NZD/USD edged higher as the USD was punished by the DXY's sell-off. In the short term, the bias is bullish, so further growth is still in cards. Technically, the pair passed above strong upside obstacles, but we still need confirmation that we'll have a larger growth.

The price resumed its growth also because the US data came in worse than expected yesterday. Unemployment Claims, Philly Fed Manufacturing Index, Existing Home Sales, and the CB Leading Index disappointed. Today, the New Zealand Trade Balance was reported at 584M versus -350M estimates, while the Credit Cards Spending rose by 1.1%.

NZD/USD Bullish Momentum!

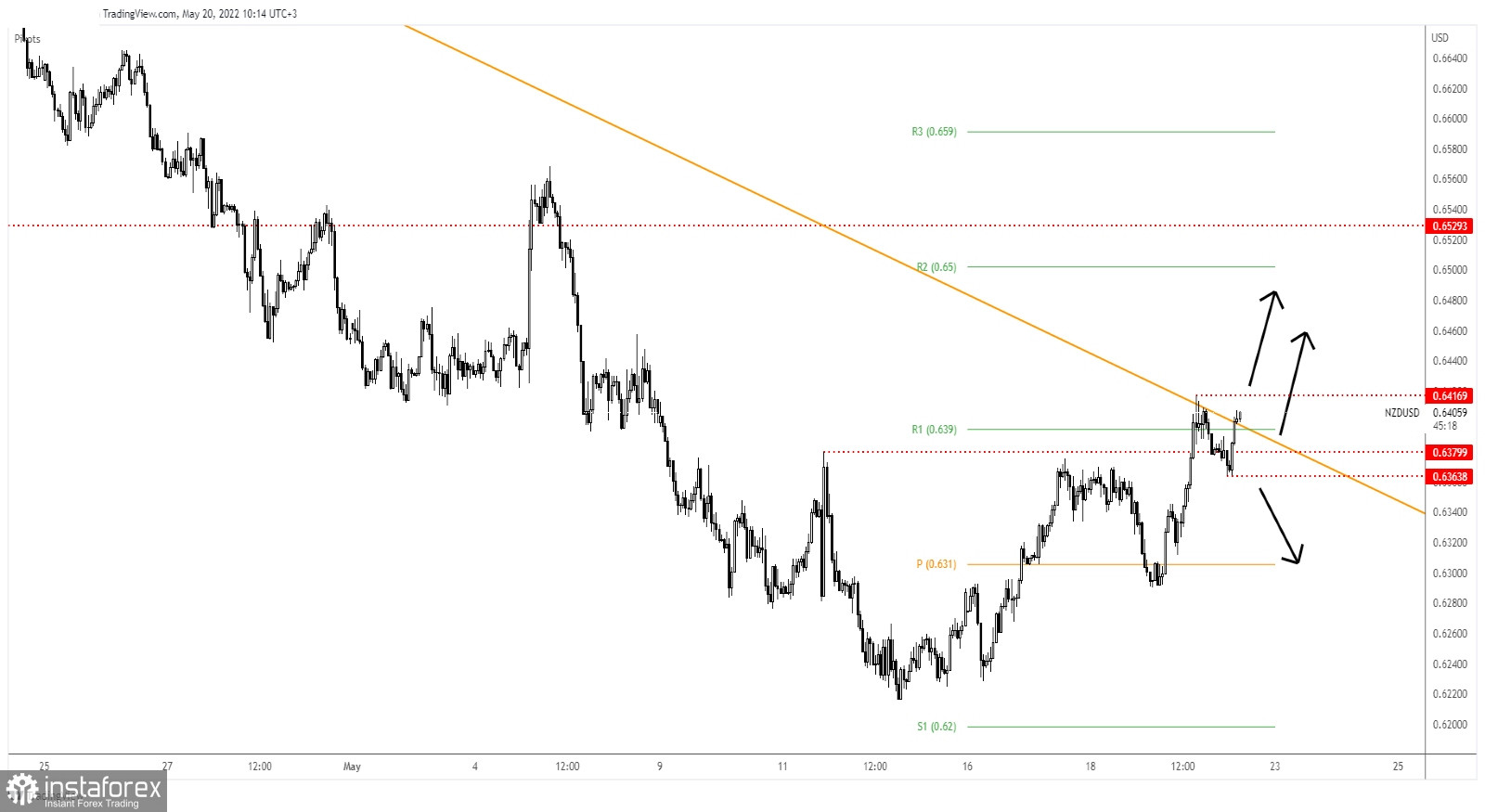

As you can see on the H1 chart, the price jumped above the downtrend line after failing to stay under the 0.6379 level. Validating its breakout above the downtrend line and making a new high may signal an upside continuation.

On the other hand, invalidating the breakout above the downtrend line may signal that the leg higher is over and that the rate could develop a new sell-off.

NZD/USD Outlook!

A valid breakout above 0.6416, a new higher high may signal an upside continuation and oculd bring new long opportunities with a potential upside target at the weekly R1 (0.6500).

A new lower low, dropping and closing below 0.6363 could activate a new sell-off.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română