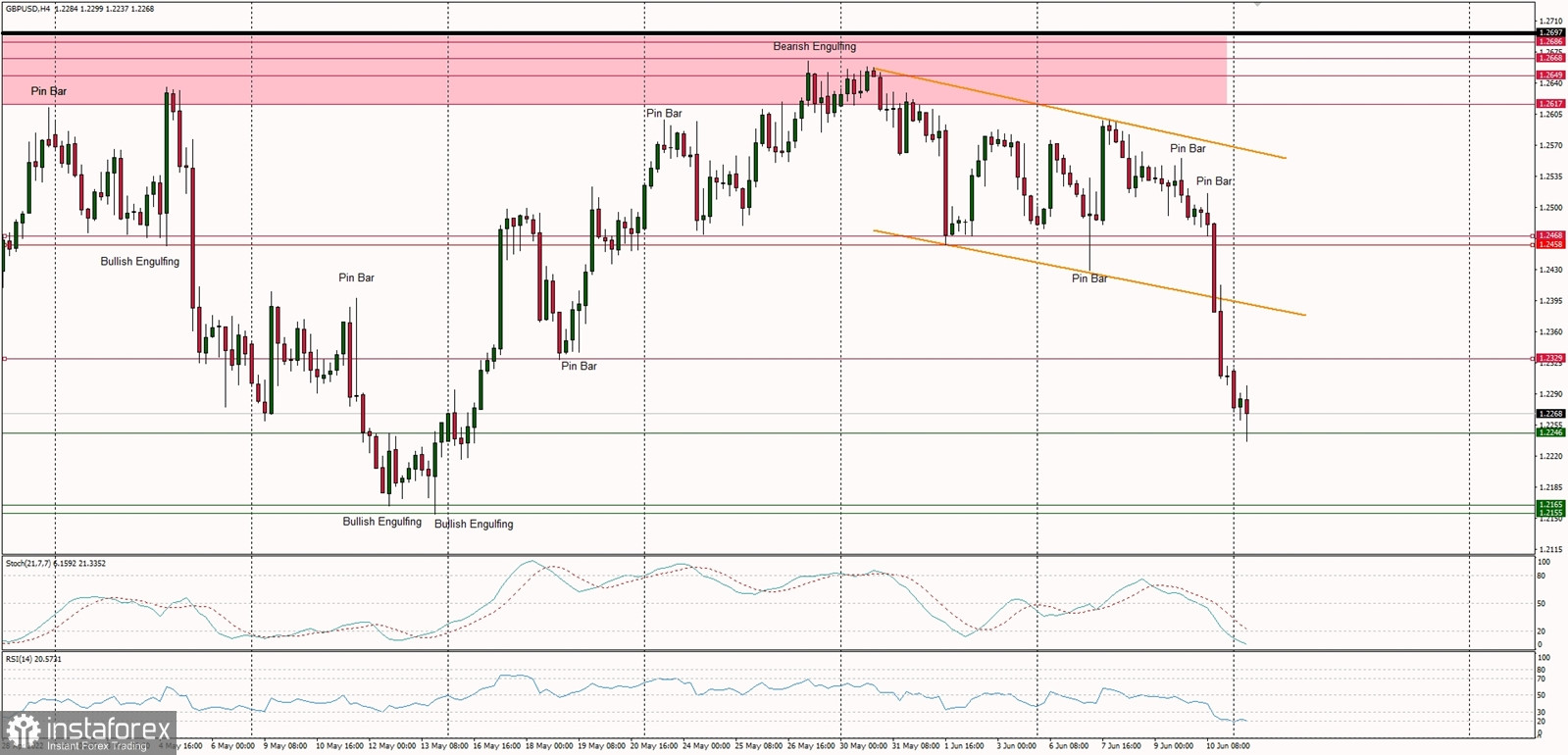

Technical Market Outlook:

After the worse than expected economic data, the GBP/USD pair had broken out of the channel and made a new local low at the level of 1.2235 (at the time of writing the analysis). The nearest technical resistance is seen at the level of 1.2328 and the next technical support is located at 1.2165 and 1.2155. Any violation below this level would likely accelerate the sell-off towards the level of 1.2078 and 1.2000. The weak and negative momentum supports the short-term bearish outlook for Cable.

Weekly Pivot Points:

WR3 - 1.2751

WR2 - 1.2671

WR1 - 1.2451

Weekly Pivot - 1.2374

WS1 - 1.2159

WS2 - 1.2081

WS3 - 1.1851

Trading Outlook:

The price broke below the level of 1.3000 quite long time ago, so the bears enforced and confirmed their control over the market in the long term. The Cable is way below 100 and 200 WMA , so the bearish domination is clear and there is no indication of trend termination or reversal. The bulls are now trying to start the corrective cycle, which is welcome after eight weeks of the down move. The next long term target for bears is seen at the level of 1.1989. Please remember: trend is your friend.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română