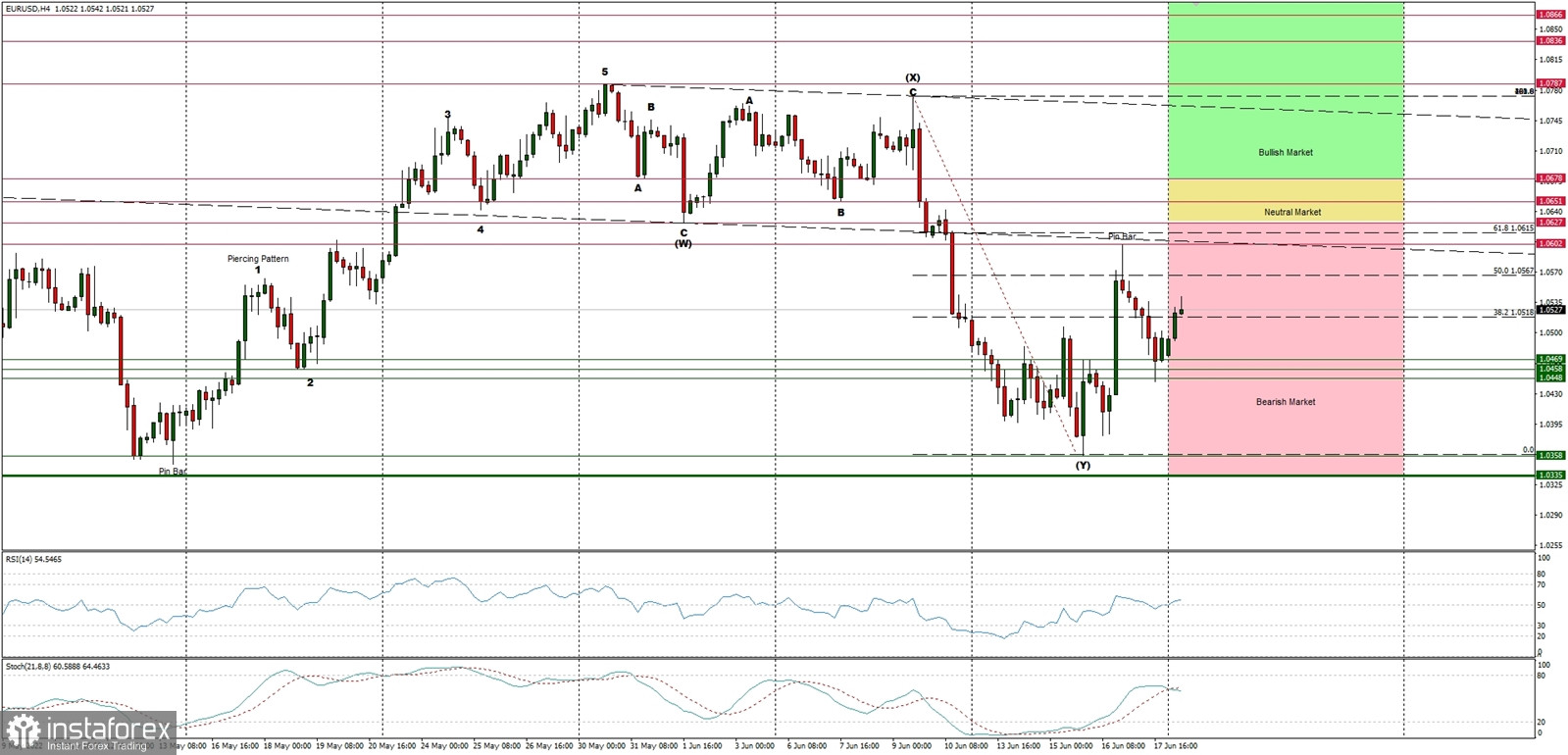

Technical Market Outlook:

The EUR/USD pair had almost retraced 61% of the last wave down and made a Pin Bar candlestick at the level of 1.0661, 14 pips away from the Fibonacci retracement level. Since then, the bulls keep trying to continue the bounce, keep making the local pull-backs, but the level of 1.0615 is still unreachable for them. The nearest technical support is seen at 1.0469 - 1.0448, so as long as the market trades above this zone, the outlook remains bullish. Please notice, that despite the recent efforts, the bulls are still trading inside the bearish zone and they need to break above the level of 1.0678 to enter the bullish zone.

Weekly Pivot Points:

WR3 - 1.0840

WR2 - 1.0724

WR1 - 1.0600

Weekly Pivot - 1.0479

WS1 - 1.0363

WS2 - 1.0238

WS3 - 1.0113

Trading Outlook:

The up trend can be continued towards the next long-term target located at the level of 1.1186 only if the complex corrective structure will terminate soon (above 1.0335) and the market breaks above 1.0678 level. The bullish cycle scenario is confirmed by breakout above the level of 1.0726, otherwise the bears will push the price lower towards the next long-term target at the level of 1.0335 or below.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română