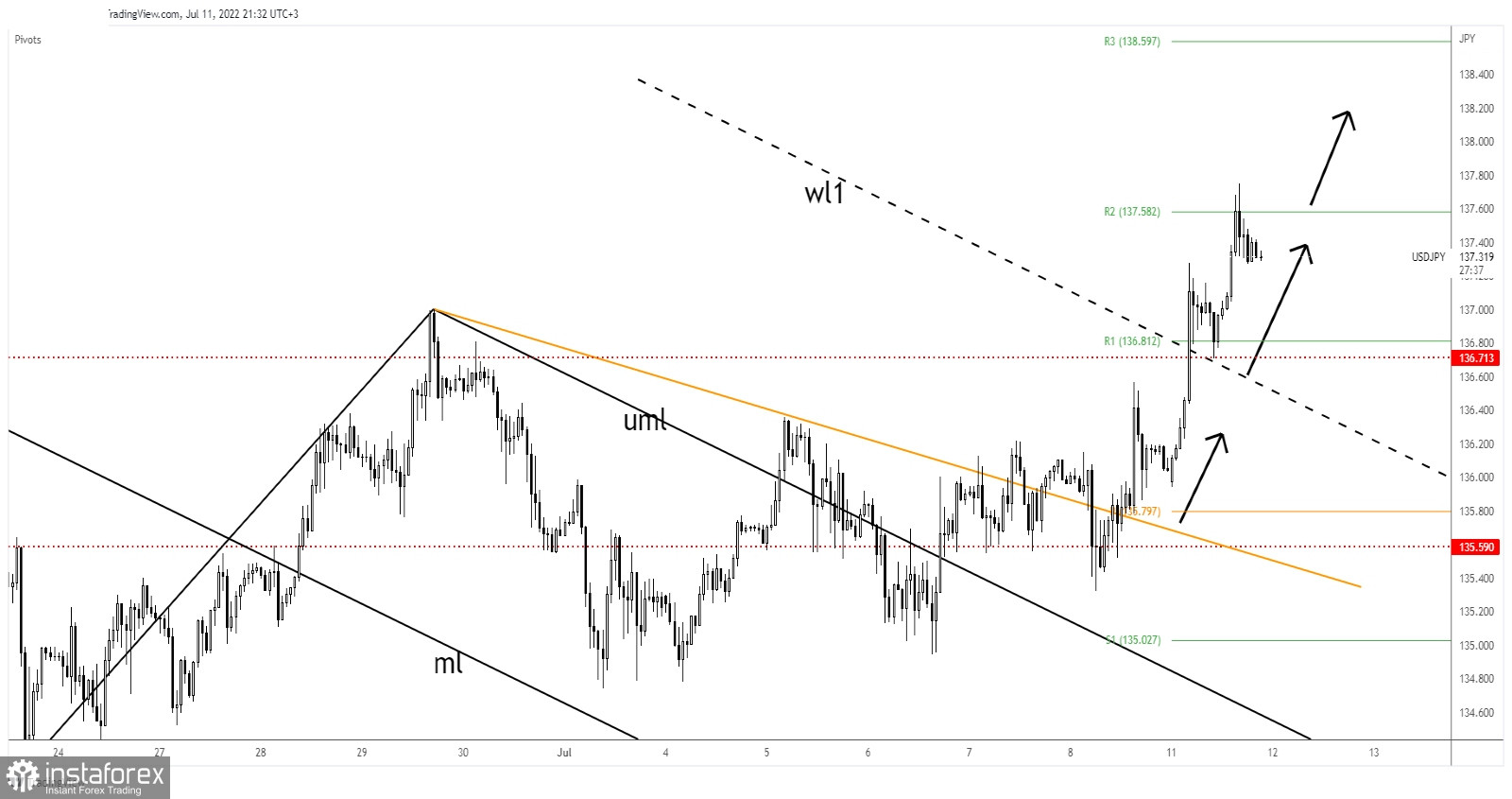

The USD/JPY pair retreated after reaching the 137.74 level. Now, it was trading at 137.31 at the time of writing. The price dropped a little as the Dollar Index slipped lower while the Japanese Yen Futures rebounded. The bias is bullish, so further growth is expected despite temporary declines.

Fundamentally, the NFP came in better than expected on Friday, while the Unemployment Rate and the Average Hourly Earnings came in line with expectations which is good for the greenback. Today, the Japanese Prelim Machine Tool Orders reported a 17.1% growth, M2 Money Stock rose by 3.3% versus 3.1% expected, while the Core Machinery Orders reported a 5.6% drop more compared to the 5.3% estimated. Tomorrow, the PPI could report a 9.1% growth.

USD/JPY Temporary Retreat?

The USD/JPY pair failed to take out the resistance represented by the weekly R1 (137.58), so a minor drop is natural. Today, the breakout above the warning line (wl1) and through 136.71 was confirmed, so the bias remains bullish.

Now, it retests the 137.27 former high. As long as it stays above this level, the USD/JPY pair could climb toward new highs.

USD/JPY Forecast!

Staying above 137.27 and making a valid breakout above the R2 (137.58) could activate further growth and could bring new long opportunities.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română