Crypto Industry News:

TBD, a subsidiary of Block, announced plans to build a new decentralized network centered around Bitcoin, highlighting founder Jack Dorsey's belief that the largest Blockchain network will play a major role in the evolution of the Internet.

The new project, dubbed "Web5," represents the latest Bitcoin-focused venture Dorsey has planned to pursue since stepping down as Twitter CEO in November 2021.

While Web3 uses Blockchain technology and tokenization to decentralize the Internet, Web5 is imagined as an identity-based system that uses only one Blockchain: Bitcoin. Web5 is essentially a decentralized web platform that allows developers to create decentralized web applications via DID and decentralized nodes, as per TBD prototype documents. Web5 will also have a monetary network centered around Bitcoin, reflecting Dorsey's belief that the cryptocurrency will one day become the native currency of the internet.

Dorsey's motivation to follow the new web development model may stem from his belief that Web3 will never achieve true decentralization. Block's CEO has publicly criticized Web3 and the venture capital community that supports its growth. In December 2021, Dorsey wrote on Twitter that natural persons do not own Web3 - they do have VCs and their limited partners.

Technical Market Outlook:

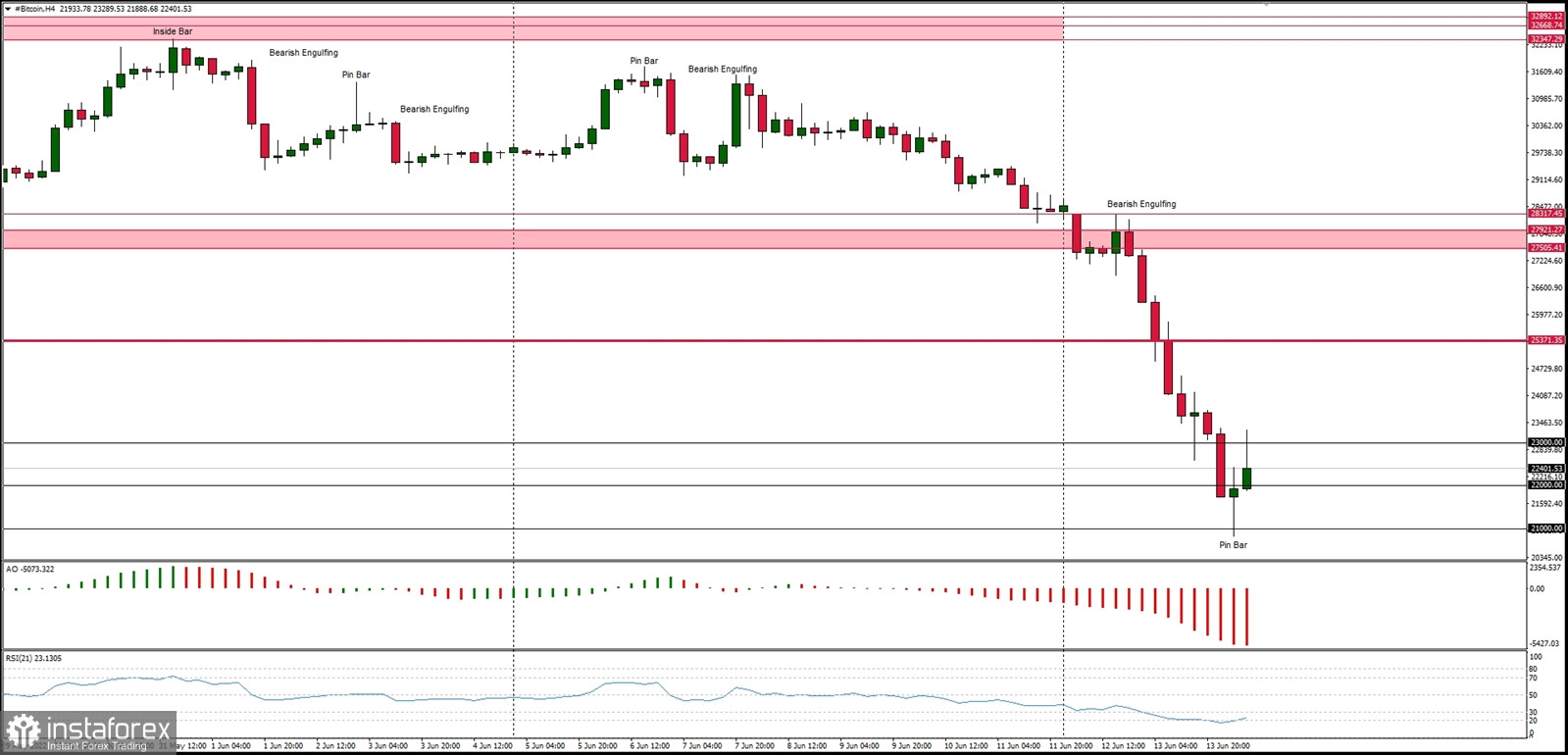

The BTC/USD pair is approaching the round and psychological level of $20k. The key long-term technical support from May 12, 2022 located at $25,371 had been violated as the down trend continues. The market is under the bearish pressure and the next target for bears is seen at the level of $20,000 or below. The nearest technical resistance is located at $23,000, but in order to change the sentiment to more bullish, the market must break through the level of $27,921 again.

Weekly Pivot Points:

WR3 - $34,537

WR2 - $33,170

WR1 - $29,508

Weekly Pivot - $28,238

WS1 - $24,813

WS2 - $23,432

WS3 - $20,071

Trading Outlook:

The down trend on the H4, Daily and Weekly time frames continues. So far every bounce and attempt to rally is being used to sell Bitcoin for a better price by the market participants, so the bearish pressure is still high. The key long term technical support is seen at the round psychological level of $20,000.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română