Crypto Industry News:

A group of eight environmental organizations called on various government agencies under Biden's administration to implement new approaches in response to proof-of-work (PoW) and other cryptocurrency mining operations.

In a letter to the US Office of Science and Technology Policy, the Environmental Working Group, Earthjustice, Greenpeace, the League of Conservation Voters, Sierra Club, Friends of the Earth, Seneca Lake Guardian and the Milwaukee Riverkeeper called on the White House to implement a policy aimed at to reduce "Electricity consumption and climate pollution from digital currencies that rely on [PoW]" demand for special chips in excavators, creating significant electronic waste and not "helping the transition" to renewable electricity.

The group proposed to the EPA to subject mining companies to "stringent reviews" of operating permits "to mitigate the damage associated with the disposal of large-scale cryptocurrency mining waste" and to address claims for noise pollution from excavators. In addition, the groups asked the Management and Budget Office of the Information and Regulation Office to establish a register of many mining operations so that companies could "disclose their sources and amounts of energy".

Other recommendations include implementation by the Department of Energy of energy efficiency standards for miners, with a tightening limit over time "to ultimately eliminate" proof-of-work mining. However, the greatest request seemed to be made to the Securities and Exchange Commission and the Commodity Futures Commission. Authorities have been asked to restrict crypto exchanges so that digital assets that meet certain "environmental and electrical standards" are listed, and to rectify "misleading claims" on the environmental impact of digital currencies ".

Technical Market Outlook:

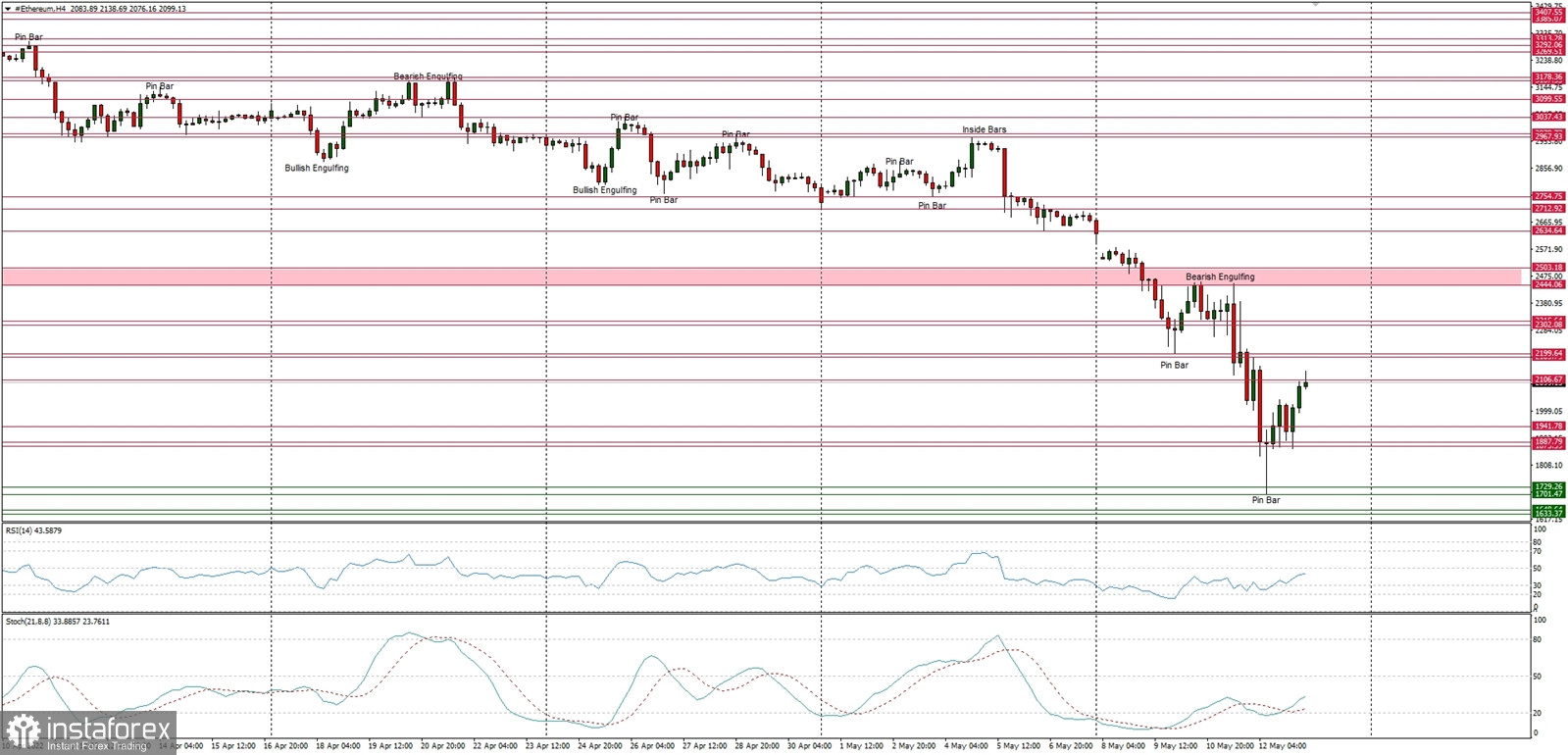

The ETH/USD pair has bounced from the new swing low at the level of $1,700 and is currently trading aroud the level of $2,100 as the bounce continues. The nearest technical resistance is seen at $2,199, but the weak and negative momentum supports the short-term bearish outlook with a new target for bears seen at the level of $1,420. The market keeps making lower lows and lower highs on the H4 time frame chart, so the down trend is intact.

Weekly Pivot Points:

WR3 - $3,235

WR2 - $3,103

WR1 - $2,780

Weekly Pivot - $2,614

WS1 - $2,276

WS2 - $2,128

WS3 - $1,807

Trading Outlook:

The down trend on the H4, Daily and Weekly time frames had broken below the key long term technical support seen at the level of $2,000 and continues to make new lower lows with no problems whatsoever. So far every bounce and attempt to rally is being used to sell Ethereum for a better price by the market participants, so the bearish pressure is still high. The next target for bears is located at the level of $1,420.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română