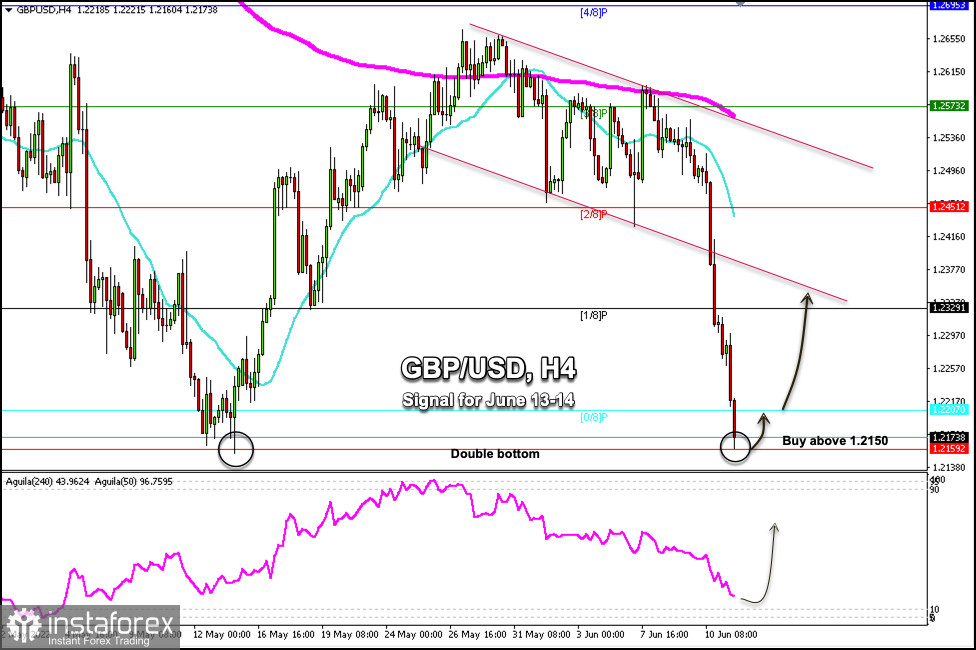

Early in the American session, the British pound reached a low of 1.2159, which coincides with the low of May 13. We can see the formation of a double bottom that could be a sign of a technical rebound in the coming days.

Last week, the pound strongly broke the downward trend channel formed on May 24. This caused a fall towards May lows due to the uncertainty that the Fed could increase its interest rate by 0.75% in its next meeting on June, 15.

The eagle indicator reached the oversold zone on the 4-hour chart. If the price tests the low of 1.2150, there is likely to be a technical bounce in the next few hours above this level and it may hit 0/8 Murray at 1.22 07 and could even hit 1/8 Murray at 1.2329.

Our trading plan for the next few hours is to buy the British pound above 1.2150 in anticipation of a technical correction, which is likely to occur in the next few hours. The eagle indicator supports our bullish strategy.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română