The price of gold registered a strong growth after finding strong demand at 1,828. Now, it is trading at 1,868 at the time of writing below 1,869 today's high. The yellow metal is strong bullish as the USD depreciated versus its rivals.

XAU/USD was lifted also by the ADP Non-Farm Employment Change which came in at 128K in May versus 295K expected and compared to 202K in April. Tomorrow, the US is to release the Non-Farm Employment Change which is expected at 325K, the Unemployment Rate, and the Average Hourly Earnings. These are seen as high-impact indicators.

XAU/USD At Resistance!

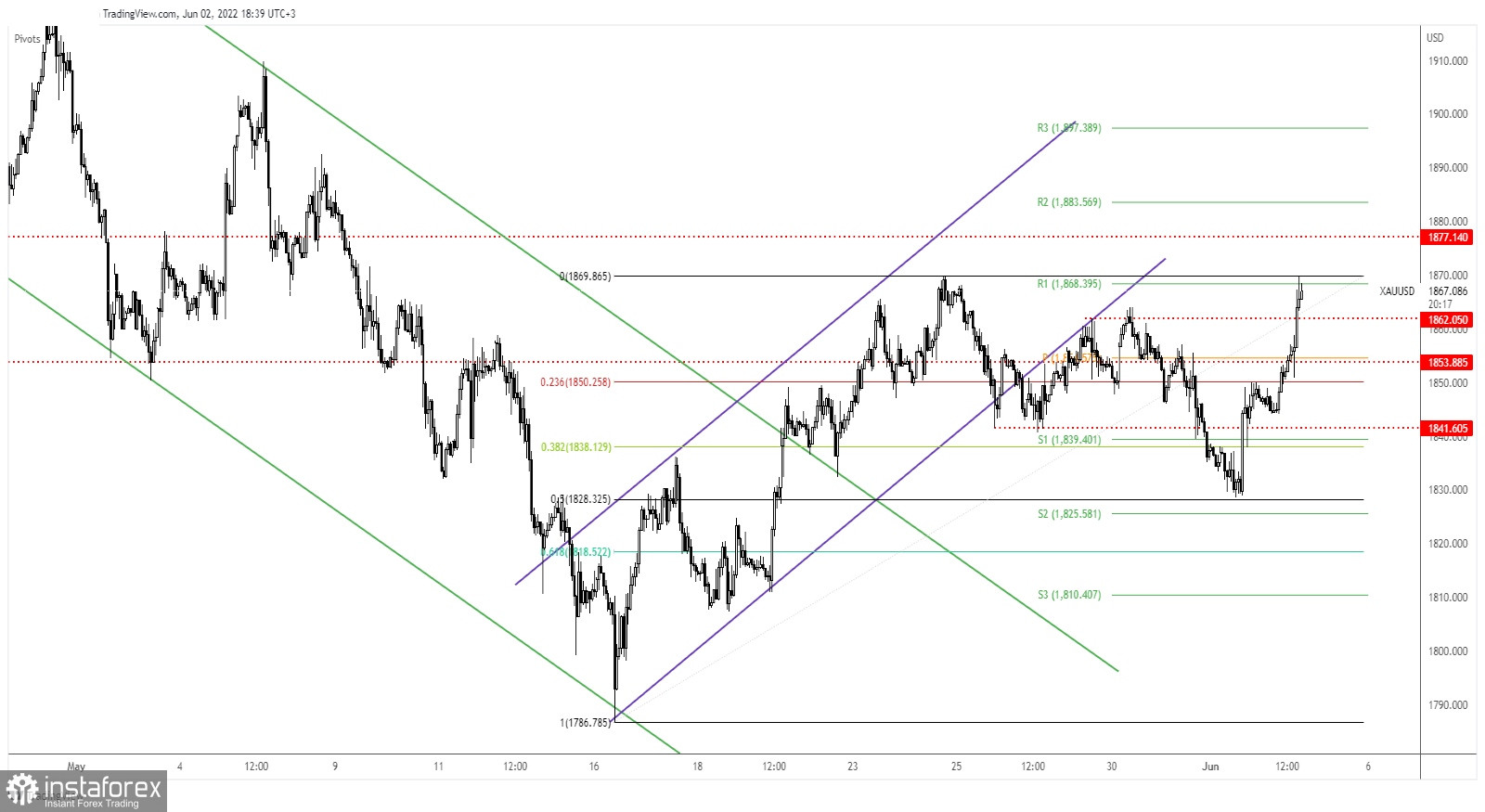

As you can see on the H1 chart, XAU/USD found support above the 50% retracement level and now it challenges the weekly R1 of 1,868 after ignoring the near-term resistance levels. It remains to see how it will react here around the resistance area, a new higher high could signal further growth.

Still, 1,877 stands as resistance as well. After its strong rally, we cannot exclude a temporary decline in the short term. Personally, I would like the rate to come back to test and retest the 1,862 before resuming its growth.

XAU/USD Forecast!

Strong consolidation above 1,862 could signal an upside continuation and could bring new buying opportunities. A temporary retreat could help the buyers to catch new upside momentums.

Also, a new higher high, a valid breakout above 1,869 could confirm further growth at least towards the 1,877 without registering a temporary retreat.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română