Crypto Industry News:

More than half of Bitcoin's addresses still haven't seen losses, raising questions about the seriousness of the current "bear market".

Data from research firm Glassnode confirms that as of June 20, 56.2% of addresses were still worth more in US dollars than when the coins were added to them.

While the BTC / USD pair dropped to 19-month lows of $ 17,600 over the weekend, analysts prepared to pull back as much as 84.5% from record highs.

There is some confusion this year as the peaks have not been "high enough" compared to the historic boom peaks. For this reason, the declines came as a surprise to many, even though they have so far failed to catch up with the previous bearish markets.

Glassnode's analysis seems to confirm this. BTC price bottoms typically occur when less than half of the addresses remain profitable, so the current downtrend has a long way to go if it is to fit in with historical patterns.

For example, profitable addresses fell to 41% in March 2020, and fell below the 50% threshold during the earlier bear market of 2018.

In addition, we may also be dealing with the beginning of panic as there are more and more "hunters" who are overly concerned about keeping their funds and decide to take losses.

Technical Market Outlook:

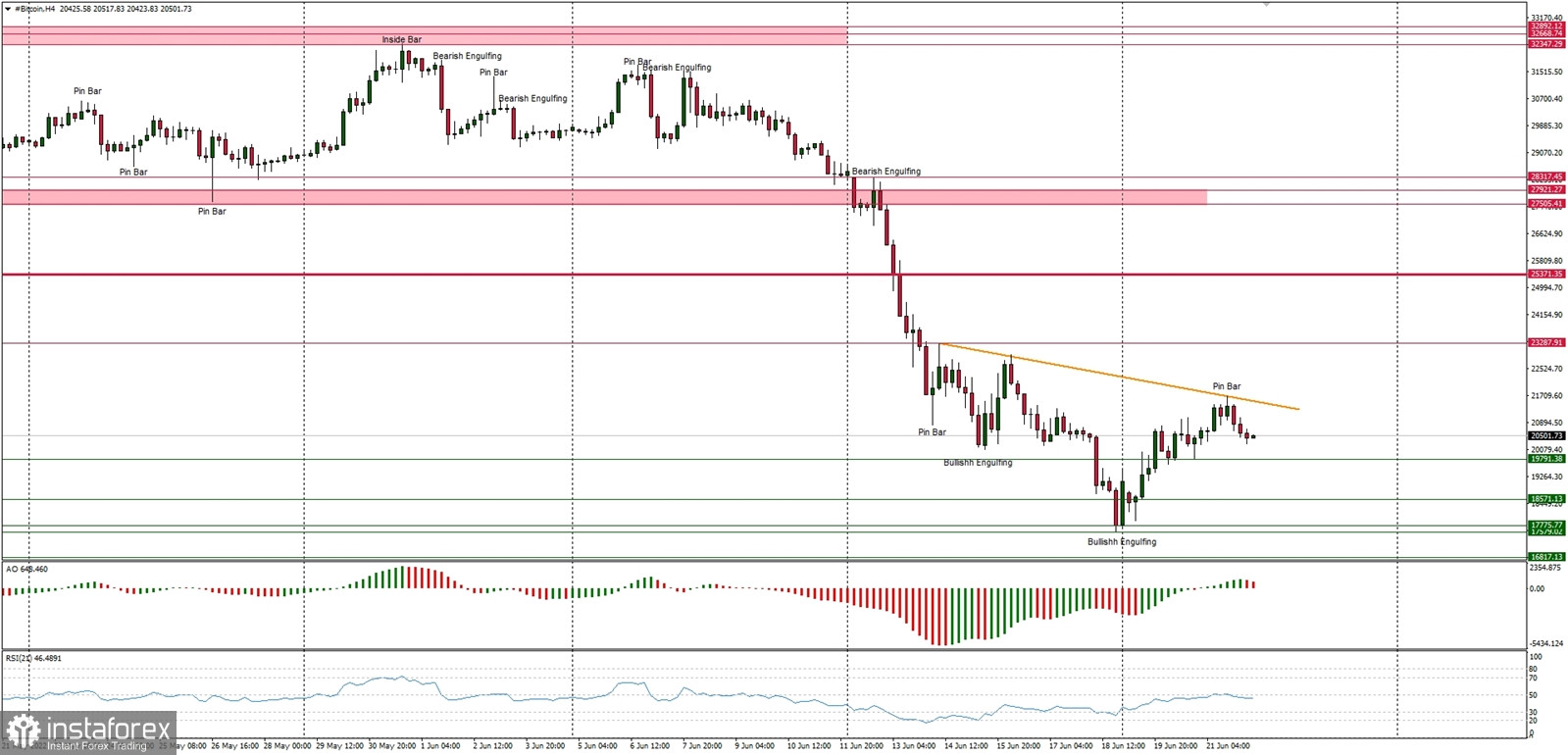

The BTC/USD pair has made a new local high at the level of $21,695 before the bounce was capped by the Pin Bar candlestick pattern. The bulls are bouncing from the extremely oversold market conditions, so the next target for bulls is seen at the level of $23,287. Any failure to hit and/or break above this level will likely result in another wave down towards the recent lows. The nearest technical support is seen at the level of $19,789. The larger time frame outlook for Bitcoin remains bearish, however, we have unconfirmed Bullish Engulfing pattern on the Daily time frame chart, so please stay focused and keep an eye on the key technical levels.

Weekly Pivot Points:

WR3 - $35,385

WR2 - $31,310

WR1 - $25,552

Weekly Pivot - $21,486

WS1 - $15,559

WS2 - $11,561

WS3 - $5,781

Trading Outlook:

The down trend on the H4, Daily and Weekly time frames continues. So far every bounce and attempt to rally is being used to sell Bitcoin for a better price by the market participants, so the bearish pressure is still high. The key long term technical support at the round psychological level of $20,000 had been violated, the new swing low was made at $17,600 and if this level is violated, then the next long-term target for bulls is seen at $13,712.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română