Crypto Industry News:

According to the Minister of Industry and Trade of the Russian Federation, Denis Manturov, Russia will "sooner or later" legalize cryptographic payments.

The country's government has been investigating various variants related to cryptocurrency adoption in 2022, but has not yet finalized any specific policy regarding the payment of digital assets. However, its legalization was recommended by the Russian Ministry of Finance in the law "On digital currency" of April.

According to a report from local TASS media, Manturov was asked this week on the New Horizon education forum about whether work is underway on legalized crypto payments:

"I think so. The question is when it will happen, how it will happen and how will it be regulated. Now both the Central Bank and the government are actively involved in it. But everyone is inclined to understand that this is a trend of the time and sooner. will it be realized later in one format or another. "

The Central Bank of Russia and the Ministry of Finance until recently had completely opposite views on the regulation of cryptocurrencies, with the central bank wanting a total ban, while the ministry sought to regulate taxation.

Back in January, the Central Bank proposed a total ban on local trading and cryptocurrency mining due to the potential 'financial stability threats' associated with the sector.

Technical Market Outlook:

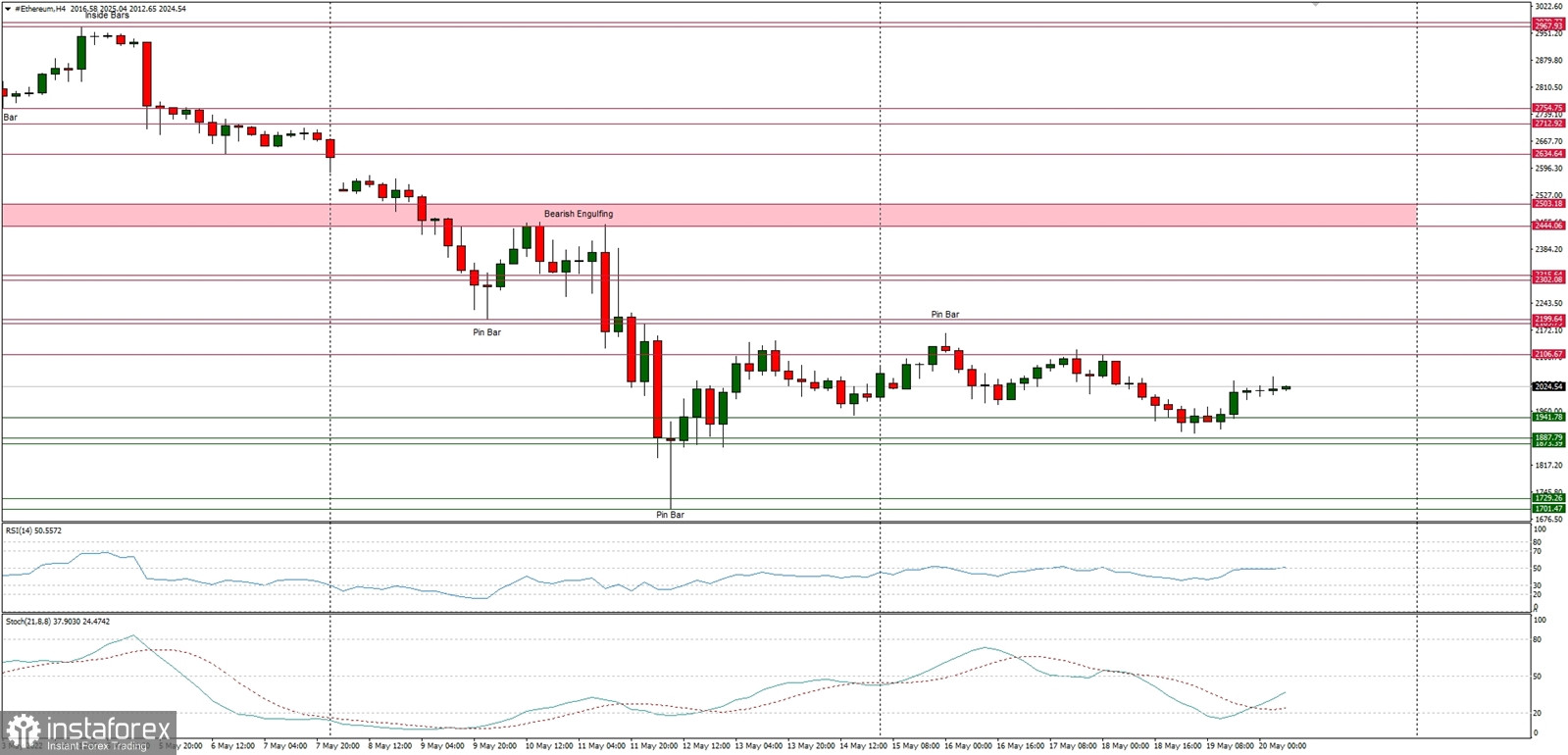

The ETH/USD pair has successfully bounced from the range low located at the level of $1,887 and is heading higher. The nearest technical resistance is seen at $2,106 and $2,199, but the weak and negative momentum still supports the short-term bearish outlook. The market keeps making lower lows and lower highs on the H4 time frame chart, so the down trend is intact.

Weekly Pivot Points:

WR3 - $3,385

WR2 - $2,946

WR1 - $2,555

Weekly Pivot - $2,120

WS1 - $1,688

WS2 - $1,275

WS3 - $820

Trading Outlook:

The down trend on the H4, Daily and Weekly time frames had broken below the key long term technical support seen at the level of $2,000 and continues to make new lower lows with no problems whatsoever. So far every bounce and attempt to rally is being used to sell Ethereum for a better price by the market participants, so the bearish pressure is still high. The next target for bears is located at the level of $1,420.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română