The EUR/USD pair is trading at 1.0391 at the time of writing. The price turned to the upside after reaching the 1.0354 level. After its massive drop, a temporary rebound was natural. The price could test and retest the immediate resistance levels before dropping again as the bias remains bearish.

Fundamentally, the pair rebounded as the US data failed to impress yesterday. The Unemployment Claims came in at 203K in the last week, the PPI rose by 0.5% matching expectations, while the Core PPI surged by 0.4% less versus 0.6% estimates.

Today, the Euro-zone Industrial Production may drop by 2.1%, while the US Prelim UoM Consumer Sentiment could drop from 65.2 to 64.1 points.

EUR/USD 1.0400 As Key Level!

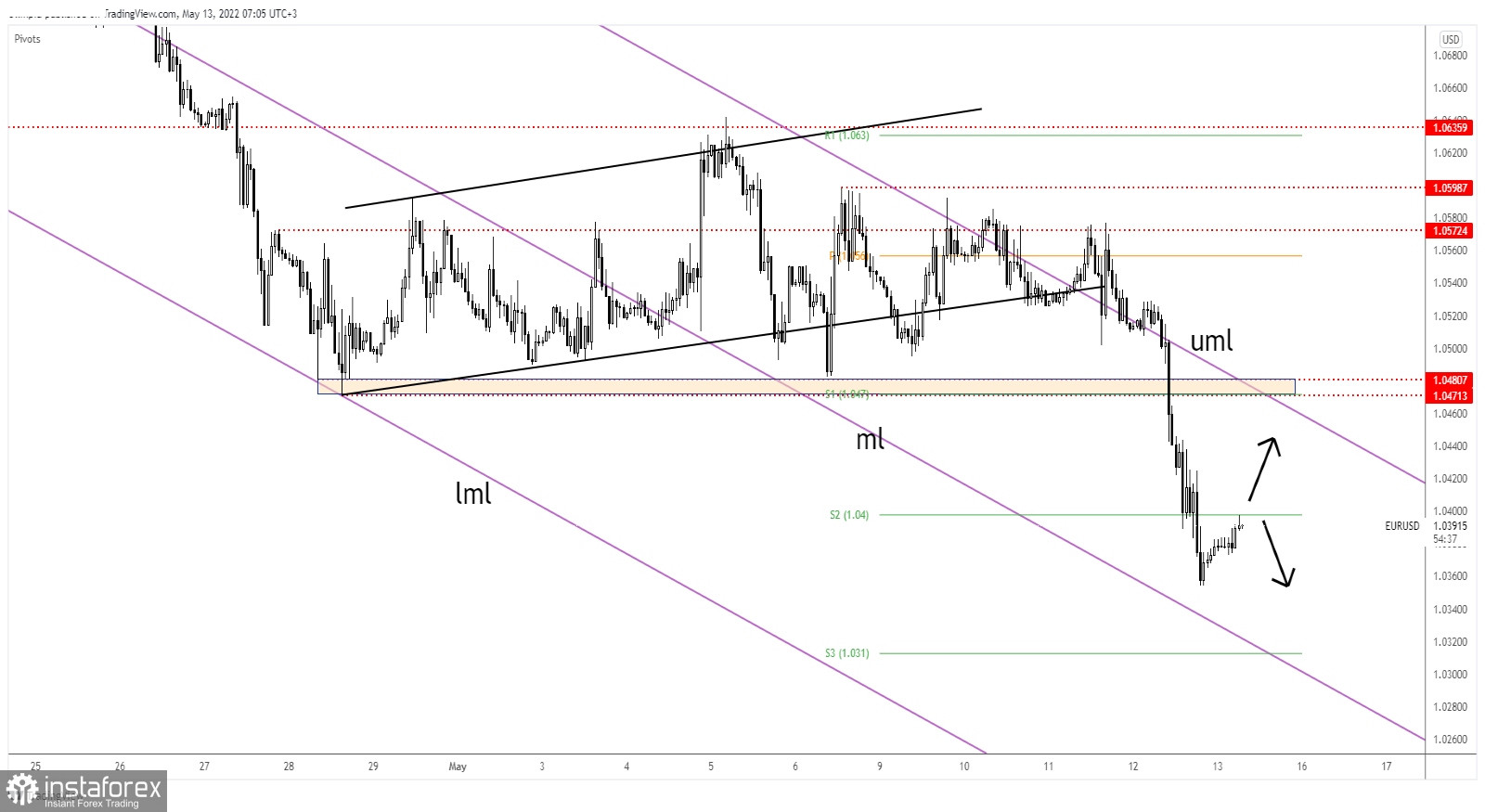

As you can see on the H4 chart, the EUR/USD pair failed to stabilize above the descending pitchfork's upper median line (uml) signaling strong downside pressure. Breaking below 1.0480 - 1.0471 signaled more declines.

Now, it challenges the weekly S2 (1.0400) which stands as an upside obstacle. False breakouts above it may signal a new sell-off. Making a valid breakout could announce further growth in the short term.

EUR/USD Forecast!

The rebound could be only a temporary one. This could bring new selling opportunities. If the rate stands below the S2 (1.0400), registering only false breakouts, we can look for new selling opportunities.

A larger rebound could bring is new selling opportunities from around the descending pitchfork's upper median line (uml). Personally, I'm not looking to buy EUR/USD as the rate could drop anytime if the DXY resumes its growth.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română