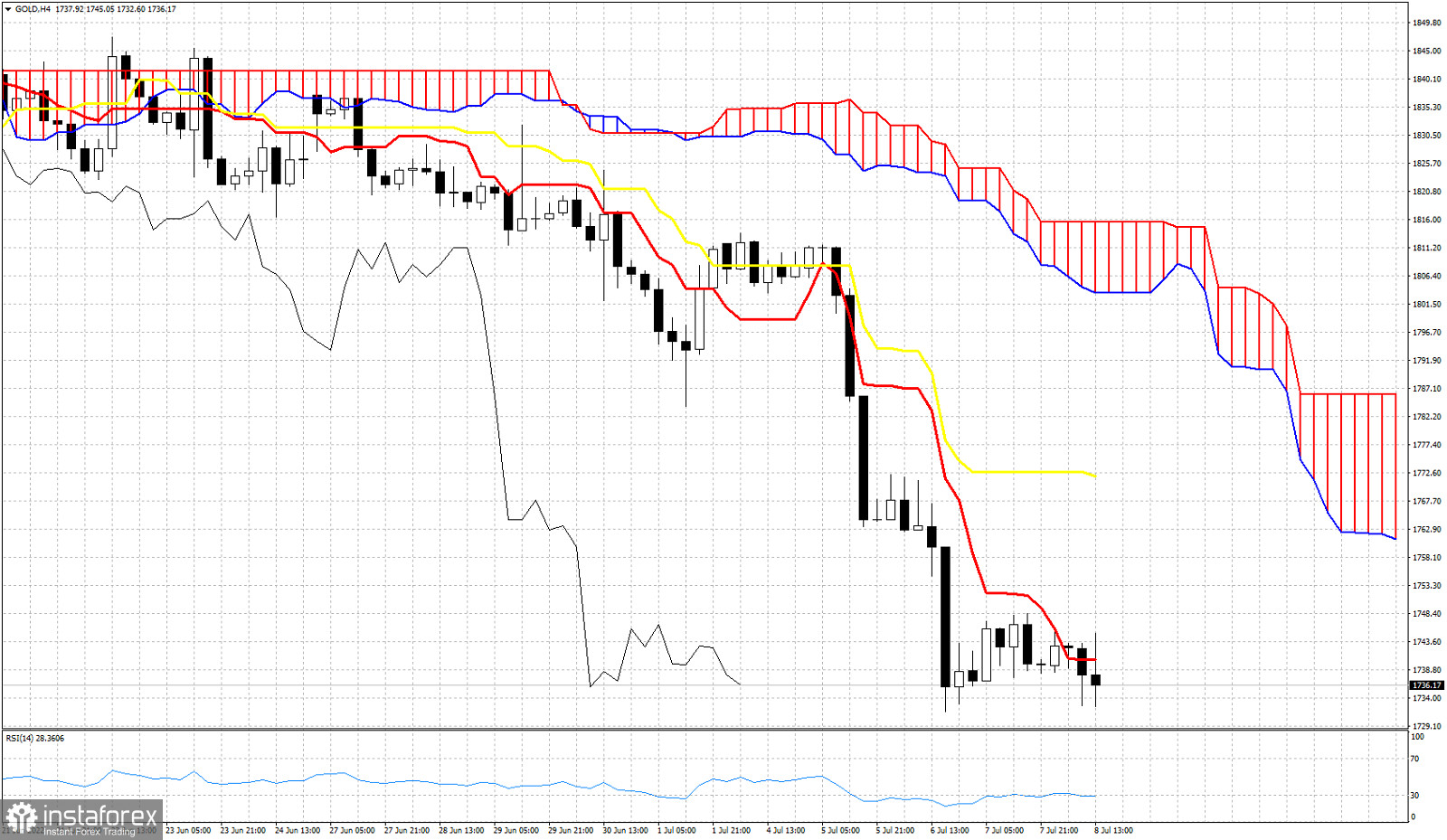

Gold price remains in a bearish trend. Price is near its weekly lows. Usually at the end of the trading week we see counter trend moves because of profit taking. It will not come as a surprise if Gold price starts a bounce higher from current levels. Although according to the Ichimoku cloud indicator trend remains clearly bearish, with the RSI at oversold levels, a bounce higher is justified. A break above the tenakn-sen (red line indicator) would be the first bullish signal and the one that could get price towards the kijun-sen (yellow line indicator) at $1,770. Bears need to be cautious. Specially if short-term resistance at $1,742 is broken upwards.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română