The AUD/USD pair came back higher as the Dollar Index drops again. DXY's sell-off forces the USD to lose ground versus its rivals. The price stands at 0.7186 at the time of writing and it seems determined to approach and reach the 0.7200 psychological level again.

Today, Australia reported mixed economic data while the Chinese figures came in better than expected. The Australian Private Sector Credit rose by 0.8% compared to 0.5% expected, the Current Account came in at 7.5B below 13.4B expected, the Company Operating Profits rose by 10.25% exceeding 5.1% estimates while Building Approvals dropped by 2.4% even if the specialists expected a 2.2% growth.

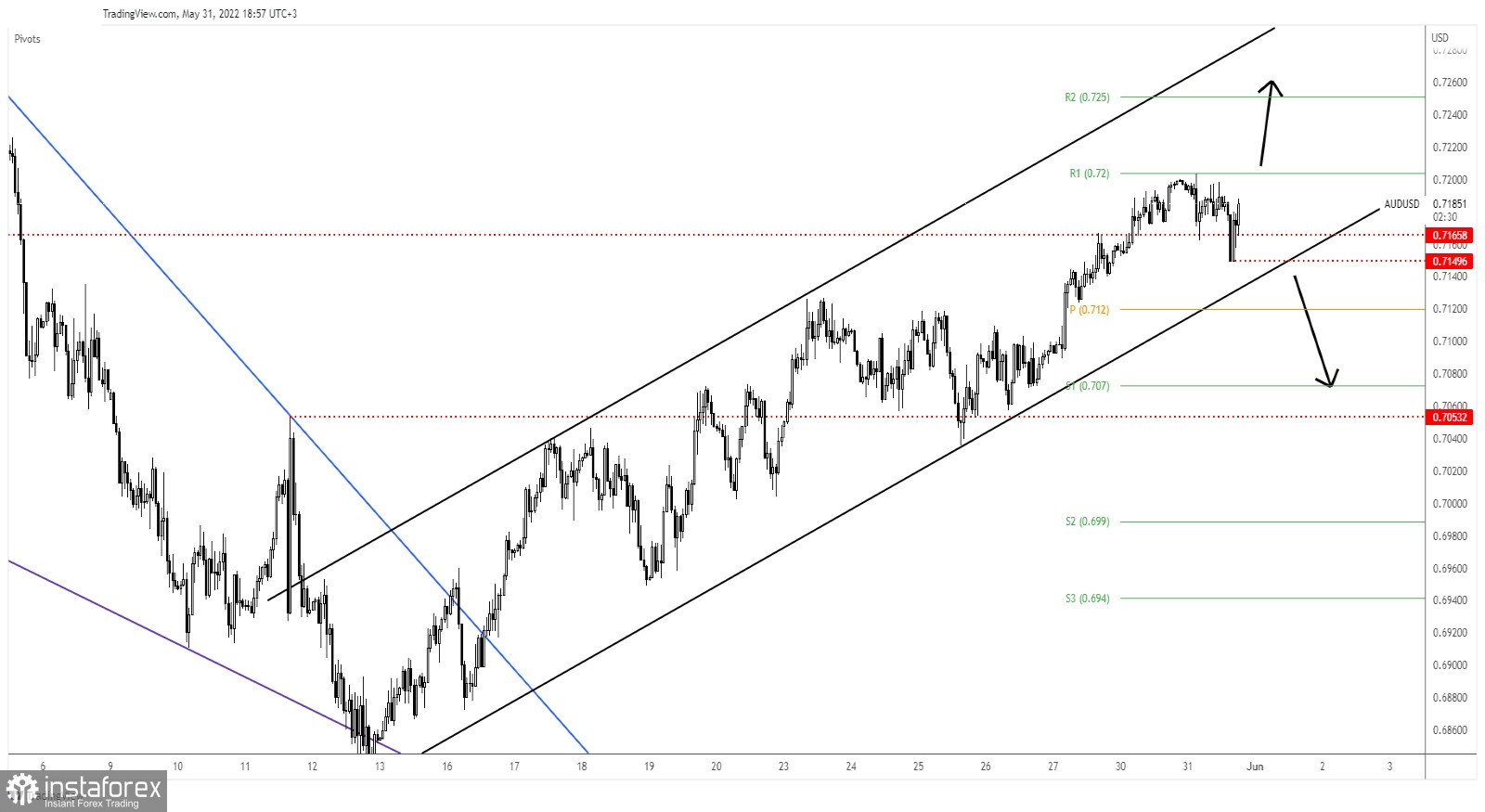

Technically, the bias remains bullish in the short term. The rate rallied in the last hours even if the US reported positive data earlier.

AUD/USD Bullish Momentum!

As you can see on the H1 chart, the AUD/USD pair failed to stabilize below the 0.7165 key level. As long as it stays above this level and above the uptrend line, the bullish bias remains intact.

The weekly R1 (0.7200) stands as the near-term resistance level. 0.7149 today's low represents the static support.

AUD/USD Forecast!

A new higher high, jumping, closing, and stabilizing above the R1 (0.7200) could really activate further growth towards fresh new highs.

On the contrary, staying below the R1 and making a valid breakdown below the uptrend line and below 0.7149 could open the door for a sell-off and could bring new selling opportunities.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română