GBP/USD is trading in the green at the 1.2233 level at the time of writing. It has rebounded as the USD was punished by the DXY's sell-off. The Dollar Index registered a false breakout above 104.92 signaling exhaustion and a potential drop in the short term. When the DXY drops, the USD could depreciate versus the other currencies.

Fundamentally, the greenback was weakened by the US Prelim UoM Consumer Sentiment which dropped unexpectedly lower from 65.2 points to 59.1 points far below 64.1 estimates. In addition, the Prelim UoM Inflation Expectations rose by 5.4%.

GBP/USD Bullish Momentum!

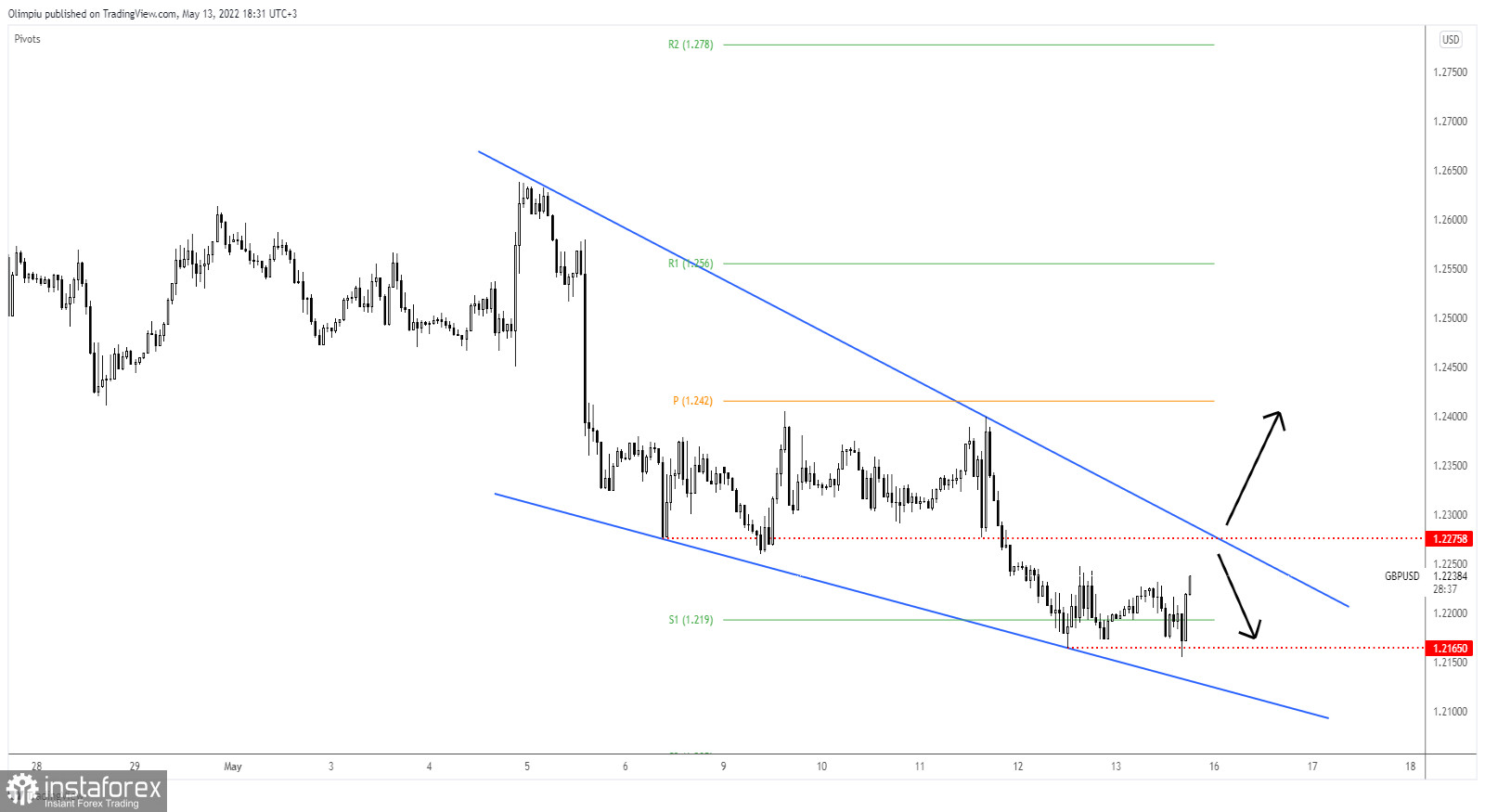

GBP/USD found support on the 1.2165 previous low and now it seems determined to approach and reach the 1.2275 and the downtrend line which represents upside obstacles. As long as it stays below the downtrend line, the bias remains bearish.

Technically, the Falling Wedge pattern could represent an upside reversal pattern. On the other hand, registering only false breakouts above these obstacles, or failing to reach them may signal a new sell-off.

GBP/USD Outlook!

The GBP/USD pair could develop a larger growth only if it activated the Falling Wedge. jumping, closing, and stabilizing above the 1.2275 and above the downtrend line may signal a larger rebound and could bring new long opportunities.

False breakouts through these obstacles may signal that the rebound ended and that the GBP/USD pair could come back down at least towards 1.2165.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română