Crypto Industry News:

The hacker who used Solana's liquidity protocol Crema Finance on Jul 2 returned most of the funds, but was allowed to keep $ 1.6 million as a reward for the white hat hacker.

The award, SOL 45,455, is worth as much as 16.7% of the $ 9.6 million lost by Crema whose disappearance forced the protocol to suspend services.

Crema's team began an investigation to identify the hacker by tracking him on Discord and the original gas source for the hacker's address. When it seemed the team might have deciphered his identity, they announced they were negotiating with the hacker. On Wednesday, the hacker returned 6,064 Ethereum and 23,967 Solana worth about $ 8 million.

The funds were returned in a series of transactions on the Ethereum and Solana networks. The first transaction in each network was a test with a negligible amount of coins, while the next one contained most of the funds sent.

Crema and team members have reasons to sleep more peacefully now that the funds have been secured. However, there is still a lot of work to be done. The team announced on Tuesday ahead of the deal that it had submitted new audit code to make sure the same exploit never happened again.

Technical Market Outlook:

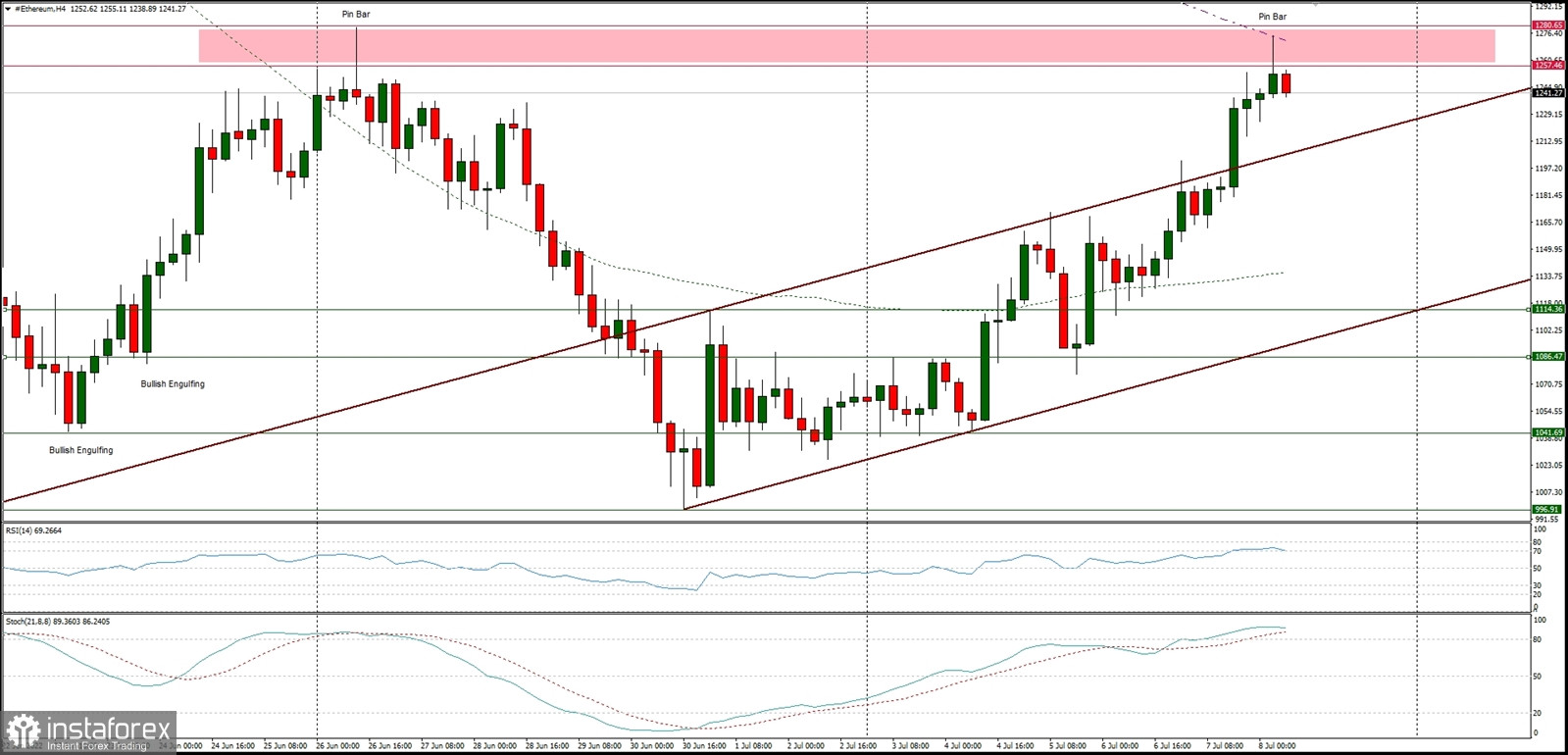

The ETH/USD pair has been seen testing the last swing high located at the level of $1,257. The bulls continue the rally, however the last h4 candle was a clear Pin Bar candlestick with a long upper shadow, so the market might pull-back a little. The intraday technical supports are seen on the levels of $1,215 and $1,202. The larger time frame chart trend remains down and as long as the key short-term technical resistance, located at the level of $1,280, is not clearly violated, the outlook remains bearish.

Weekly Pivot Points:

WR3 - $1,452

WR2 - $1,340

WR1 - $1,207

Weekly Pivot - $1,098

WS1 - $957

WS2 - $839

WS3 - $701

Trading Outlook:

The down trend on the H4, Daily and Weekly time frames had broken below the key long term technical support seen at the level of $1,420 and bears continue to make new lower lows with no problem whatsoever. So far every bounce and attempt to rally is being used to sell Ethereum for a better price by the market participants, so the bearish pressure is still high. The next target for bears is located at the levels below $1,000, like the last swing low seen at $880. Please notice, the down trend is being continued for the 11th consecutive week now.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română