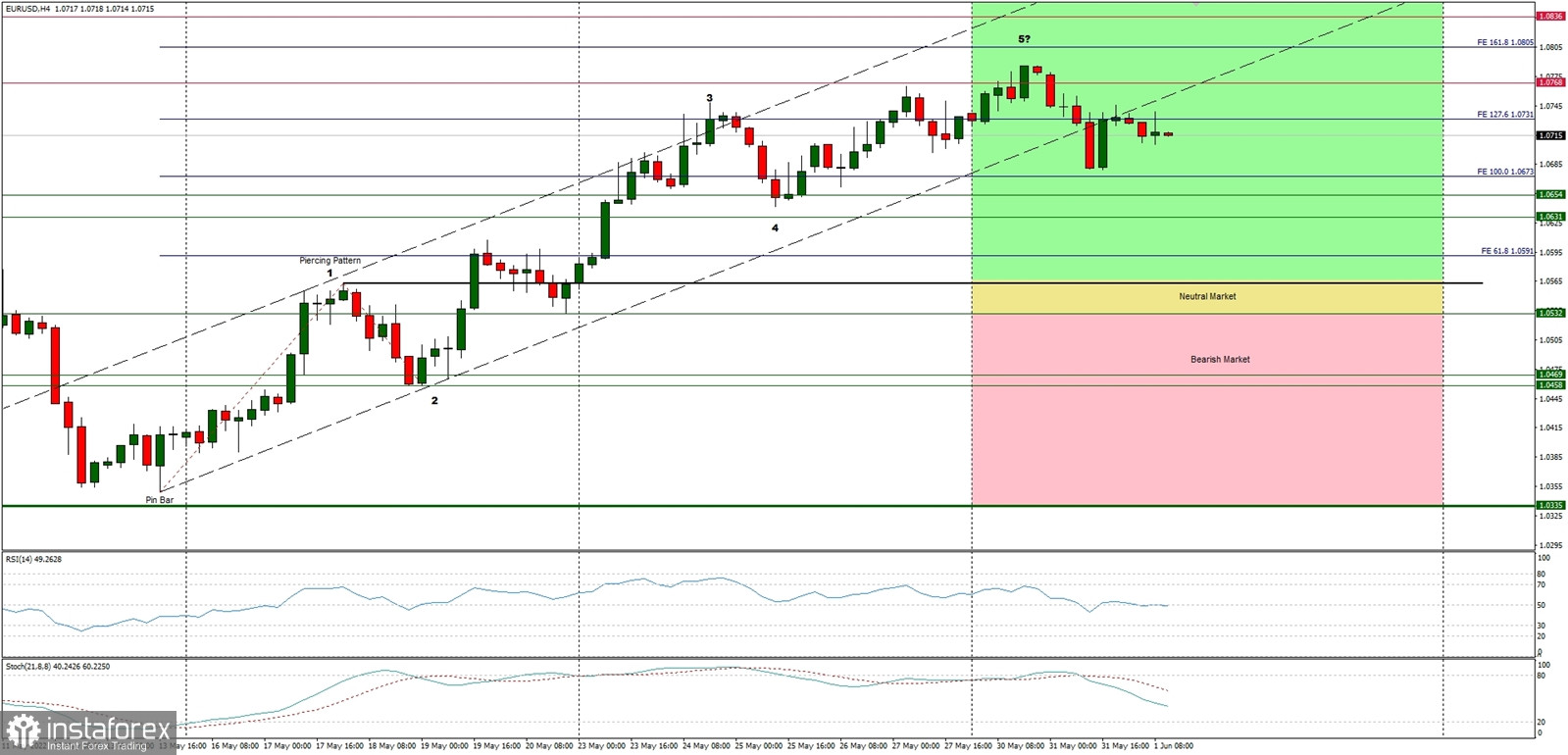

Technical Market Outlook:

The strong and positive momentum support the short-term bullish outlook for EUR/USD, however the bulls failed to break through the key short-term supply zone located at the level of 1.0786 and did not hit the 161% Fibonacci extension of the wave C located at 1.0805 yet. Instead, the market fell out of the channel and now is trading around the immediate technical support located at 1.0654. If this level is clearly violated, the upwards cycle might be terminated. The breakout below the level of 1.0567 invalidates the impulsive wave pattern.

Weekly Pivot Points:

WR3 - 1.1043

WR2 - 1.0898

WR1 - 1.0827

Weekly Pivot - 1.0691

WS1 - 1.0625

WS2 - 1.0485

WS3 - 1.0411

Trading Outlook:

The market had bounced from the key long-term technical support located at the level of 1.0336 and is heading higher. The up trend can be continued towards the next long-term target located at the level of 1.1186 only if bullish cycle scenario is confirmed by breakout above the level of 1.0726, otherwise the bearswill push the price lower towards the next long-term target at the level of 1.0336 or below.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română