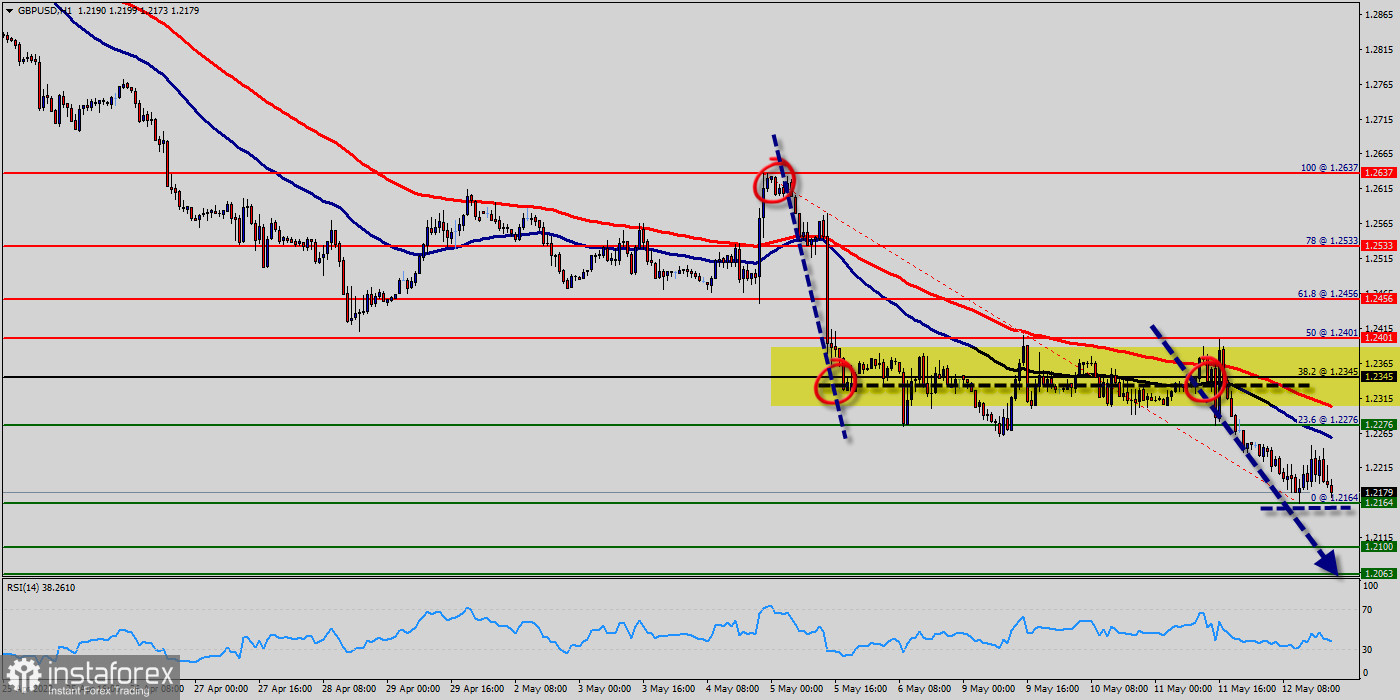

The GBP/USD pair fell sharply from the level of 1.2276 towards 1.2164. Now, the price is set at 1.2185. The resistance is seen at the level of 1.2276 and 1.2345. Moreover, the price area of 1.2276/1.2345remains a significant resistance zone.

Therefore, there is a possibility that the GBP/USD pair will move downside and the structure of a fall does not look corrective. The trend is still below the 100 EMA for that the bearish outlook remains the same as long as the 100 EMA is headed to the downside.

Thus, amid the previous events, the price is still moving between the levels of 1.2276 and 1.2100. If the GBP/USD pair fails to break through the resistance level of 1.2276, the market will decline further to 1.2100 as as the first target.

This would suggest a bearish market because the moving average (100) is still in a negative area and does not show any signs of a trend reversal at the moment. Amid the previous events, the GBP/USD pair is still moving between the levels of 1.2276 and 1.2100, so we expect a range of 1.76 pips.

This would suggest a bearish market because the RSI indicator is still in a negative spot and does not show any trend-reversal signs. The pair is expected to drop lower towards at least 1.2063 so as to test the daily support 2.

On the contrary, if a breakout takes place at the resistance level of 1.2345, then this scenario may become invalidated.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română