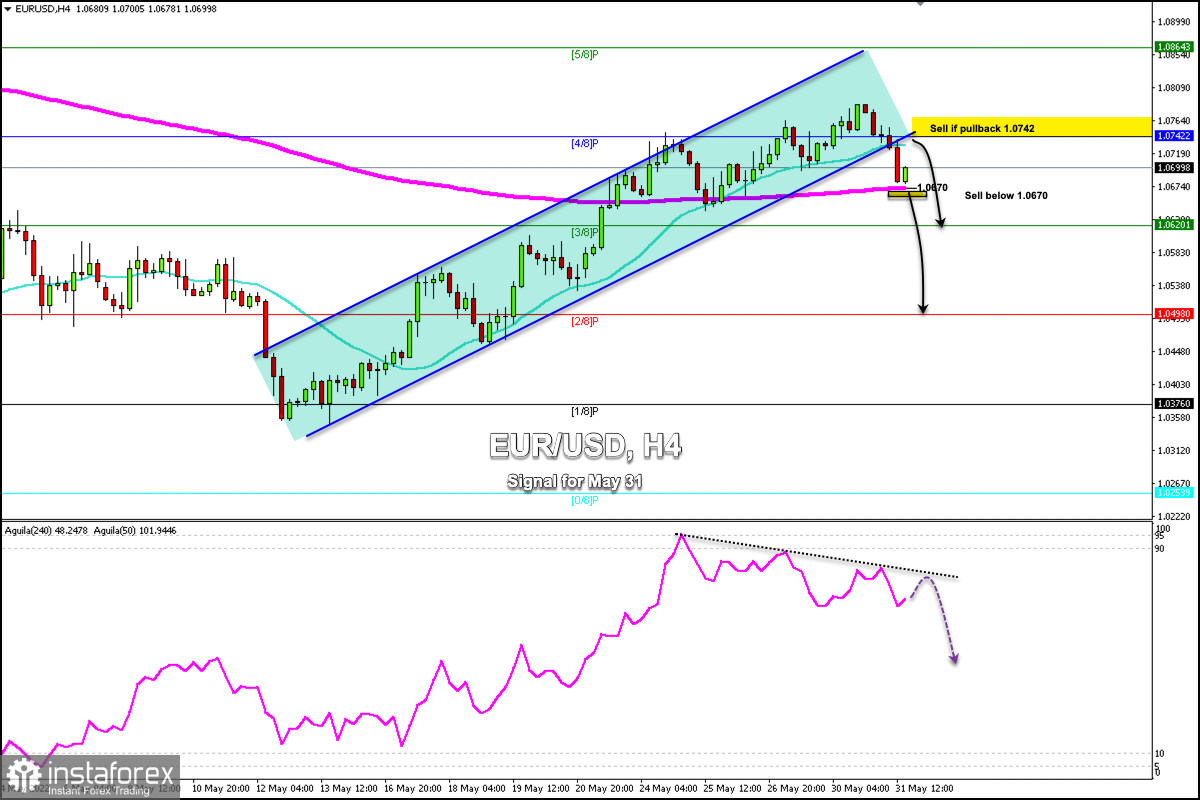

Early in the American session, EUR/USD is trading below the 21 SMA and below the 4/8 Murray with a slightly bearish bias, but supported by the 200 EMA located at 1.0670.

Seeing as the Euro is now consolidating below the 21 SMA, the outlook could change to bearish. For this, we should expect a sharp break and a close below the 200 EMA around 1.0670 on the 4-hour chart.

From the low of 1.0348 to the high of 1.0785, we place the Fibonacci grid. In light of the recent technical correction, EUR/USD reached the 23.6% Fibonacci level which coincides with the 200 EMA around 1.0680.

If the downward pressure continues and the euro breaks below the 23.6% Fibonacci, we could expect a drop that could make the price reach the 50% Fibonacci level and even 61.8% at around 1.0515.

Euro has found strong support above the 200 EMA. So, in the next few hours, we could expect a technical bounce and it could reach the zone 4/8 Murray around 1.0742. A pullback into this area could be a good opportunity to sell as long as the euro consolidates below this area, with targets at 1.0670 and 1.0620.

Otherwise, a close on daily charts below 1.0670 could accelerate the bearish move and the euro could make a technical correction to 2/8 Murray around 1.0498.

Since May 24, the eagle indicator has reached the overbought zone. EUR is likely to rebound in the next few hours which will be seen as an opportunity to continue selling.

For the euro to resume its uptrend, we should expect a close above 1.0760 (4/8 Murray) on the daily chart. Above this level, the euro could resume its uptrend and reach 5/8 Murray at 1.0864.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română