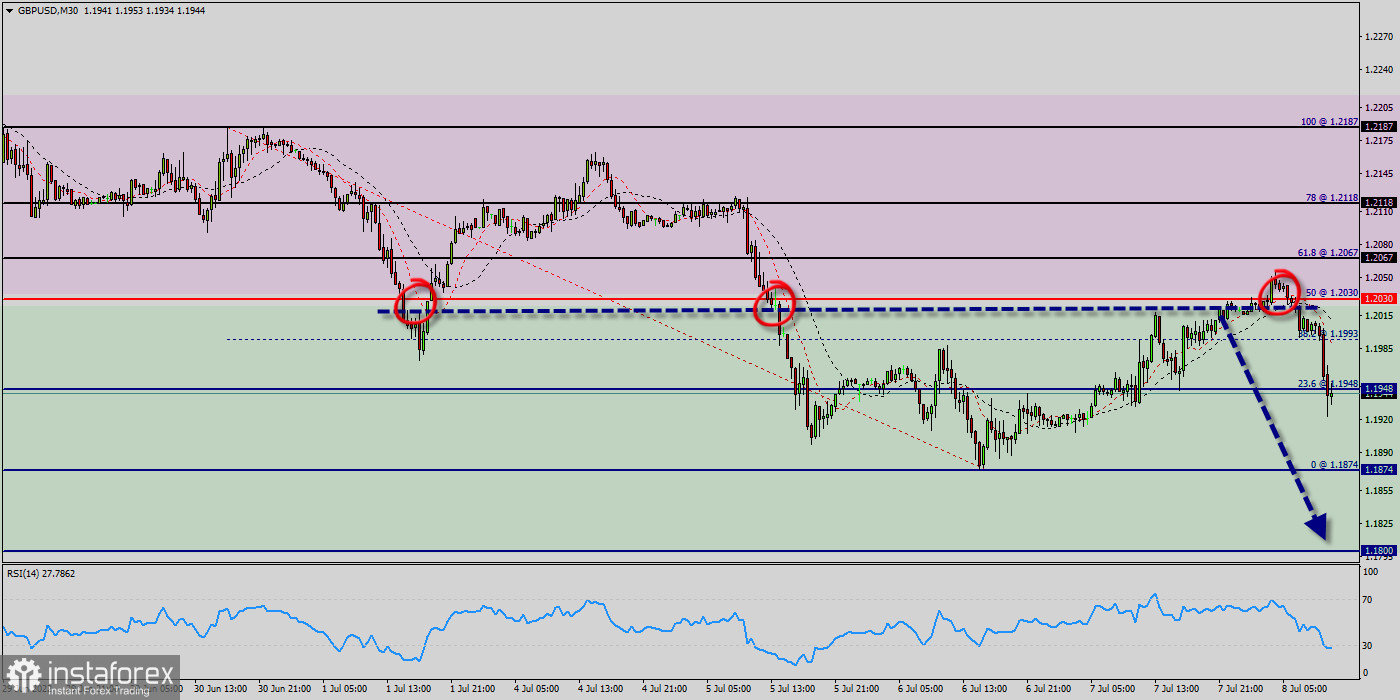

The GBP/USD pair continues to move within the correction and the downward channel. The Pound to the US Dollar exchange rate on Forex is 1.1948. Moving averages indicate the presence of a short-term bearish trend. Prices have broken through the area between the signal lines down, which indicates pressure from sellers of the currency pair and a chance continuation of the fall of the instrument. The recent bearish consolidation recharged Sterling sellers, who remained in force and smashed the GBP/USD pair to two-week lows below 1.2030. Cable lost more than 156 pips over the week (1.2030 - 1.1874). Intraday bias in the GBP/USD pair remains downside for consolidation below 1.2030. Outlook stays bearish as long as 1.2030 resistance holds. On the downside, break of 1.1948 will resume larger down trend to the weekly bottom of 1.1874. Break there will target 1.1800 long term support. At present, the GBP/USD pair sets mildly on the downside at this point. Current down trend should targets of 1.1874 and 1.1800. Thus, the market is indicating a bearish opportunity above the above-mentioned support levels, for that the bearish outlook remains the same as long as the 100 EMA is headed to the downside. Break could prompt further downside acceleration to 00% Fibonacci retracement levels at 1.1874.

The GBP/USD pair continues to move downwards from the level of 1.2050. Yesterday, the pair dropped from the level of 1.2050 (this level of 1.2050 coincides with the double top) to the bottom around 1.1948. Today, the first resistance level is seen at 1.2030 followed by 1.2067 (golden ratio), while daily support 1 is found at 1.1874.

Also, the level of 1.2030 represents a weekly pivot point for that it is acting as major resistance/support this week.

Amid the previous events, the pair is still in a downtrend, because the GBP/USD pair is trading in a bearish trend from the new resistance line of 1.2030 towards the first support level at 1.1874 in order to test it.

If the pair succeeds to pass through the level of 1.1874 , the market will indicate a bearish opportunity below the level of 1.1874 to reach 1.1800.

However, if a breakout happens at the resistance level of 1.2067, then this scenario may be invalidated.

Alternative scenario :

On the upside, break of 1.2067 major resistance will turn intraday bias neutral first. But outlook will remain bearish as long as 1.2030 resistance holds.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română