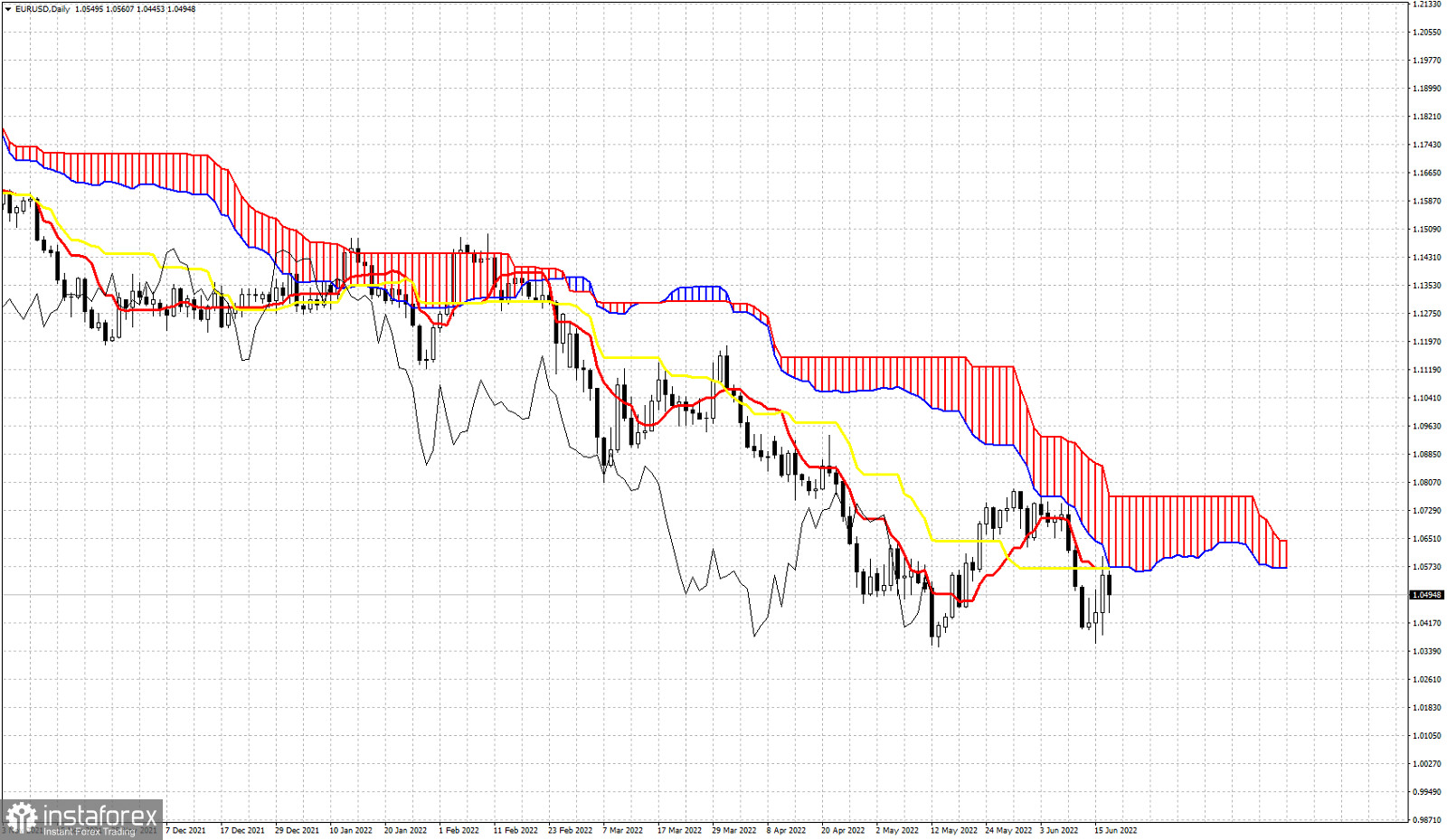

EURUSD remains in a bearish trend according to the Ichimoku cloud indicator. During the week price tried to push above resistance but failed and price got rejected. We saw lower lows relative to last week but in the end we saw a close well above its lows. Price remains below key resistance at 1.0570 where we find a confluence of resistance indicators. First we find the lower cloud boundary of the Daily Kumo (cloud). We also at the same area we find both the tenkan-sen (red line indicator) and the kijub-sen (yellow line indicator). In Ichimoku cloud terms, trend changes only if price breaks above the cloud. This happens if price breaks above 1.0770. Until then bears have the upper hand. Next week if EURUSD bulls manage to break above 1.0570 then they will have increased hopes for a move even higher towards 1.0770 resistance.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română