Technical Market Outlook:

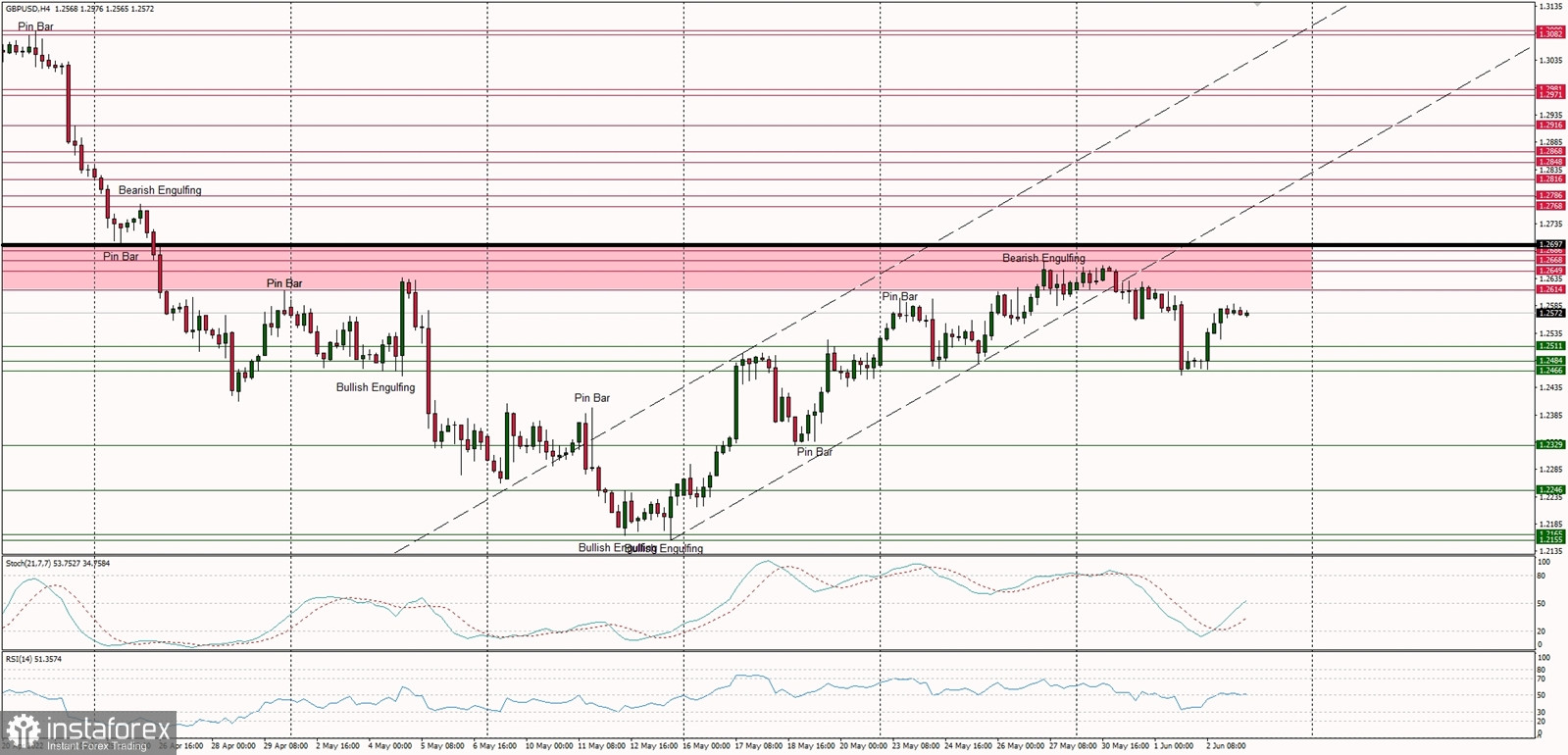

The key short-term technical support located at 1.2466 on GBP/USD H4 time frame chart had been well defended and the bulls are continuing the bounce. As long as the market trades above the level of 1.2466, there are still chances for the breakout higher. The momentum is now weak and negative, but the market is off the oversold levels, so in the case of a bounce extension the test of the supply zone is still possible.

Weekly Pivot Points:

WR3 - 1.2895

WR2 - 1.2786

WR1 - 1.2716

Weekly Pivot - 1.2588

WS1 - 1.2516

WS2 - 1.2399

WS3 - 1.2312

Trading Outlook:

The price broke below the level of 1.3000 six weeks ago, so the bears enforced and confirmed their control over the market in the long term. The Cable is way below 100 and 200 WMA , so the bearish domination is clear and there is no indication of trend termination or reversal. The bulls are now trying to start the corrective cycle, which is welcome after eight weeks of the down move. The next long term target for bears is seen at the level of 1.1989. Please remember: trend is your friend.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română