Overview :

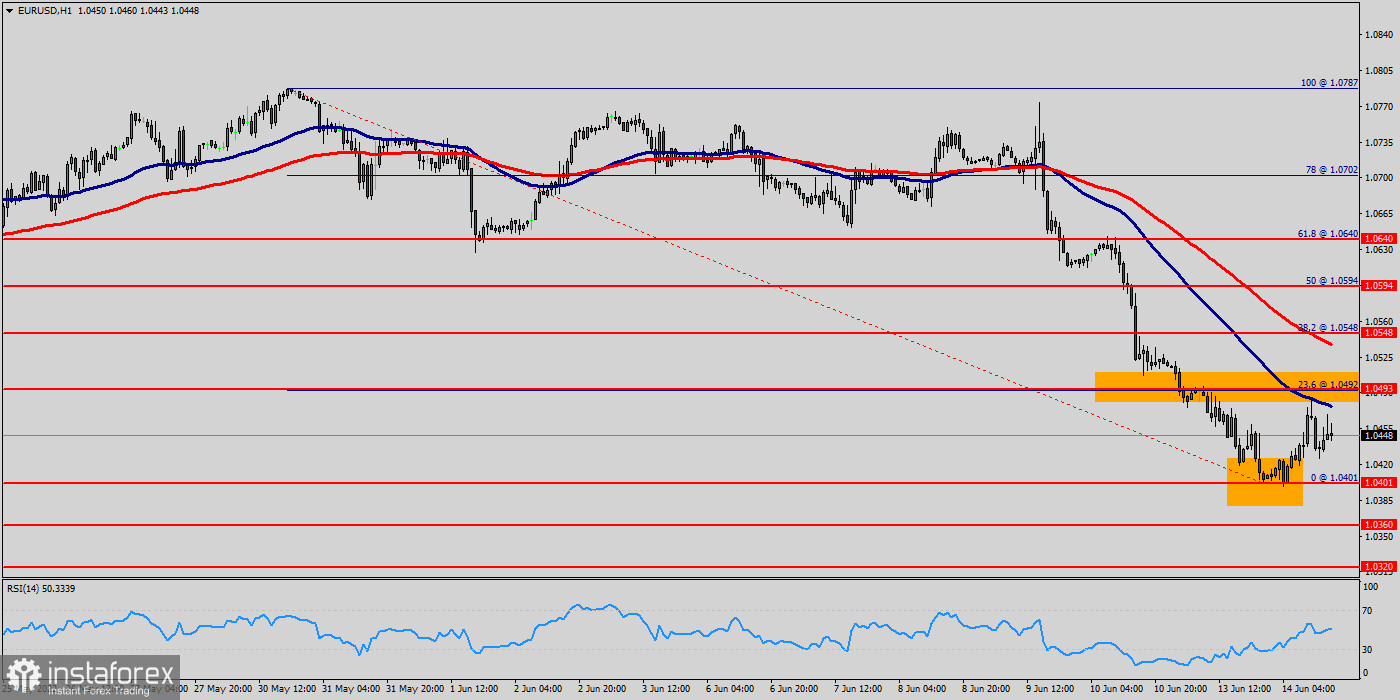

The direction of the EUR/USD pair into the close this week is likely to be determined by trader reaction to 1.0493 and 1.0401.

The EUR/USD pair climbed above the level of 1.0401 before it started a downside correction.

It broke a fateful bullish trend line with support near 1.0493 on the one-hour chart.

Right now, the EUR/USD pair settled below the key 1.0493 resistance.

So, it is at a risk of a downside break below 1.0493. According to previous events, the EUR/USD pair has still moving between the level of 1.0493 and the 1.0401 level (those levels coincided with the Fibonacci retracement levels 23.6% and double bottom respectively).

If this move creates enough late session downside momentum then look for a wave into 1.0401, followed closely by 1.0360.

The EUR/USD pair settled below the 1.0493 resistance zone, opening the doors for more downsides in the near term. Similarly, The EUR/USD pair could dive if it breaks the 1.0401 support.

Today, the first resistance level is seen at 1.0493 followed by 1.0548, while daily support 1 is seen at 1.0401.

Furthermore, the moving average (100) starts signaling a downward trend. Therefore, the market is indicating a bearish opportunity below 1.0493 or 1.0548.

It will be good to sell at 1.0493 with the first target of 1.0401. It will also call for a downtrend in order to continue towards 1.0360 in coming hours.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română