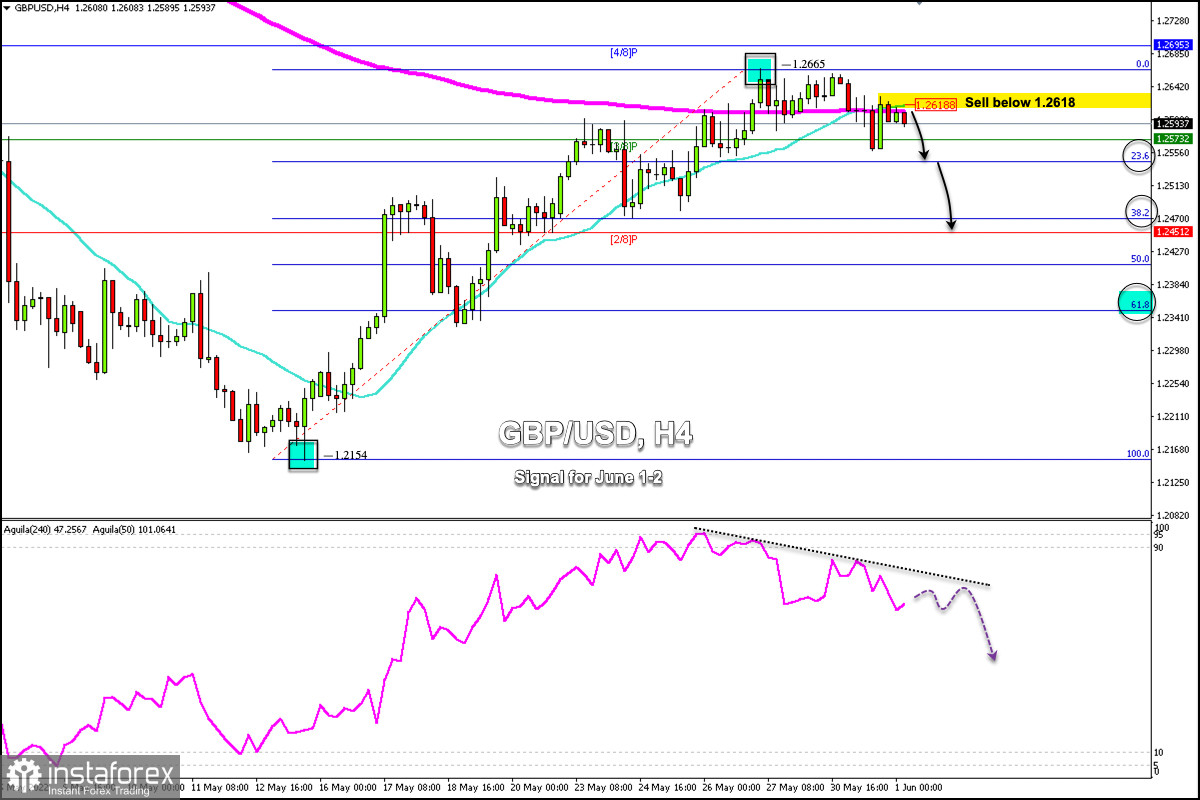

GBP/USD is trading below the 200 EMA located at 1.2618. We can see seven attempts on the 4-hour chart to consolidate above this level, but without success.

The intraday retracement from highs at 1.2665 could continue in the next few hours if GBP/USD consolidates below the 200 EMA.

From the low of 1.2157 to the high of 1.2665, we place the Fibonacci grid. The British pound is expected to fall in the coming days towards 23.6% located at 1.2550 and even towards 38.2% around 1.2470.

The market is awaiting the most important event this week which will be the US non-farm payrolls. The pound is likely to consolidate below 4/8 Murray (1.2695) until waiting for data that could change the trend of the pair or resume the main downward movement.

The pair needs to consolidate on daily charts above 1.2660 to attract buyers and extend the move higher to 5/8 Murray at 1.2817.

Conversely, if the British pound trades below the 200 EMA, it will be an opportunity to sell with targets at 1.2550 and 1.2470.

If the downward pressure continues and the pound breaks below the 23.6% Fibonacci, we could expect a drop that could make the price reach the 50% Fibonacci level and even 61.8% at around 1.2350.

Since May 24, the eagle indicator has reached the overbought zone. GBP is likely to rebound in the next few hours which will be seen as an opportunity to continue selling.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română